SME#49: Meet Four Players Working Their Way Onto Your Dashboard

In Car Infotainment Series - Part 2

Welcome back to Streaming Made Easy (SME).

I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

Last week, we dipped our toes into the waters of In Car Infotainment to understand what it is, how much it weighs and who has a stake in the space.

This week, we’re going to dig deeper into the value proposition for consumers and how existing players serve the segment.

Part 2 at a glance:

What do consumers want?

Who gives it to them?

What do consumers want?

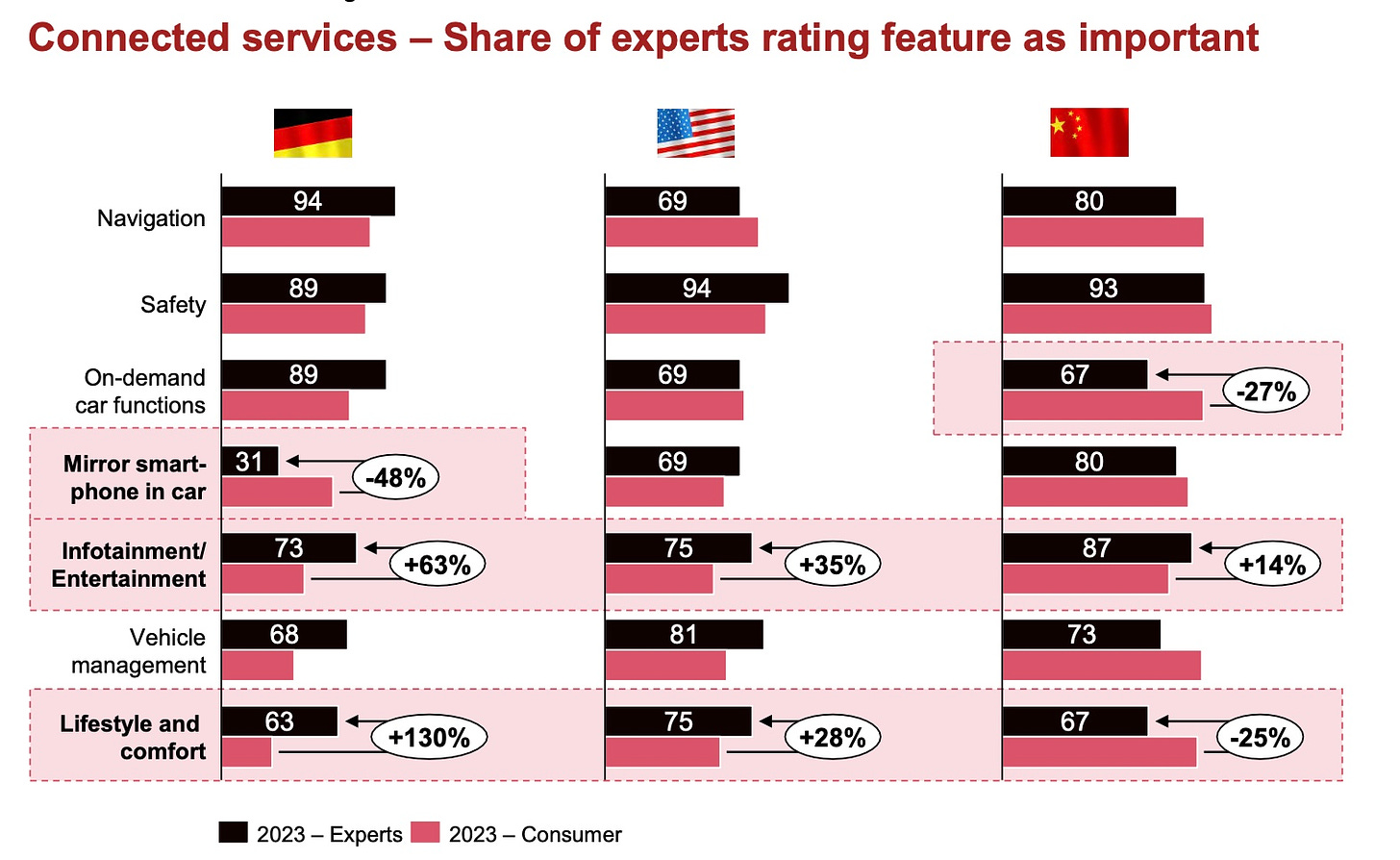

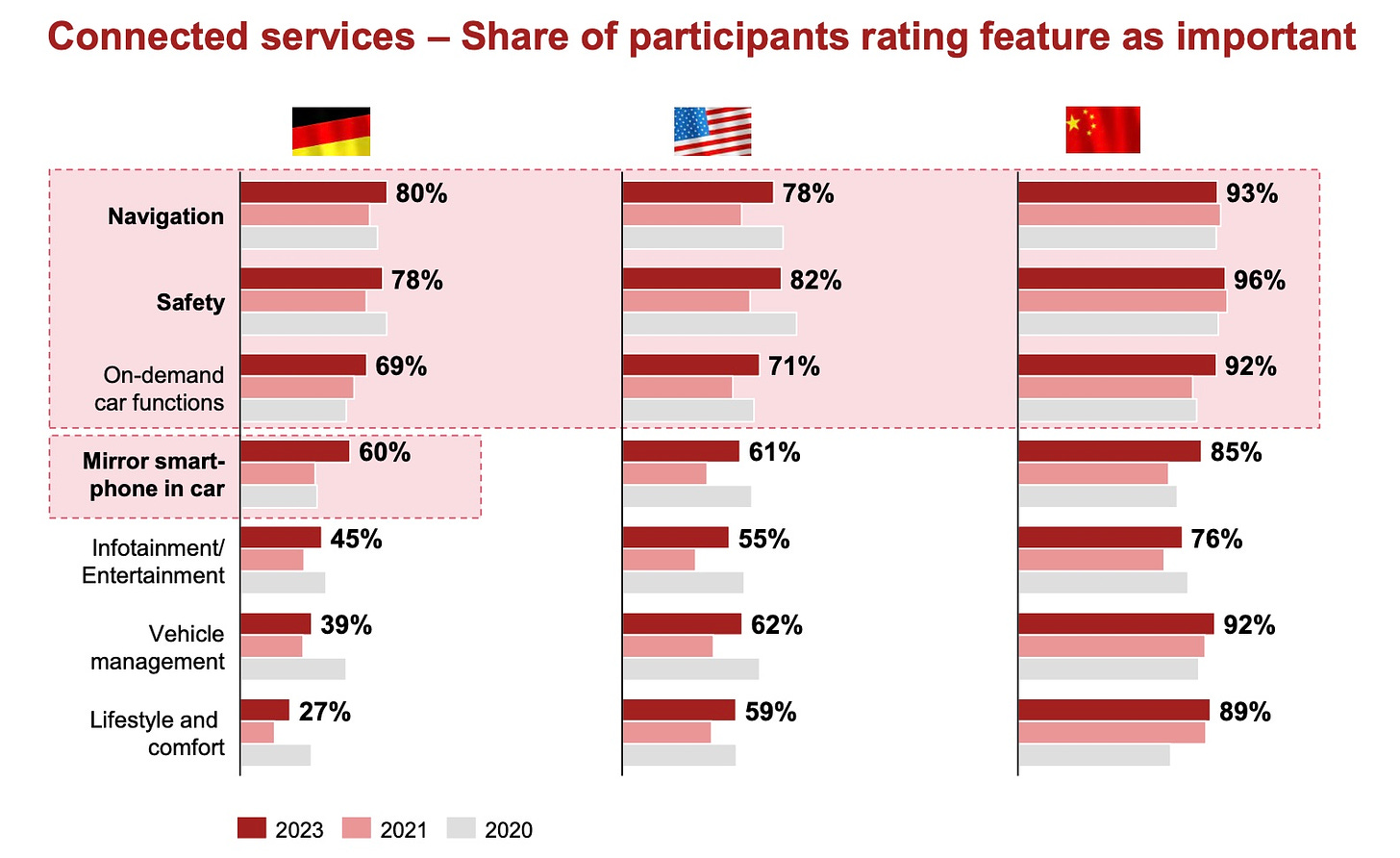

PwC conducted their 11th annual consumer survey (n = 3,000 in Germany, US, China) to understand consumer preferences in auto & mobility.

Fascinating to see PwC confronted consumers and experts in this survey. As an industry, we sometimes tend to project behaviours or needs onto consumers that they actually don’t have.

What are the connected services categories important to consumers?

