Welcome back to Streaming Made Easy. This week, we discuss the FAST Sports landscape which offers me an opportunity to feature my latest project: “The European FAST Tracker”.

Based on this Tracker (and more), I draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space.

Book time to explore my existing work and discuss opportunities to work together.

💡Analysis:

Sports and News are often cited as the two genres holding the Linear TV fort.

As mentioned in a previous piece on the state of TV viewership, Sports events monopolised the top 10 ratings in the US in 2022 and also did to a certain extent in the UK and France with competitions like the World Cup or the Six Nations Tournament.

Since Sports do not experience the overall viewership decline Linear TV does, one might argue that the segment could pursue business as usual and wait for the wave to catch them (if ever).

This might have been true 3 years ago when sports organisations were still asking themselves this question:

Why should we launch a D2C business? If we were to do it, wouldn't it affect our media rights' sales?

Fast forward to today, the value of a direct-to-competition value proposition no longer needs to be proven. The sports industry has seriously accelerated in the space.

My take is that the pandemic and the lack of in stadium experience has pushed sports organisations to embrace OTT. Clubs and leagues were in need of keeping a connection with their audience and D2C services do just that.

Now, a lot has happened since then and some D2C services have already experienced the struggle of growing a (profitable) D2C operation. Golf TV will no longer exist as a standalone proposition and the content will be integrated within the wider Warner Bros Discovery D2C service.

What does that tell us?

Sure it’s a cost-cutting move by WBD but it also means that the service didn’t find a big enough audience to build a sustainable streaming business, unlike GCN (Global Cycling Network) which will remain as a standalone offering.

This also signals that unlike what is often preached, not every sport (niche or not) will be successful in D2C. It’s hard to grow a paying subscriber base at scale. Ask Netflix and other general entertainment streaming businesses.

It’s a great segway into why sports organisations should therefore embrace FAST.

Why start a FAST channel?

Sports organisations need to anticipate the Premium glass ceiling. Subscription stacking has its limits: for example, in Germany, to watch all German and international football fixtures, you need 6 subscriptions at 105€ / month. Add to that 50€ of movie and entertainment SVOD subcriptions, households spend already 150€ a month on streaming alone.

It will therefore be harder and harder to make it into the “must have” streaming services.

In addition, a handful of sports (and within each sport a handful of sports events) will find a home on Linear TV. The others must innovate to feature their sports and find their audiences.

That’s where FAST comes in, you can:

Create a richer experience in your app,

Expand your reach by syndicating your channel,

Enter markets where your rights weren’t picked up,

Showcase your library in a new way in and out of your app,

Target casual sports viewers or feed even more your super fans with live events.

What is the State of Sports in FAST?

It’s been a slow start between Sports and FAST.

With 114 channels out of 1628 channels (Variety - April ‘23), Sports FAST channels represent 7% of the US FAST channel line up.

