The Canal+ Master Plan

How the Pay TV player intends to become THE entry point in French Television

Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

My Best Finds 🔎

It seems not everyone wants to watch TV via a Smart TV or a Set top box in Germany.

Stop meaningless comparisons between TV and Social says Matt Hill, Thinkbox.

Damn right especially as the latest study from France Télévision reveals that a 20” spot on Linear TV or BVOD has a 94% attention rate vs 37% via online video platforms.

While US Pay TV players are looking for options to stop the bleeding (they lost 2M subscribers in Q1’2024) with initiatives like StreamSaver from Comcast (an actual discount of only 1.98$ according to Rick Ellis), French Pay TV operator Canal+ introduces a TV bundle at 2€ per month.

You’ve heard that right: 2€!!

One is a SVOD bundle, the other a TV bundle but they both operate under the same premise: you have to innovate to acquire and retain your Pay TV customers.

TV+ is the latest project from Canal+ and part of its grand master plan to rule the French TV market and beyond.

Today at a glance:

Get to know Canal+

What is TV+?

Why this move?

Get to know Canal+

Fun fact, Canal+ (or Canal Plus) invented the + way before it became a thing in streaming.

The company was indeed founded in 1984 by Havas Group, one of the world's largest global communications groups, to become the 1st French Pay TV channel. In a nutshell, it was the French HBO.

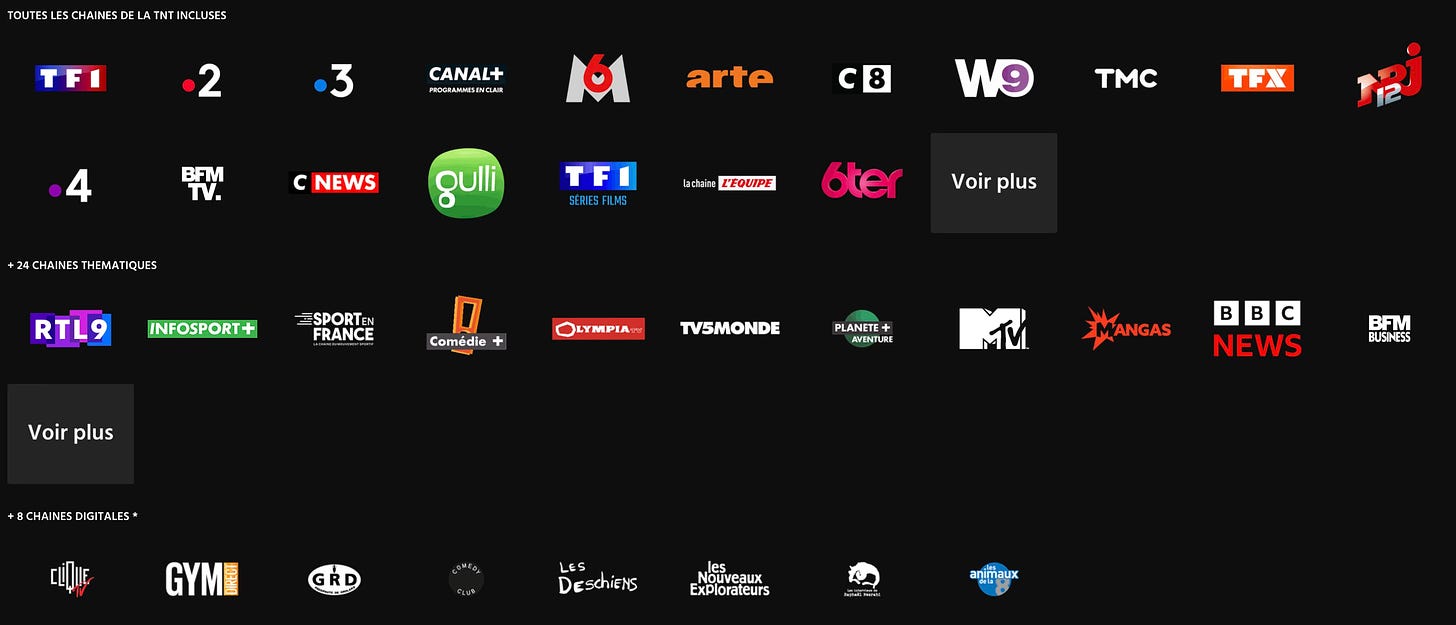

Canal+ went from one channel in 1984 to a portfolio of 10 Pay TV channels, 3 Free to air channels and 30+ Thematic channels today.

They are accessible via their own devices (satellite and internet boxes) but also CTVs, Operator Set top boxes etc.

Canal+ is more than a Pay TV Channel network. It is also:

An aggregator of third-party channels and services from the French TV landscape and the best of streaming platforms (check out my piece on the French launch of Max and how Canal+ will be instrumental to its success).

