Welcome back to Streaming Made Easy (SME).

I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

If you read my Summer Series on the TV OS landscape, you know Apple & Google run the mobile OS world and how crowded and competitive the Smart TV market is.

OS providers cannot rely on TV sets alone to grow their OS footprint.

They are therefore on the lookout for the next pockets of business: one is the dashboard of your car.

As it’s never been easier to receive connected entertainment on our phones, we expect this level of entertainment access wherever we are - including in a car.

Let’s dive into what the In Car Infotainment ecosystem has in store for us with a 2-Part Mini Series.

Part 1 at a glance:

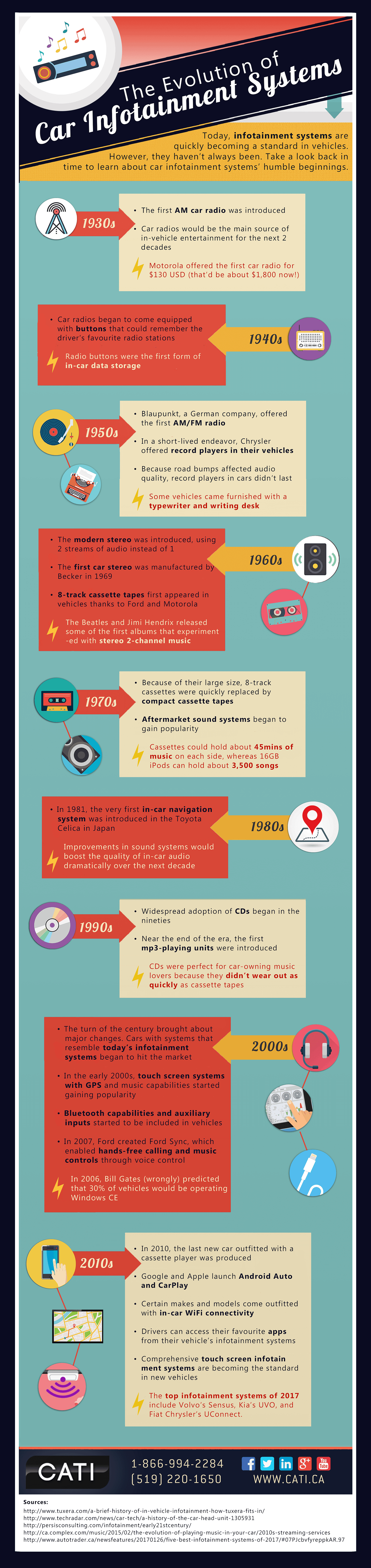

A quick (and visual) history of our Entertainment options on the road

An overview of the In Car Infotainment landscape

A quick (and visual) history of our Entertainment options on the road

It all started in the 1920s with the 1st radio, then cassette tapes, CDs came along to ultimately be replaced by touch screens and our mobile phones.

Is the mobile phone now the master of everything or built-in platforms stand a chance?

Let’s find out.

An overview of the In Car Infotainment landscape

First things first, what qualifies as In Car Infotainment?

In Car Infotainment is a suite of advanced features that is integrated into cars to provide entertainment, information, connectivity and communication.

How much does In Car Infotainment weigh?

