Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

My Best Finds 🔎

The most interesting piece I read on how US streamers aim to rethink how they pay talent.

A similar move is taking place in France but it’s coming from the talent, not the streamers. In a column, 7000 actors and actresses accuse streamers of violating a law which came into effect in 2019 in Europe and in 2021 in France. The law indeed states that platforms must offer an additional remuneration based on the program’s performance. No luck so far.

Warner Bros Discovery recently announced the launch of Max in France on June 11th.

I consider this launch to be the most challenging one to date for Warner Bros Discovery.

Why?

It follows over a decade-long partnership with local French Pay TV player OCS (created by Orange and now part of Canal+) who built the HBO brand locally.

It happens at a time when streamers have more doubts than certainties on their ability to win in new markets.

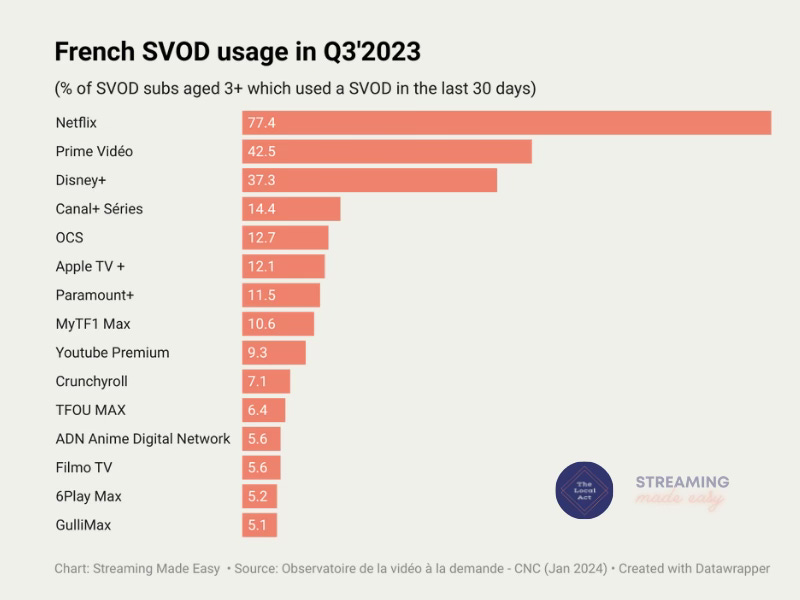

France will likely be no exception. The market is indeed crowded and despite a 4.3% increase in SVOD penetration (to reach 57.5% in September 2023 according to the NPA/Harris Interactive OTT Barometer), French subscribers use on average 2 services with only 6.6% of SVOD subscribers using more than 3 services.

How do you get a spot in the Top 5 then?

Let’s dig in.

Today at a glance:

HBO Through The Years:

From 2008-2022: The Traditional Licensing Approach

2023: Transition and Laying Foundations

2024 And Beyond: All In On Streaming

What’s Next?

From 2008-2022: The Traditional Licensing Approach

It feels like ancient times.

A time when US companies like HBO relied on distribution deals with local players to showcase their content to European audiences. It was what some like to call: the content arms’ dealers’ era. You have content, you license it to players with an audience, they build you up locally.

Throughout the years, HBO collaborated with many partners in key markets e.g.:

With these exclusive deals, local broadcasters had the 1st or 2nd Pay TV windows to the HBO’s catalog meaning they were the 1st ones to release new shows like Game of Thrones and exploit HBO’s deep library of programs.

I witnessed first hand the collaboration between HBO and OCS to launch news series 24-48 hours after the US broadcast then day and date (i.e. simulcast). It’s no brainer today to operate day and date but it was no small task at the time (especially with piracy concerns around such premium IPs).

In France and in Sky’s territories (UK, Germany, Austria, Switzerland, Italy), HBO also licensed its brand name. Hence why OCS was tagged “The Home of HBO” and why Sky launched '“Sky Atlantic” to offer a home to all the HBO content.

All these local players built the HBO audience and brand in Europe. It’s a shame to see the HBO brand gone. The content speaks for itself but still it means starting the brand building from scratch.

During this period, HBO has had no direct customer relationship which means they have a whole new playbook to put in place.

The OCS output deal ended in December 2022 and the Max launch is set for June 2024 so what happened to HBO in 2023?

2023: Transition and Laying Foundations

With the OCS output deal gone, HBO had to find a new home for its library.