It’s no surprise (and a relief) to see navigation and safety as the top features expected by consumers.

What about Infotainment/ Entertainment?

It comes 5th (behind mirror smartphone) with 45% in Germany, 55% USA and 76% China. It’s rated higher than 2021 but not so much versus 2020.

The survey suggests that younger consumers view infotainment/entertainment as more important.

Experts rate the importance of infotainment and lifestyle higher than consumers do. There you go ☺️

The survey doesn’t cover the actual use cases for In Car Infotainment. I had a chat with industry executives who mentioned the following ones:

while you drive (primary screen off, secondary screens on)

while you are parked

while you charge your car

in an autonomous car

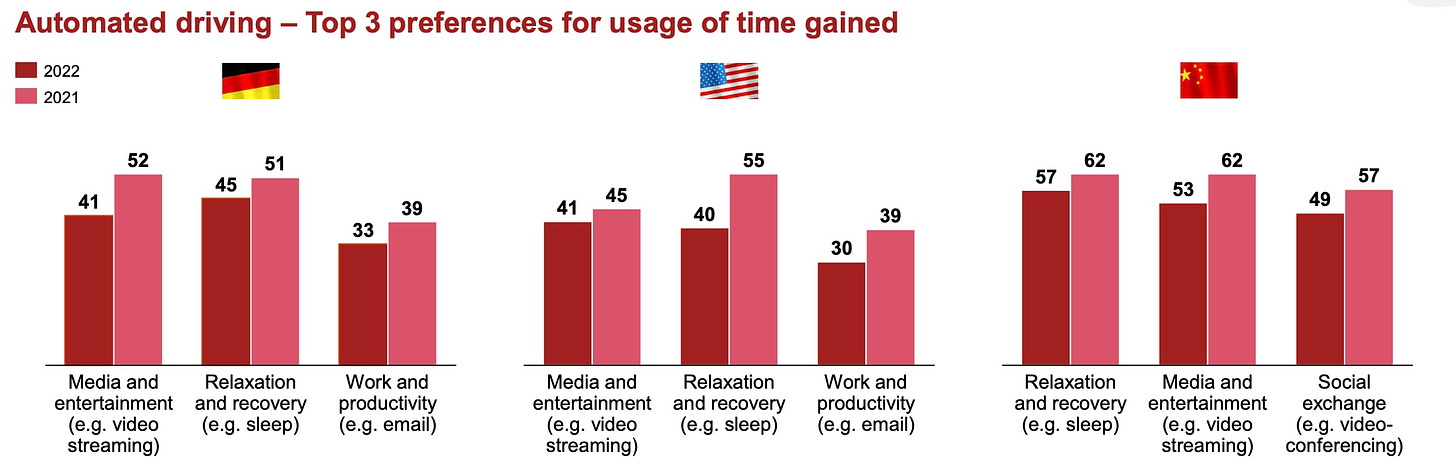

And on that, the survey shows that Infotainment would be a top 3 use case.

