Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

Sports and News are often cited as the two genres holding the Broadcast TV fort and rightfully so.

I covered the Sports segment earlier this year ↓

What about the News segment then?

Today at a glance:

What is our relationship to the News?

Where do we source the News?

What does the News FAST Landscape look like?

What is our relationship to the News?

There is not one answer to this question.

Our relationship to the News varies based on our age, our gender, our country or the socio-economic context we live in.

These criteria will impact what News outlets we have access to, how we consume News and how much we trust or distrust the sources of News at our disposal.

News organisations face several headwinds e.g. News avoidance, distrust or simply decrease in interest. Again the severity of the trends vary market by market.

Source: Reuters Institute

When we are interested in the News, where do we source them?

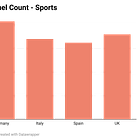

Let’s look at the UK as an example.

There is not one source of News. We tend to dab into one or more sources to get up to speed.

It’s no surprise to see that:

→ Television/Radio/Newspapers are down.

→ Online/Social Media are up.

What does that tell us?

Traditional News outlets are being disrupted and they cannot rely on their legacy recipe to deliver the News to today’s audiences.

News outlets must aim at being ubiquitous while adopting the codes of each distribution channel they address.

Just as News outlets started embracing new platforms like TikTok (check out Brut’s account) or Instagram (love BBC News’ Instagram account with its 26M followers), they should embrace FAST to meet their audiences where they spend time.

The move to FAST is even an easier one for them as FAST resembles Broadcast TV.

What does the News FAST Landscape look like?

It’s been a slow start between News and FAST, particularly in Europe.

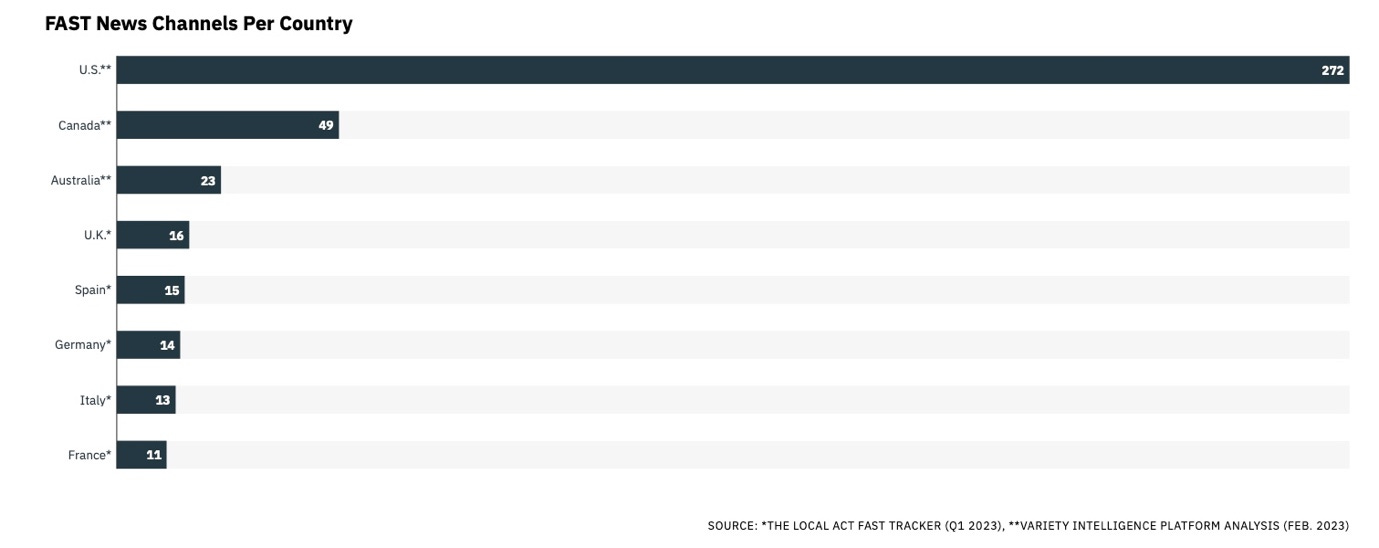

With 272 channels out of 1628 channels according to Variety, News FAST channels represented 16% of the US FAST channel line up in April 2023.