A suite of digital platforms: myCANAL, CANAL VOD

Europe's leading studio for the production and distribution of films and series, owner of the largest catalogue of French and European films: STUDIOCANAL.

Canal+ is the main shareholder in MultiChoice, the leading Pay TV operator in English and Portuguese-speaking Africa; Viaplay, the Scandinavian leader in Pay TV and streaming and Viu, Asia's leading streaming operator.

Canal+ by the numbers:

2.2B streams in 2023

They have 26.4M subscribers in 50 markets:

9.8M in France at the end of 2023 (Canal+ France MD, Christophe Picard-Legry, quoted 10.6M subs in a recent interview)

16.6M outside of France

They ambition to reach a subscriber base of between 50 and 100M.

In 2023, Canal+ entered the list of the 50 Most powerful French brands in the world for the first time.

Now there is no doubt that the Pay TV business is no walk in the park.

Canal+ grew its French subscriber base by 300K subs in 2023 (+3.1% YoY) and by 600K outside of France (+3.7% YoY); ARPU grew; churn decreased according to Canal+.

I bet US Pay TV players would love to see that kind of growth.

5 things Canal+ got right:

✅ International expansion: either directly or through investments;

✅ Ubiquitous distribution: while making sure they weren’t too reliant on 3rd-party distributors aka « gatekeepers »;

✅ Strong premium rights with US studio output deals, F1, Premier League, Top14;

✅ Aggregation play: where they bring the best of video across TV channels, streamers;

✅ Product excellence: the myCanal platform is by far my favourite entertainment hub, a savant mix of curation and algorithmic recommendations.

What is TV+?

In May 2024, CANAL+ launched TV+, its new streaming offer bringing together all live TV and replay in one place, plus a selection of CANAL+ content for €2 a month with no commitment.

So what’s in it exactly?

80 live TV channels (+ their catch up services) i.e. all terrestrial TV channels (TF1, M6 and co) + a selection of thematic TV channels (RTL9, MTV, Comédie+ …);

8 digital channels (Comedy Club, Clique TV, Gym Direct …);

A selection of Canal+ exclusives (shows like Baron Noir, Spirals, The English, Intérieur Sport on Mbappé, comedy superstar Florence Foresti). Interesting to see it’s often the season 1 of these shows, a way to upsell (to premium tiers) to continue watching;

20K on demand programs;

5 registered devices with 1 stream per account (vs 2 in most packages) unless you pay another 2€ on top to unlock a 2nd stream.

Where can it be accessed? The MyCanal app: web, mobile, Samsung, LG, Hisense, Apple TV, Fire TV, Android TV, game consoles.

Only stopping by? Consider subscribing to receive Streaming Made Easy 📫

Loving it? Consider sharing it with your network ❤️

Why this move?

