Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

© TF1 “Spoiler alert: at the end, all of our TV series are free”

ICYMI 🔥

There’s a new kid in OS town: meet Titan OS. It’s European, it’s independent and it’s a spin off of TP Vision (formerly Philips) so it’s no newbie to the CTV biz.

Netflix & WWE’s Raw are a perfect fit because it’s first and foremost: entertainment (ok maybe a sport too).

A great example of a 360 strategy centred around a sports IP with the Super Bowl activation across CBS, Paramount +, Nickelodeon and Pluto TV.

Today’s piece is part of a newly launched Series called “Local Heroes”.

Why this Series?

We, rest of the world, follow closely the latest trends and developments in the US which can sometimes blind us.

We must have a distinct read of what’s happening in our markets.

For this 1st edition, I chose French commercial broadcaster TF1.

Why TF1?

It perfectly embodies the modern day challenges of an almost 50-year old commercial TV broadcaster in Europe: declining linear viewership, rocky ad market, competition from streaming, social media.

Today at a glance:

The Genesis

The Portfolio

The State Of Play

The Trials And Errors

The Streaming Era

What’s Next?

The Genesis

TF1 stands for Télévision Française 1.

The free to air channel launched on January 6th 1975 and broadcasted 60 programs per week. In 1977, they had a 50.4% market share.

The company was initially a public company but was taken private in 1987 by the French government.

The Portfolio

TF1 is most known for its broadcasting business but there’s more to the company. TF1 is indeed:

→ A network of 9 TV channels

→ A network of digital platforms (MyTF1, MyTF1Max, Tfou Max etc.)

→ A Content Producer & Distributor (in and outside of France) with TF1 Studios, Newen Studios (and its 50 production labels).

→ A powerful advertising sales house (TF1 PUB)

→ A Performing Arts Content Producer, a Music Publisher and so on.

It busts the myth of the dying linear network company who couldn’t transform itself.

The State Of Play

However, it’s undeniable that TF1, like fellow European and US commercial broadcasters, faces major headwinds:

→ A structural decline of Linear TV viewership.

→ An aging core audience.

→ A (not so) contextual decline of Linear Ad revenues.

Médiamétrie (our Nielsen or BARB) released its 2023 numbers and French individuals aged 4+ watched 3h19 of television daily (vs 3h26 in 2022).

No demo is spared but year on year:

Women below 50 (a core segment for advertisers) decreased their viewing time by 12 mins (good news though, it’s half of the year prior which saw a 25-min decline in 2021 vs 2022),

The 25-49 or 25-59 years old are the ones who decreased their viewing time the most (-16 mins).

A stable number of people still watch TV (down by 0.4%), we simply watch less of it.

Note: From January 1, 2024, Mediamétrie will take into account TV consumption by all French people, on all screens and in all locations (before they looked at households equipped with at least one TV set, and measured the audience on TV screens at home, as well as on all screens (TV, computer, mobile, tablet) outside the home).

Only stopping by? Consider subscribing to receive it every Friday morning

Loving it? Consider sharing it with your network ❤️

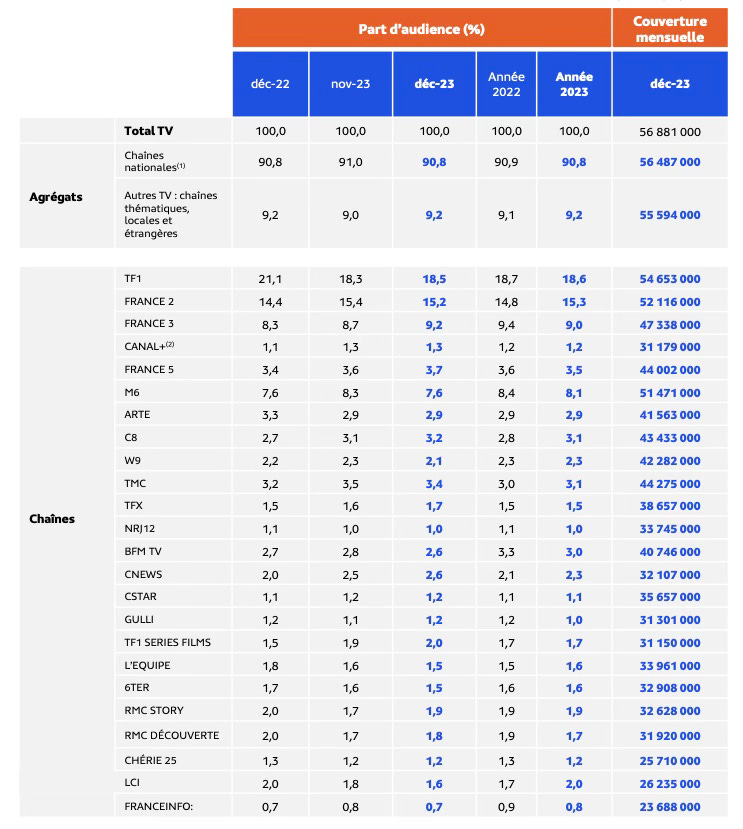

What is TF1’s market share?