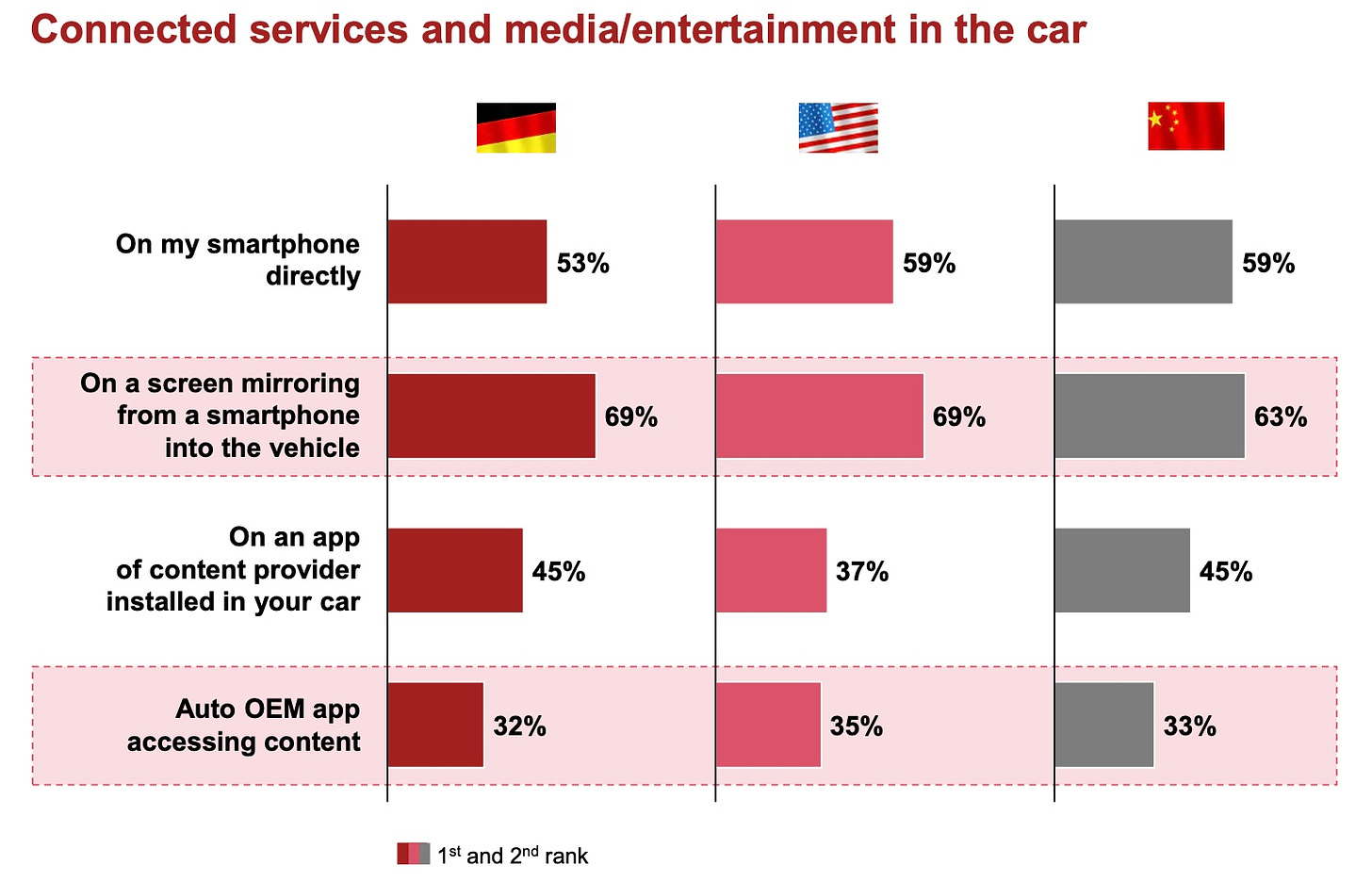

How do consumers want to access these entertainment options?

Tough competition from smartphones and screen mirroring features. Next in line is a content provider app while Car OEMs come last.

Who gives it to them?

Car manufacturers are first in line to provide an Infotainment experience but they will have to prove themselves as evidenced above.

Entertainment companies see this as another distribution opportunity.

OS providers are keen to contribute, if not take over.

Independent enablers could be decisive here.

I chose 4 European examples to illustrate each segment and how they go about building an enjoyable, yet safe, In Car Entertainment experience.

Disclaimer: this is not an exhaustive list.