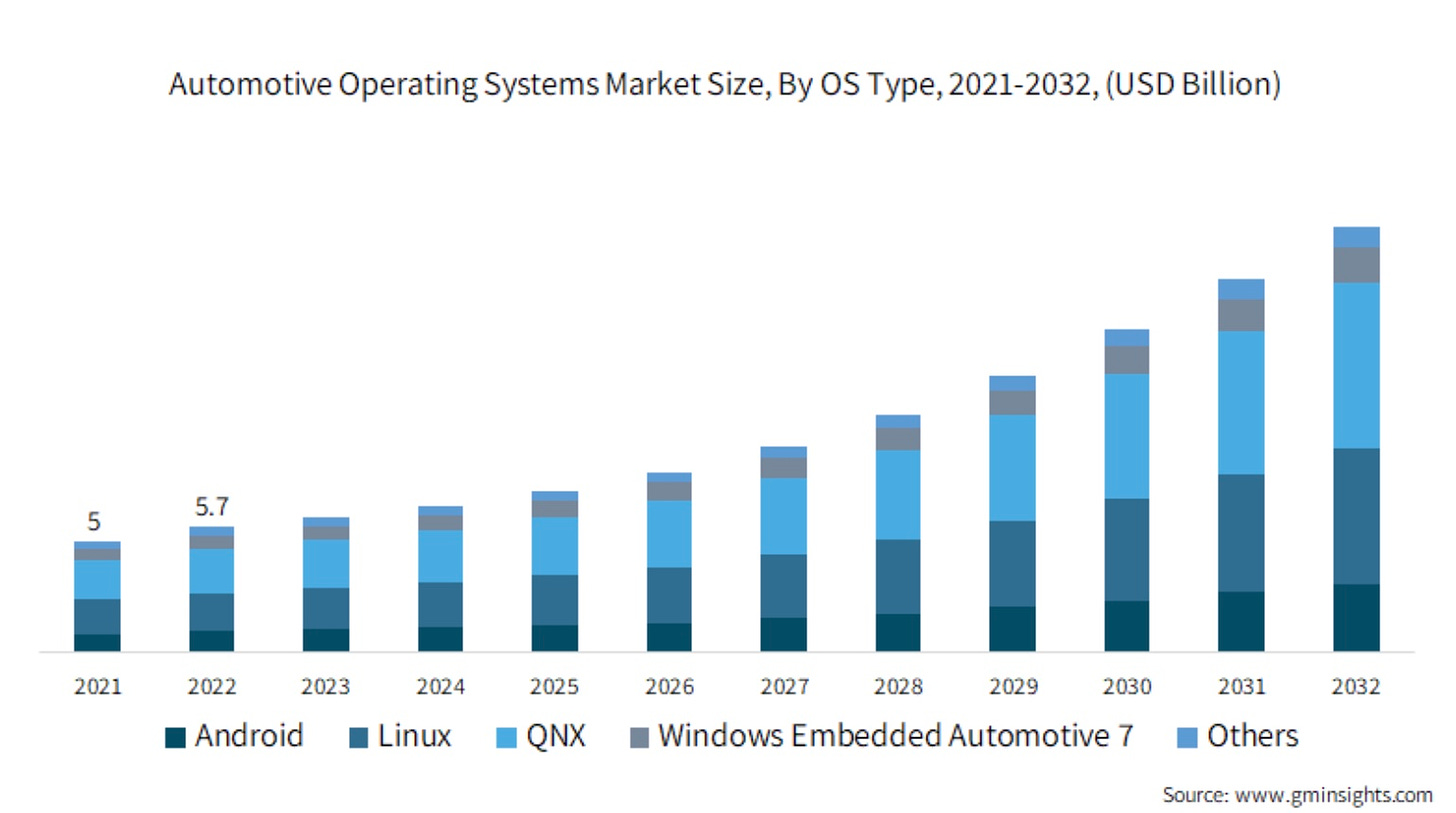

According to research companies Vantage Market Research and Straits Research, the global In-Car Infotainment market size was valued between 20.36B$ and 20.96B$ in 2022.

Growth estimates tend to vary:

→ 36.98B$ by 2030, growing at a CAGR of 7.12% during the forecast period (2023-2030) according to Vantage Market Research.

→ 50.6B$ by 2031, growing at a CAGR of 10.3% during the forecast period (2023-2031) according to Straits Research.

Quite the gap.

For reference, the Smart TV business weighed 211.42B$ in 2023 and is expected to grow at a CAGR of 11.4% from 2023 to 2030 to sit at 451.26B$ by 2030 (for more data insights).

What are the leading regions?

North America is the largest contributor in the global In-Car Infotainment market and is anticipated to grow at a CAGR of 9.9% during the forecast period.

Europe also has some skin in the game with its high-end car manufacturers (BMW, Mercedes to name a few) but it’s APAC who is expected to grow the fastest with a 14% CAGR between 2023-2028.

Who has a stake in growing this vertical?