On a stand alone, it’s the most watched free to air TV Channel in France with 18.6% of market share (down by 0.1% YoY).

With sister channels included (TCM, TFX, TF1 Séries Films, LCI), TF1, as a group, is n°2 with a 26,9% of market share (down by 0.3% YoY).

Public company, France Télévisions Group, is n°1 with 29.3% of market share.

What about their revenue performance?

According to their Q3 2023 earnings, the 1st nine months of 2023 brought a 11.1% YoY decrease of the Group’s revenues (to 1,547.5M€).

The production arm, Newen Studios, dragged the company’s results (with a 33.6% revenue decrease) due to “Tough comparison basis: termination of soap opera ‘Plus belle la vie’ and activity with SVOD Salto; delivery of flagship series ‘Liaison’ and ‘Marie-Antoinette’ in Q3 2022”.

The ad revenues were down 4% but MyTF1 ad revenues brought in 16.4% more revenues than in 2022.

The Trials and Errors

The company didn’t stand still and understood early on the need to address audiences who didn’t want to tune in (or not as much) to watch live TV.

They launched their catch up service, MyTF1, back in 2011. In 2021, MyTF1 Max (an ad-free version of MyTF1) came to be (a move that UK broadcasters made years ago too e.g. former ITV Hub).

The main reason behind that launch?

Sure, it was a way to address consumers who wanted to get rid of ads, offer premieres to upcoming shows. But it was also a way to launch on CTV without angering (breaching) the Telcos (deals).

Let me explain.

In France, Telcos started paying to carry TF1 in the 2010s after months of intense negotiations.

Then here came Connected TVs looking to carry the MyTF1 app with no intention of paying carriage fees.

On CTV, you couldn’t watch the linear feed and catch up programming unless you had MyTF1Max, see the trick to keep Telcos happy?

This greatly limited the adoption of MyTF1 on CTV.

The Streaming Era

The last 3 years have been rocky:

→ TF1’s premium SVOD joint venture, Salto, with fellow broadcasters M6 and France Télévisions, closed in March 2023.

→ Their merger with fellow commercial broadcaster M6 was killed by French Anti-trust authorities.

A new CEO, Rodolphe Belmer (ex- Canal + and ex-Netflix board member), joined at the end of 2022.

A year or so later, TF1+ came to be.

What is TF1+?

A brand new free streaming service (their words, not mine).

Exit replay, catch up, AVOD. Enter streaming, streamer, monthly active user.

Words matter.

TF1 is determined to be more than a Linear TV Broadcaster. With this launch, they truly enter their streaming era.

What does the service offer?

15K hours of programming, available on demand, across an array of content formats and genres: TV series, movies, sports, factual, news etc.

Revamped programming grid with:

The disappearance of the Kids slot replaced by “Bonjour” a new morning show to compete with France Télévisions.

The come-back of daily soap “Plus Belle La Vie” (formerly a France Télévisions program).

Series Boxsets

Live TV feeds (except thematic channels TV Breizh, Ushuaia TV, Histoire…)

50+ FAST feeds

Extended content availability (from 7 to 30 days post broadcast)

Cool features: Top Chrono (AI generated sports recap), Synchro (a recommendation engine for co-viewing).

Ad-supported with a premium tier (5.99€ / 59.99€).

A new ad value proposition with Signature+ which offers advertisers an exclusive mono pre-roll slot on the Top 10 Most Watched Programs. The 1st advertisers include: Aldi, Bouygues Telecom, Dacia, KFC, L’Oréal Professionnel, le Groupe LVMH, Renault, Société Générale).

This resembles the ITV X playbook.

What does it look like?

See for yourself 👉 here

Where is it available?

As a distribution nut, it’s the piece I love the most.

TF1+ goes live across Telcos (with deals with Orange, Free, SFR and Bouygues) AND CTV OEMs all at once (Samsung, LG, Fire TV, Android TV, Hisense, Sony, Apple TV, Philips etc.).

No deals with Canal+ and Molotov (part of Fubo) yet who will therefore keep distributing MyTF1 as is.

This list of partners is a sign that you can’t rely on set top boxes anymore, it’s time to invest further with smart TVs.

It may seem like a no brainer in other markets but we’ve been slower to embrace CTV.

During a radio interview, Belmer said Hisense TVs would feature a TF1+ button (on 2024 models). He downplayed it during the interview but it’s a big deal as it’s prime placement, a powerful short cut to your app and a known brand awareness play (as we hold the remote every day).

Another big change: the end of the flat carriage fee model with distributors said to be paying minimum guarantees and getting a cut of the ad revenues according to fellow publication Influencia NPA Conseil.