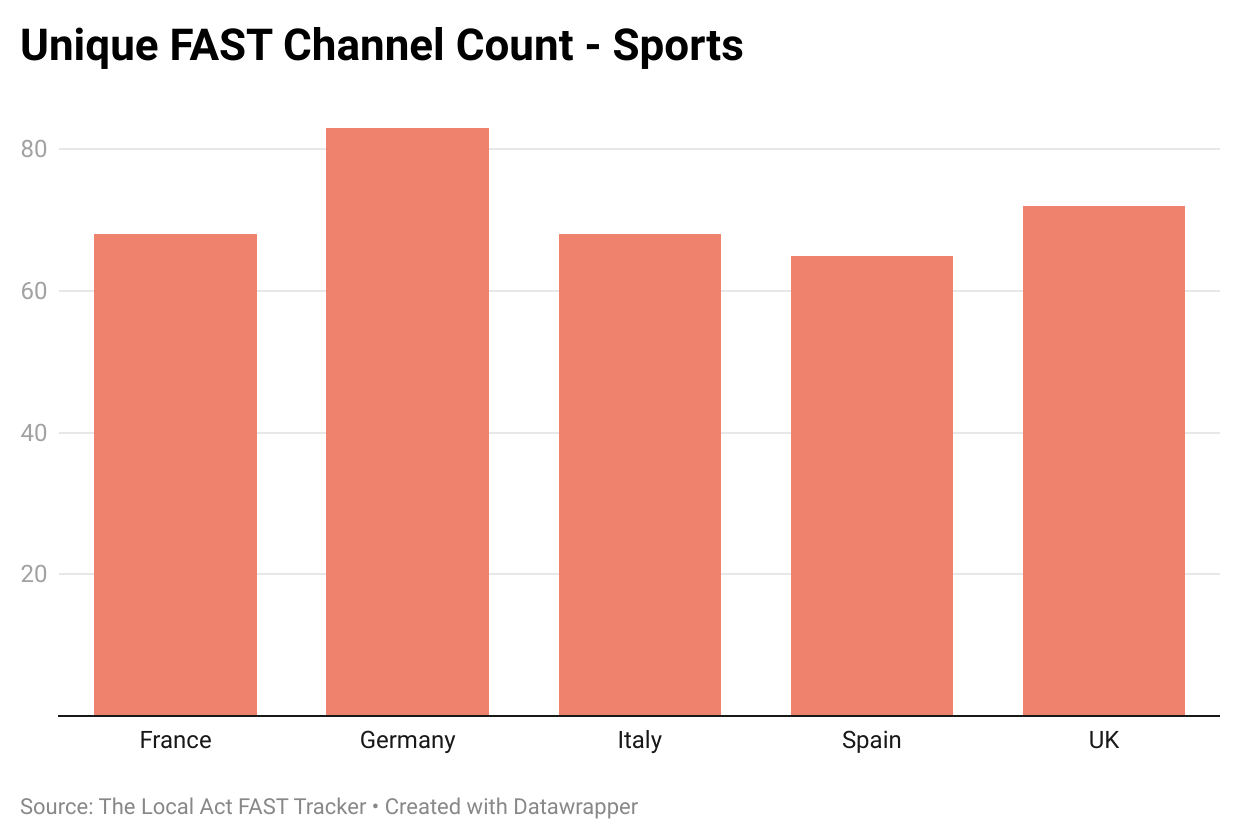

In Europe, Germany leads with 83 sports channels live in Q1’23.

Sports channels represent 20% of the German line up but remember that international markets are below the 500 channel mark.

The demand from the platforms is there but the supply isn’t fully yet.

Who’s active in FAST?

I often hear that FAST only caters to niche services and niche sports. That may have been true at first (and I applaud companies who innovated early on to and got into FAST) but take a look at the brands and sports active today:

OTT Platforms like DAZN, Broadcasters like L’Equipe, Viaplay or Tennis Channel joined single-sports FAST channels like MLB, The Rugby Network, Motorvision.TV or Ski TV.

The region also has its sports pure player: UK-based company SportsTribal which aggregates 50+ 3rd-party FAST channels but also powers the MLB one referenced above.

The other thing I hear is that channels are full of archived content only.

Tennis Channel (called T2 in the US) has already broadcasted 3.5K live games since its launch in the DACH region in 2020.

Within the last 6 months, DAZN launched 5 channels and brings a live component too:

3 in Germany:

→ DAZN FAST

→ DAZN FAST+ (exclusive to Samsung TV+ with live football games)

→ DAZN Rise (dedicated to Women’s Sports)

2 globally:

→ DAZN Women’s Football (global)

→ DAZN Combat (global)

Who are the most distributed sports channels in Europe?

The ones from the 1st movers in the space.

2023 will mark a turn for Sports and FAST.

The entrance of a premium global player like DAZN will give food for thought to the sports ecosystem and I expect more brands to launch.

Linear TV (Free & Pay) and more & more SVOD will keep the lion’s share of the rights to the most followed sports events globally but FAST will be a force to be reckoned with.

It will not be THE play for sports organisations, it will be A play to bring additional value to super fans, reach casual fans and bring a buck or two home.

That’s it folks. Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post each working day on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

NEW - The European FAST Tracker: 1700+ FAST channels in the US alone but what is happening in Europe? What are the leading genres? Who are the active content providers and platforms? With this Tracker, I draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until September 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).