Car Manufacturers of course.

Like any device manufacturer, they need to innovate both on the hardware and software fronts.

Between 2 equally beautiful and powerful cars, what can create an edge for one of them?

The In Car experience is one of the additional selling points.

Now for In Car Infotainment to become a thing, one needs an Operating System to run things.

This is where the OS providers come in and not just anyone: Apple and Google.

Both have invested the space early on (with the ambition of ruling the Car OS ecosystem like they do with mobile) with their respective Apple CarPlay and Android Auto ventures.

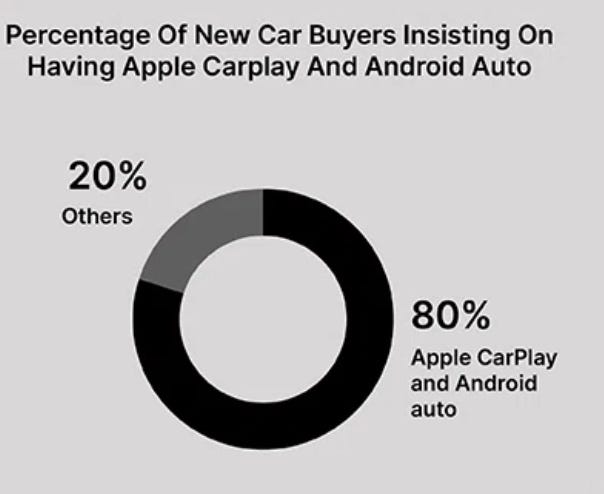

How big are they today?

A report from Straits Research found that 98% of newly produced vehicles were compatible with either CarPlay or Android Auto.