Reason #1

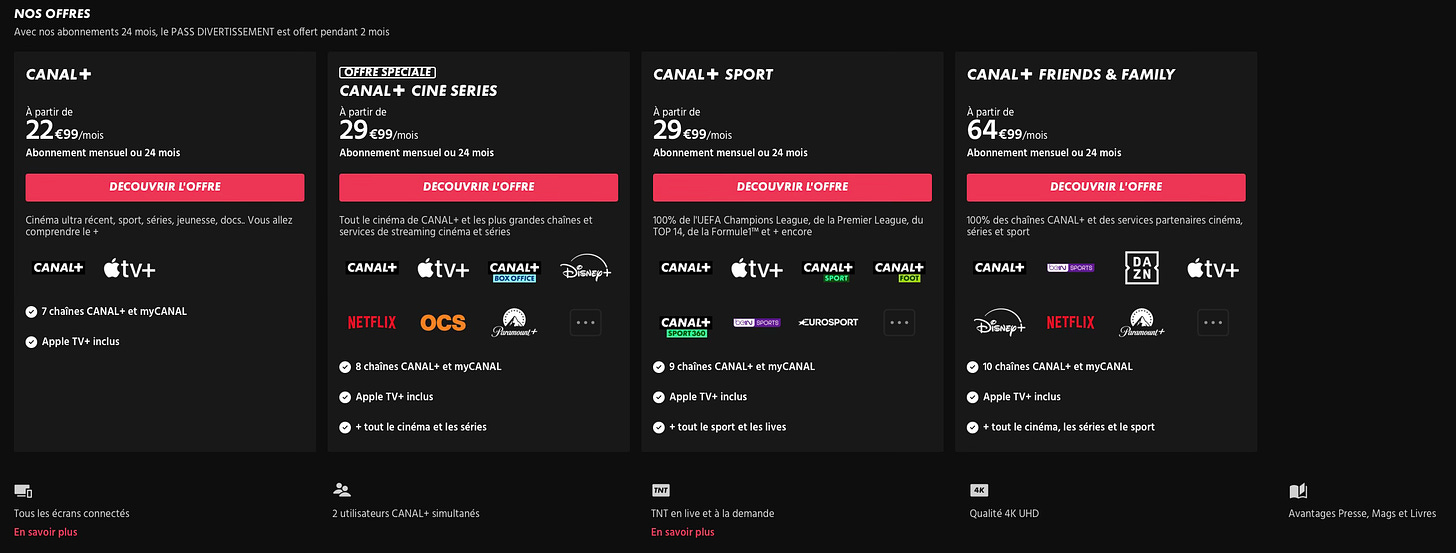

Canal+ is pricey. Regardless of how good it is, not everyone can afford it.

These last few years, they’ve made efforts to address new customer segments like younger demos (-26 years old) or TV series fans (with Canal+ Series) with cheaper packages but with 9.8M subscribers in a 30.8M household market, there is still room to grow.

Reason #2

TV usages are changing.

In France, we’ve had the particularity of plugging set-top boxes to our TVs to make them smart due to the high penetration of affordable triple play bundles (internet, landline, TV) which stood at 74.3% in Q3 2022.

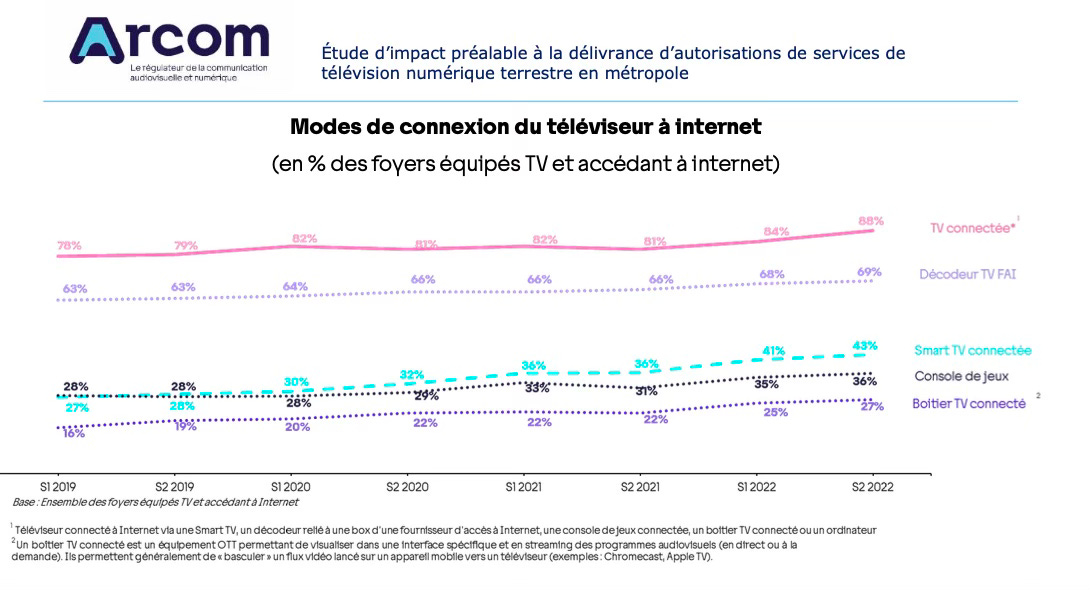

88% of TVs are somehow connected to the internet (via Smart TVs, dongles, STBs, game consoles) but look how high (69%) the operator STB is vs the CTV (43%).

Now wtihin 3 years, CTV grew from 27% to 43%. You can no longer dismiss CTV as a nice to have aspect of your distribution strategy. TV+ complements Canal+ existing CTV strategy by offering a low priced entry point to its entertainment hub.

Reason #3

They can work to upsell these subscribers to higher priced packages.

It could also be used as a retention tool i.e. you push the offer to subscribers leaving you.

With this move:

Canal+ shows it’s determined to be the single entry point in an increasingly fragmented market made of Telecom operators (who sell triple and quadruple bundles), vMVPD Molotov (whose entry-level package sits at 6.99€), CTV platforms (ambitioning to become the default entertainment hub), broadcasters (like TF1+ or M6+), streamers, social media platforms, all of which are fighting for our wallets and our daily attention.

But is a TV-only package (even priced so cheap) what customers really want in a world dominated by Youtube and Netflix?

I have my doubts but eager to see the 1st subscription numbers (if ever).

In the meantime, my advice to French Telecom operators: revamp your OTT strategy. Canal+ is coming after your Pay TV business and so are CTV platforms. Now is the time to launch true OTT offerings i.e. without a set top box requirement.

For more on European bundle strategies ↓

That’s it for today but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

On top of Streaming Made Easy, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my LinkedIn following + my Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.