The 1st numbers

During the 1st 9 months of 2023, MyTF1 garnered:

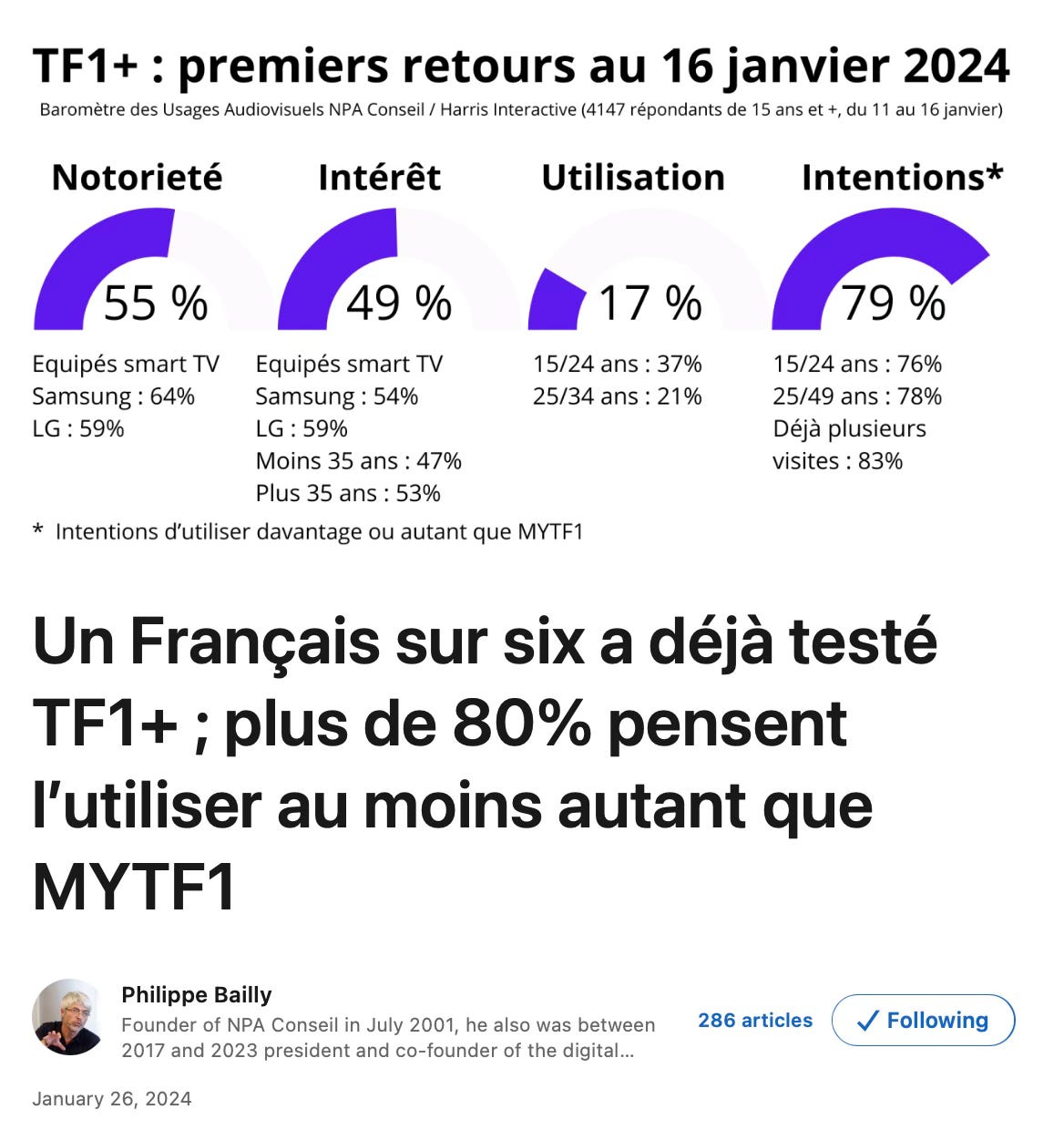

We’re 3 weeks in with TF1+ so it’s too early to tell but the 1st metrics they shared sure show promise:

+70% daily users

+80% video views

x3 account creations

For more post-launch insights, check out Harris Interactive / NPA latest barometer:

What’s next?

The ambition is clear:

“To be the free TV destination for family entertainment and news in France (…) and get a piece of the 2B$ French digital video business”.

Claire BASINI, MD B2C activities, TF1 Group, in an interview for Le Media Plus.

Today, the Group holds a 4-5% market share and the ambition is a double-digit one within 3 years.

Looking further down the line, the question is, of course, the ability for streaming to make up for the contracting linear ad market.

Only time will tell and it won’t happen overnight.

One thing is for sure: TF1 invests to be future proof and to become a broadcaster AND a streamer to the French.

That’s it for today but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and on Linkedin.

By day, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my 6K LinkedIn following + my 3.8K Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.