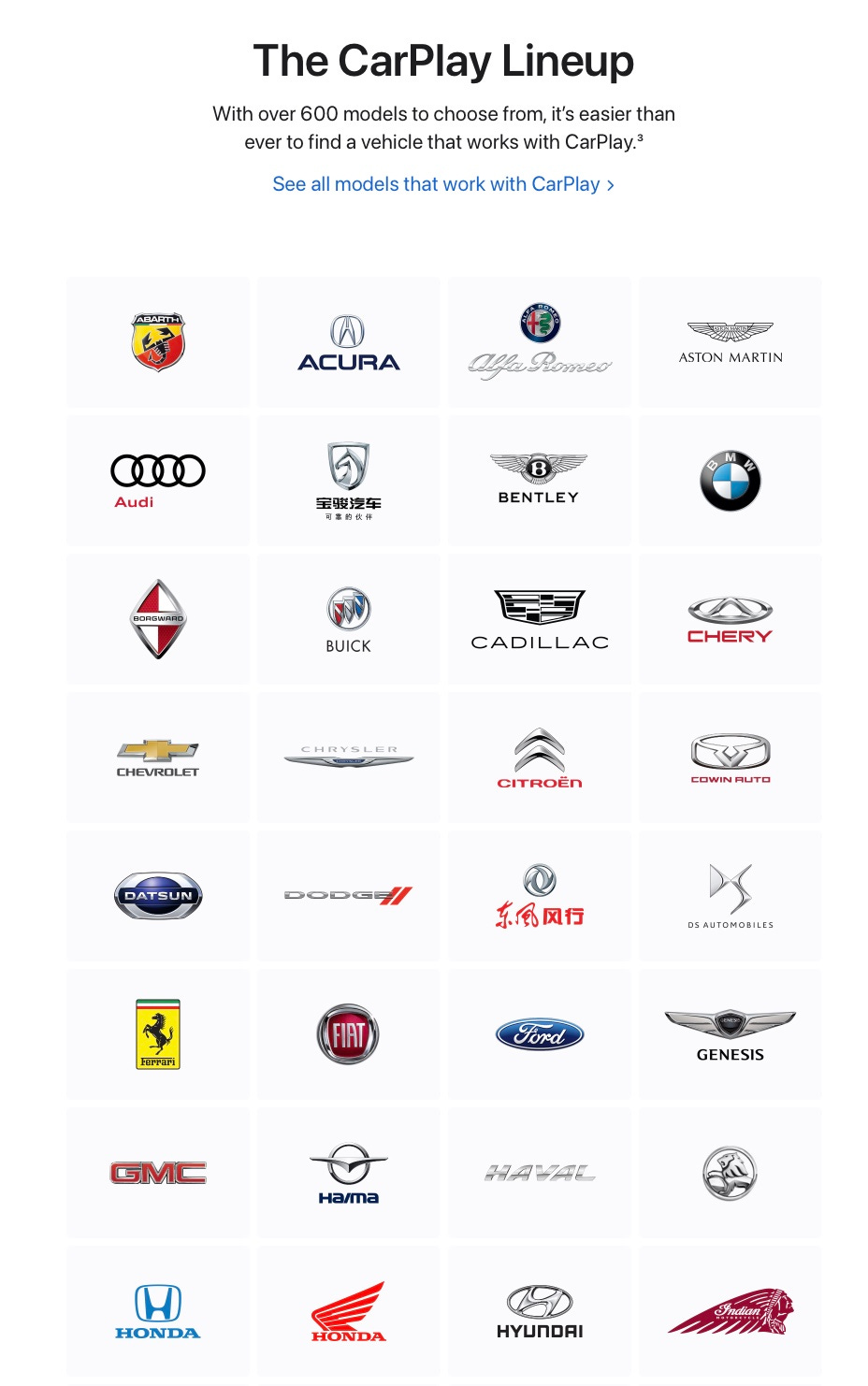

Apple CarPlay is embedded in 600 car models.