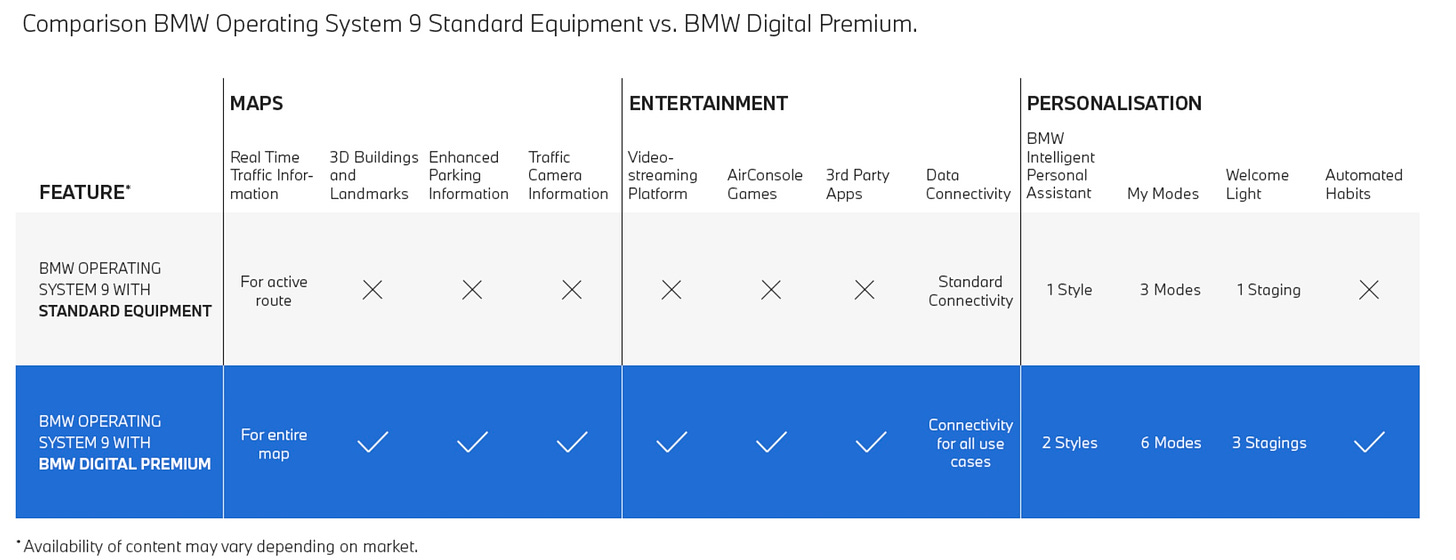

→ BMW iDrive

BMW opted for a buddy and build approach.

The buddy approach with Apple CarPlay and Android Auto support.

The build approach with iDrive and the BMW Operating System and the ConnectedDrive Store.

To get entertainment options, you need a Digital Premium Subscription (whose price I didn’t find) which is only available to BMW OS 9 Cars (2023 models onwards, no retro compatibility).

It claims to offer an extensive entertainment offering with access to country-specific third-party apps in the BMW ConnectedDrive Store for streaming music, podcasts, news, streaming videos and AirConsole games, but I couldn’t find a precise list of supported apps.

See for yourself here.

→ ScreenHits TV

ScreenHits TV is a UK-based platform which brings together all your favourite streamers into a unique TV Guide.

They want to solve the discoverability challenge viewers face when choosing what to watch next.

I spoke to Rose Hulse, CEO of ScreenHits TV, to understand how their automative journey came to be.

❓What made you jump into In Car Entertainment?

“We first became focused on automotive three years ago when we were approached by a few premium car manufacturers who discovered our consumer product and asked if we'd be interested in launching it as a launcher in their vehicles.

We have simply expanded our distribution reach and decided to become the main launcher to accessing all forms of video streaming and live TV in cars with a built in entertainment centre. We have essentially become a Smart TV solution for vehicles.”

❓What is the ScreenHits value proposition to car OEMS ? to their end users?

“ScreenHits provides multiscreen displays, integration with Dolby Atmos, Child Protection PINs, voice control, Watch Together, Gaming, and further Parental Controls. We are targeting customers that want to have a simple, easy solution to provide accessibility to their video subscriptions they are paying for, whether they are at home, on the go or in their car.”

Check out the Nio / ScreenHits TV integration:

→ Xperi TiVo

In a previous edition, I showed you “in action” the BMW 5-Series powered by TiVo.

It’s the perfect example of an OS provider looking to grow its footprint beyond TVs.

I spoke to Patrick Byrden, VP Business Development and Strategy at TiVo, to find out more about this partnership:

“The DTS AutoStage™ video service, Powered by TiVo™, brings an award-winning, content-first experience to the connected car, delivering free premium content across live TV, news, sports, movies and more. With the video service, consumers enjoy a personalized viewing experience tailored to their tastes, empowering them to choose what they want to watch.”

❓Where can I get one?

“The new generation BMW 5-Series are now in showrooms across the United States, Germany, United Kingdom, Italy, France, Spain, and South Korea.

All this varied entertainment content, across the globe, is continuously refreshed with over-the-air updates to adapt to the evolving in-vehicle entertainment landscape locally and globally and, importantly, it adapts to the car owner’s needs.”