In Q1 2023, EU5 markets (UK, Germany, France, Italy and Spain) had between 11 to 16 News channels in market.

In the US, I believe more than half of these FAST channels are local news outlets but even if we only take National News channels, the US News industry has taken the FAST train way more than we did.

Who’s active in FAST in Europe?

We have 4 main categories of News FAST channels live today:

→ Broadcasters e.g. Euronews, RTVE, France 24, Africa News. The launch of BFM TV (a Free to Air channel) is imminent on Samsung TV Plus France.

→ Pure players e.g. Ticker News, Reuters

→ Newspapers e.g. Le Figaro, El Pais, The Guardian

→ International outlets e.g. CNN, Bloomberg, NBC News Now

Within the Broadcaster category, few invested the FAST space and it made me wonder: Do they feel they don’t need to?

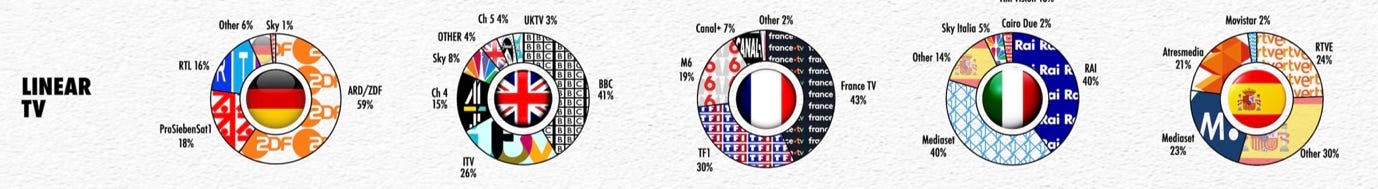

They may be market leaders in viewership within the Broadcast TV category but surely they must be worried about eyeballs moving away from Broadcast TV to Streaming, Social Video etc.

As it stands today, no market was spared when it comes to viewership decline in Broadcast TV and looking for new pockets of audience and revenues should be a priority.

Source: Eshap

What’s the FAST strategy behind some of these existing channels?

RTVE took its existing linear channels (not just their News channel, Canal 24 horas) and put them on Samsung TV Plus Spain. As a Public Service Media, they have a mandate to be as widely distributed as possible. Being available on FAST platforms is a natural next step.

Euronews has been active in FAST for years and according to the company, it made them more valuable to existing and new distribution partners.

In markets where they were distributed, the brand and audience grew through new distribution outlets underlying the value, for their existing partners, of keeping the channel.

In markets where they weren’t, they were able to show that there was an appetite for their channel which ultimately led to new distribution opportunities.

Do Broadcasters have concerns around their existing distribution deals with incumbents?

I’m sure they do.

If Pay TV providers pay to carry a Broadcast TV channel, why should CTV and FAST platforms get it “for free” (as in no or limited upfront payment but with a split of ad revenues based on the channel performance).

The double standard won’t last long and the latest conflict between DirecTV and Warner Bros Discovery regarding CNN Max is the perfect example (even though CNN Max is available behind the paywall as part of a Max subscription).

This is why, most channels tread carefully and build bespoke FAST channels (with a different programming, a mix of live/non live programming) with the underlying term FAST in their channel name.

To go or not to go

Whether you go into FAST or not, times are changing.

Audiences shift from Pay TV to CTV, from legacy media to digital.

The best strategy is a multi-faceted one where you show up with your brand, your editorial and your content everywhere your audience hangs out.

There won’t be a premium spot in FAST (and beyond) for everyone.

Better get to it now.

That’s it for today.

Before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. My “FAST Made Easy” masterclass has been in high demand.

→ Content Marketing: Explore how I can put my 5.2K LinkedIn following + my 2.5K Newsletter subs to work for your company like I do for mine.

I cater to Streamers, Distribution Platforms and Technology Vendors.

Book time to see if we’re a fit.