Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

ICYMI 🔥

TF1+ expands to Belgium, Luxembourg and Switzerland. The beauty of streaming? You can cross borders more easily but will the TF1+ content offering be as appealing as in France? With 321M French speakers globally, I see the potential but you need to rethink your acquisition strategy to avoid a sub-part content offering outside of your core market.

“Time to cheap in CTV” says the French Telco players. Reasoning: as CTV players distribute TV services, they should pay the CNC tax (which funds content creation) like they do.

Today’s piece is part of a recently launched Series called “Local Heroes”.

The 1st edition focused on TF1 and its streaming service TF1+.

The 2nd edition got you up to speed on Freely, the latest initiative by UK broadcasters.

The 3rd edition had to be about French commercial broadcaster M6.

Why?

No it’s not because I’m French and have a soft spot for French players (although …).

The reason why I chose M6 is that they had to make this move with the launch of M6+ for the same reasons TF1 made theirs with TF1+.

Both companies attempted to merge in 2021 to later abandoned the project as the requirements imposed by the French competition authorities rendered the merger pointless.

The merger aimed to build a strong local champion to compete against big tech.

Without it, it became urgent, for both broadcasters, to rethink their strategy to stay competitive in this landscape where broadcasters, streamers and social media platforms fighting for eyeballs and ad $$.

Let’s see where M6 is at now.

Today at a glance:

The Genesis

The Portfolio

The State Of Play

The Merger

The Value Proposition

The Ambition

The Genesis

M6 is a free to air channel launched on March 1st, 1987 by CLT (Compagnie Luxembourgeoise de Télédiffusion). It took the slot n°6 on French Television from a music channel called TV6.

The ambition: “a new way to do television” with movies, TV series, magazines, news and a lot of music for the young demos according to its CEO, Jean Drucker. 30% of the programming had to be dedicated to music.

For a long time, it was nicknamed “the one too many” (“la chaîne de trop” in French) but later renamed “the small channel that grows” (“la petite chaîne qui monte ») proving it deserved its spot in the French TV landscape.

The Portfolio

M6 is most known for its broadcasting business but there’s more to the company. M6 is indeed:

→ A network of Free (M6, W9, 6ter, Gulli) and Pay TV channels (Paris Première, Téva, Série Club, M6 Music, Tiji, Canal J, RFM TV, MCM et MCM Top).

→ A network of 3 radio stations (RTL, RTL2, Fun Radio).

→ A network of digital platforms (6play, Gulli Replay, Gulli Max).

→ A content producer & distributor (in and outside of France) with SND, M6 Studio, M6 Film etc.

→ A powerful advertising sales house (M6 Publicité).

→ A technology company with Bedrock Streaming which is behind the D2C platforms of M6 and RTL Group (M6 owns 50% of the venture).

→ A music publisher, a merchandising powerhouse with M6 Interactions and so on.

M6 isn’t confined to France as it has businesses in Canada, Portugal, Africa, Brazil etc.

The State Of Play

What is M6’s Linear market share?

On a stand alone, it’s the 4th most watched free to air TV Channel in France with 8.1% of market share (down by 0.3% YoY).

With sister free to air channels included (W9, 6ter, Gulli), M6 holds a 13% market share (down by 0.5% YoY) amongst the 4+ demo. The number goes up to 20.5% for the 25-49 year old demo.

For reference, Public company, France Télévisions Group, is n°1 with 29.3% of market share, and TF1 Group n°2 with 26,9%.

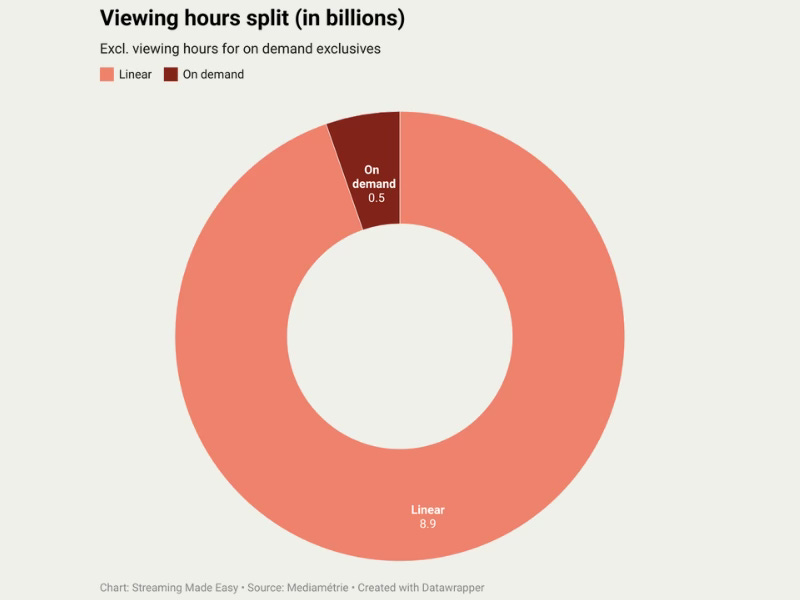

According to their Annual 2023 earnings, M6 garnered 9.4B viewing hours in 2023.

On demand viewing represented only 5.6% via 6play and Gulli Replay.

6play (their on demand platform) had an average 16.6M monthly users (1/3rd of viewers are below 35 years old).

What about their revenue performance?

2023 brought a 0.7% YoY decrease of the Group’s revenues (to 1315.6M€).

The ad revenues were down 1.5% (with TV ad revenues registering a 2.2% decrease).