Check out the BMW 5 Series with TiVo:

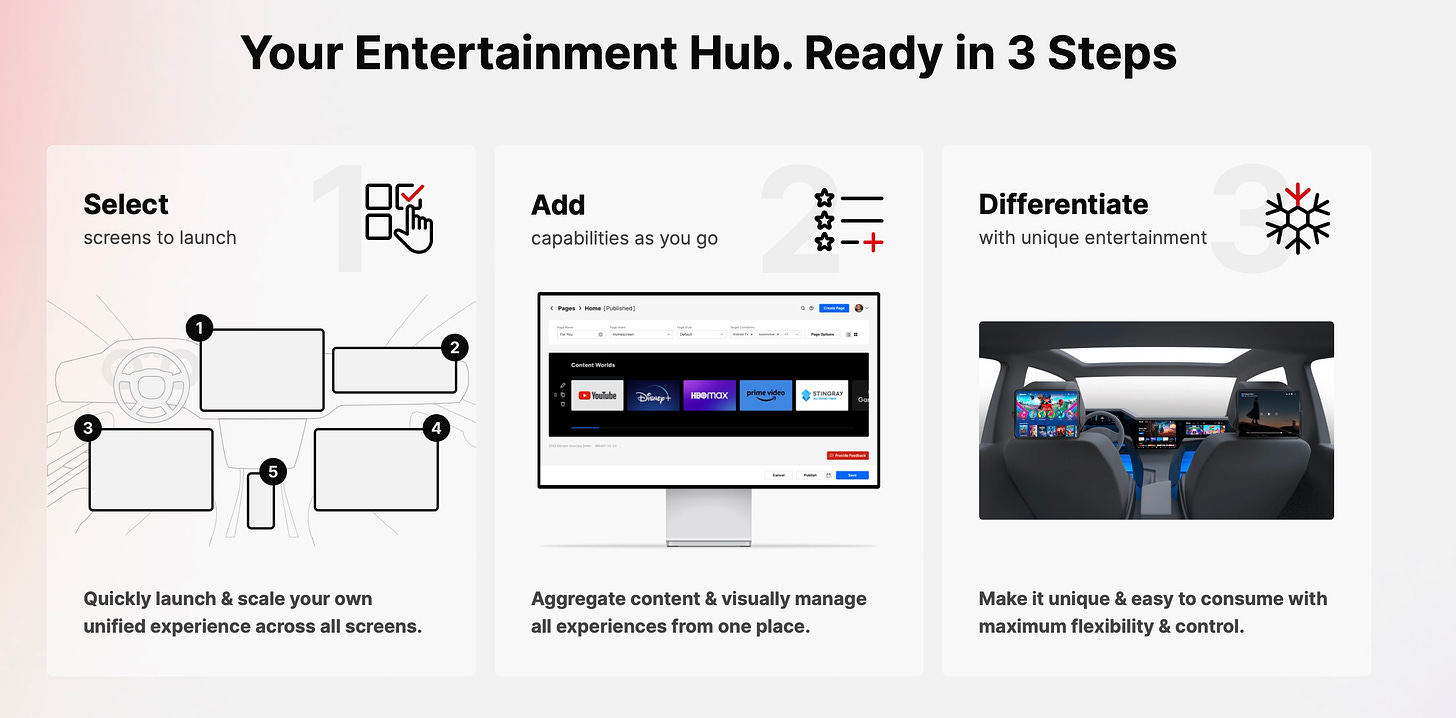

→ 3SS

I wanted to feature one last segment: Technology companies.

Why?

Entertainment Technology companies can be (and should be) a resource to Car OEMs.

How so?

I have serious doubts as to Car OEMs’ ability to build an entertainment platform from scratch.

It’s a world they don’t know.

It’s a lengthy process.

The alternative?

To rely on a 3rd-party’s expertise and integrate a while-labelled (or grey-labelled) solution which has done all the heavy lifting already for TV and can be tweaked for Cars.

German-based Technology Company 3SS is one of the companies with their 3Ready platform.

Check out their In Car Hub solution.

Car manufacturers can leave Apple & Google in full control or compete.

If the latter, then the right partnerships will be essential.

That’s it for today.

See you next week for another edition of SME but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. My “FAST Made Easy” masterclass has been in high demand.

→ Content Marketing: Explore how I can put my 5.5K LinkedIn following + my 3K Newsletter subs to work for your company like I do for mine.

I cater to Streamers, Distribution Platforms and Technology Vendors.

Ping me to see if we’re a fit.