They knew Max was a year or so away and had to shift quickly towards a direct-to-consumer model which saw the launch of the “Pass Warner” .

Why is there more than HBO in this Pass? Because in January 2023, WBD and Canal+ failed to reach an agreement for the renewal of their TV channel deal leaving these channels orphans of the Canal+ audience.

What is Pass Warner?

Model: SVOD

Launch date: March 2023

Content Depth: films, series and documentaries from their entire portfolio (HBO, TCM Cinéma, Boing, Toonami, CNN, Cartoon Network, Discovery Science, Boomerang, Adult Swim, Eurosport, ID, Discovery Channel, WB TV) as well as Cartoonito (a kids TV channel launched by Warner Bros Discovery in April 2023)

Pricing:

9.99€ per month (7-day trial)

Distribution: add-on subscription within Prime Video France

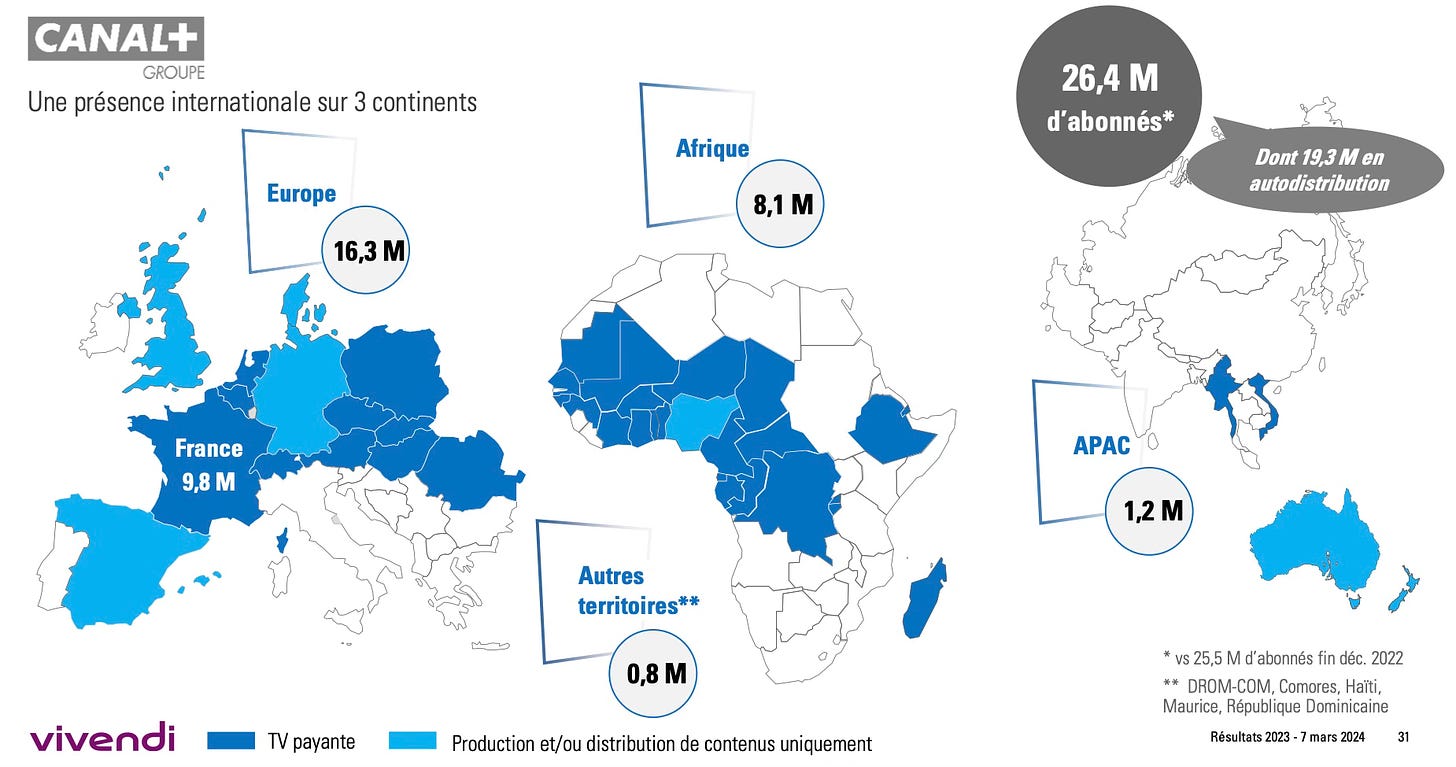

This must have been a challenging year because despite the unquestionable strength of Prime Video in France (with 12M Prime Video subs), WBD no longer had OCS (and its estimated 3M subs), nor Canal+ 9.8M subs.