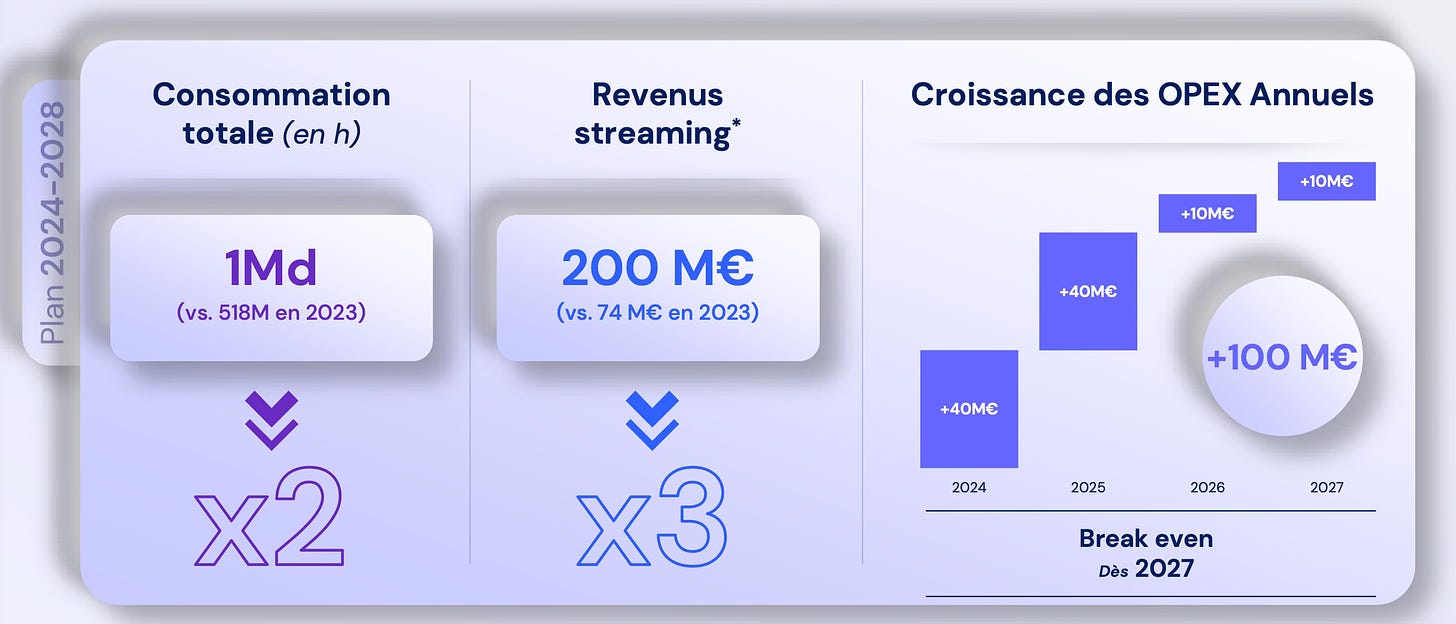

5.6% of engagement brought in 7.1% of revenues with streaming (digital ad revenues + subscription revenues) at 74M€ in 2023. There’s room to grow for sure.

Only stopping by? Consider subscribing to receive Streaming Made Easy every Friday morning

Loving it? Consider sharing it with your network ❤️

The Merger

Bertelsmann (which owns the RTL Group which in turn owns 48,3% of M6) was looking to sell its French and Dutch businesses.

The Dutch sale went through in a 1.1B€ operation (RTL NL with Videoland are now part of the DPG Media Group).

The French one didn’t.

Why?

The French Authorities considered that the TF1/M6 pair (with -/+ 70% of the TV advertising business) would represent a threat to the French audiovisual market.

To approve the merger, they stated a set of requirements (including having TF1 or M6 leave the merged group) which led the two groups to give up on the merger.

M6 was still up for grabs (suitors included Banijay) but timing was poor for a sale as M6 was applying for a new license in 2023 and was therefore prevented from a change of controlling shareholders for the next 5 years.

This left TF1 and M6 with a blank page as to their next moves.

TF1 launched its streaming service TF1+ in January 2024.

M6 will launch theirs mid May.

The Value Proposition

M6 launched their catch up service, M6 Replay, back in 2008.

The service was revamped and renamed 6play in 2013.

In 2022, 6play Max (an ad-free version of 6play) came to be.

2024 brings us M6+.

What does the service offer?

M6+ will be “more immersive, more engaging and more accessible”.

30K hours of programming (incl. 10K programs exclusive to the platform) available on demand, across an array of content formats and genres: TV series, movies, sports, factual, news etc.

Series Boxsets

A Hayu corner with the best of reality TV.

1K podcasts

Features: vertical videos, fan engagement features, a new gen search engine boosted by AI, cast, profiles, device management

A device coverage said to each 95% with 20+ partners including in car entertainment.

Live TV feeds

20+ FAST feeds

Ad-free tier (today 6play Max is at 4.99€).

Let’s check in again when the service is live to discuss look and feel plus their actual distribution network.

The Ambition

The ambition is clear: doubling the streaming hours and tripling the revenues by 2028.

This looks attainable in 4 years time.

The question though: what will their Linear TV business look like by then? Stable at best? Can they attract a new pool of advertisers on TV and in Streaming?

I’m eager to see David Larramendy, former advertising boss, taking over Nicolas de Tavernost stepping down as chairman of M6 after 24 years in the role.

The choice of a “Mad Man” (Madison Avenue Man) is calculated.

M6 must be aggressive in growing its advertising business in a competitive landscape.

As Thomas Rabe, CEO RTL Group said:

“We will continue to pursue our strategy to build national media groups of sufficient size to compete with the US platforms”

At least until 2028 when their broadcast license is up for renewal again…

That’s it for today but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

On top of Streaming Made Easy, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my 6.3K LinkedIn following + my 4.5K Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.