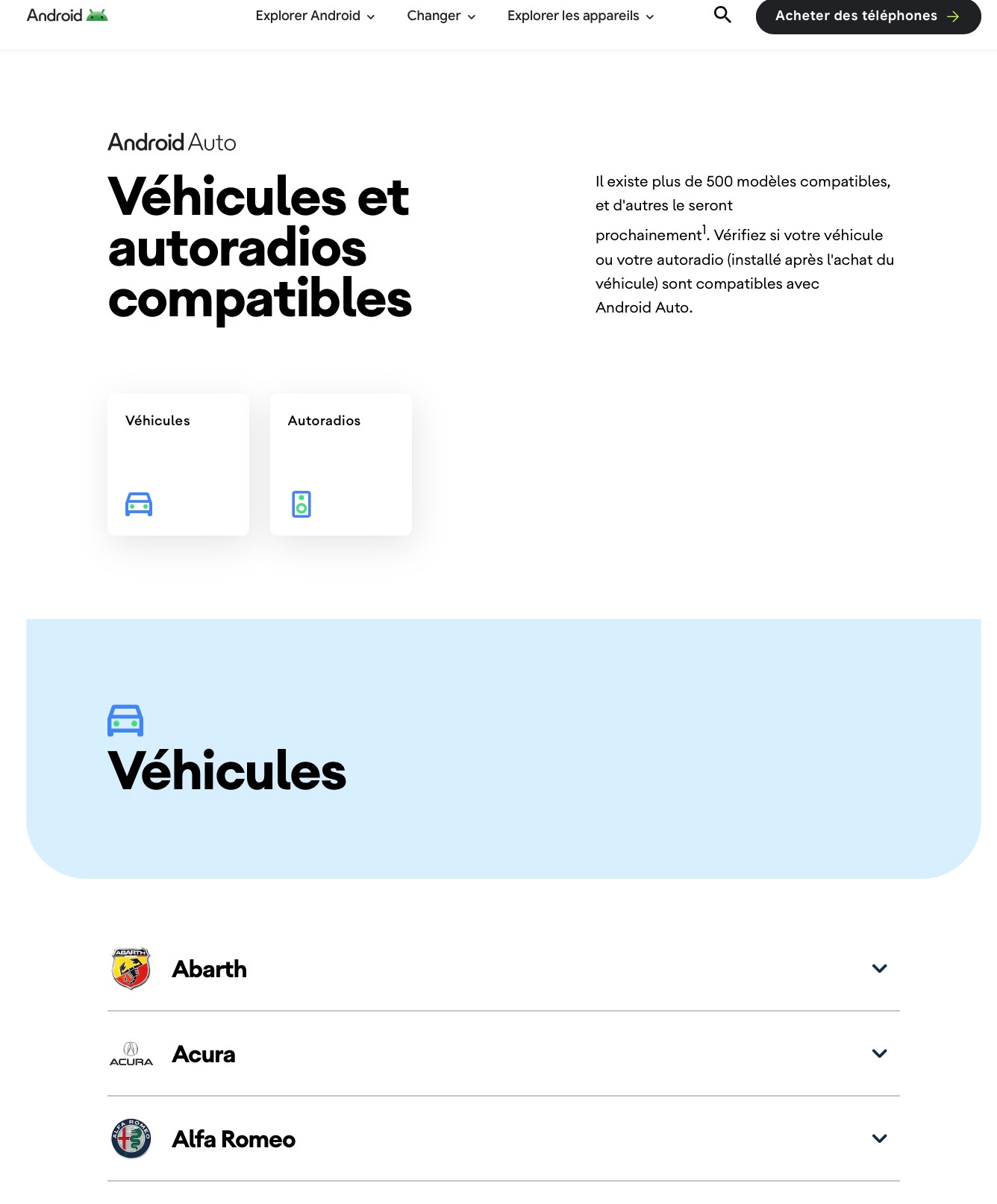

Android Auto in about 500 models.

Who else?

The Car Connectivity Consortium had developed MirrorLink as a uniform standard for integrating smartphones into the dashboard but couldn’t compete with Apple and Google and called it a day in September 2023.

Now you may have noticed that the phone is at the centre of everything.

You connect your phone via Bluetooth or USB which is then mirrored on your car’s screen.

It’s not a native car OS though so who went native?

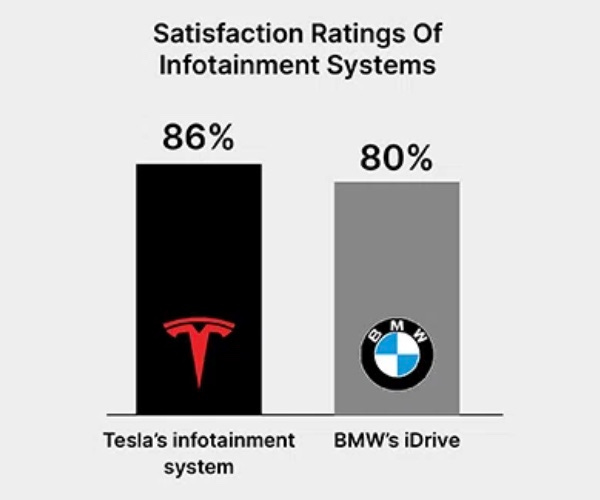

Telsa did. They built their own infotainment system (not without its challenges though but the satisfaction rate is high.

General Motors announced earlier this year they would stop supporting CarPlay and Android Auto to offer a more deeply integrated experience with Google.

Risky as consumers like choice.

What about Jeff?

Back at CES 2022, Amazon announced partnerships with Ford, Jeep, Chrysler, Lincoln, Stellantis (Citroën, Peugeot, Fiat etc.).

What’s next?

Apple CarPlay will go native later this year with a bespoke CarPlay OS.

It will assume control of the car's instrument cluster, displaying essential gauges such as fuel and oil levels, engine temperature, mileage per gallon, and additional information.

Their goal?

Get a top spot in the Car OS ecosystem.

Phase 1 was a mirrored infotainment experience (which Apple & Google won).

Phase 2 will be all about an integrated experience, do car manufacturers have a shot? If so, should they do it alone?

That’s it for today.

Next week, we’ll dig deeper into what consumers want, what they get and who’s best placed to serve this segment.

See you next week for Part 2 but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. My “FAST Made Easy” masterclass has been in high demand.

→ Content Marketing: Explore how I can put my 5.5K LinkedIn following + my 3K Newsletter subs to work for your company like I do for mine.

I cater to Streamers, Distribution Platforms and Technology Vendors.

Ping me to see if we’re a fit.