I bet teams couldn’t wait to see Max finally going live.

Only stopping by? Consider subscribing to receive Streaming Made Easy 📫

Loving it? Consider sharing it with your network ❤️

2024 And Beyond: All In On Streaming

Fast forward to today, Max will offer 3 tiers:

Basic with ads at 5,99€/month with 2 concurrent streams in Full HD;

Standard at 9,99€/month with 2 concurrent streams in Full HD, 30 off line download (1st time I see a limit like this). All the TV channels from their portfolio (Warner TV, Discovery Channel, Cartoon Network, ...);

Premium at 13,99€/month with 4 concurrent streams in 4K UHD + Dolby Atmos and 100 offline downloads.

A Sports Add-on at 5€/month for the Eurosport channels with 2 live streams.

The ad inventory will be sold by Canal+ Brand Solutions. CPMs will be lower than Netflix and the ad load will be small as they ramp up.

Who are the distribution partners?

« As many partners as possible, as soon as possible »

Clément Schwebig - President Western Europe & Africa

That I love.

You see the know how of the local WBD teams who know that you can’t win with platform exclusivity, with Connected TV only or without bundles.

Launch partners include: Canal+, Prime Video, Orange, Free, Bouygues, SFR. There’s no mention of Samsung, LG and co. but given their existing global deals with these platforms, the app should be live in time for the launch.

The one distribution deal which will make a difference is the bundle with Canal+.

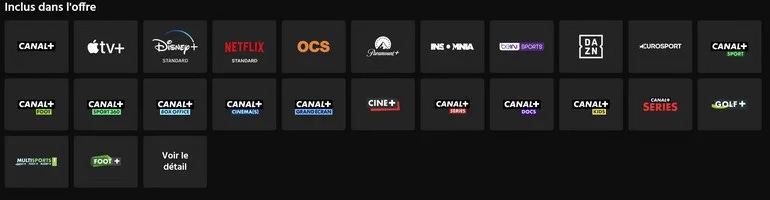

Max will indeed be included in several C+ bundles: Canal+ Cinéma Séries, Rat+, Friends & Family, Intégrale.

Why it matters?

It’s an instant x millions of subs. I say x because Canal+ doesn’t break down its 9.8M subscribers by tier.

Max will be in good company with other US streamers:

Bundle Ciné Séries

Bundle Friends & Family

How is the launch timing?

Great and not so great.

Great because Max arrives a week before season 2 of House of the dragon and a few weeks before the 2024 Paris Olympics (Free to air broadcaster France Télévisions & Eurosport are the official French broadcasters).

Not so great because they are late to the party. Launching in 2024 when most global competitors have been in market for several years (Disney+, Apple TV+, more recently Paramount+) or even 10 years in the case of Netflix, means they will have to claw their way in to the top.

SVOD stacking is also not a thing in France: French subscribers use on average 2 services with only 6.6% of SVOD subscribers using more than 3 services.

What’s next?

The UK, Germany, Austria and Italy are next since the output deal between Sky and WBD ends at the end of 2025 meaning a Max launch in these markets in 2026.

What will the Sky / WBD partnership look like?

With its 17,78M customers in Q1 2024, Sky is a must have partner for WBD but not as part of an output deal play as stated by Gerhard Zeiler in a recent interview.

“We see it every single day — that this content is working. Every single day we see the ratings for the Warner Bros. and the HBO content which we sell to Sky.

Sky was always a great partner for us, and it’s still a great partner today. That’s number one. But we want, we need to, and we will launch Max in these three markets. These are three of the most important markets outside of the U.S.

There is no reason we should not do that. Why should we disadvantage ourselves by not launching Max?”

Gerhard Zeiler, president of Warner Bros. Discovery international

Their partnership could resemble the Canal+ one (both companies are MVPDs i.e. multichannel video programming distributors) with a wide range of bundles.

How about Sky Atlantic though?

There’s more to Sky Atlantic than HBO content as Sky has long been producing its own originals (e.g. Chernobyl, Gangs of London etc.) but could the channel get premieres or 2nd windows to HBO’s content?

Let’s check back in 2026.

That’s it for today but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

On top of Streaming Made Easy, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my LinkedIn following + my Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.