Welcome to Streaming Made Easy #38. I’m Marion & this is your weekly European take on the Global Streaming Video Business.

Every Friday, you get 1 analysis, 1 streamer snapshot & 1 content recommendation (→ previous editions).

Enjoy today’s read and don’t forget to comment or share.

© Ad Exchanger

Today at a glance:

Analysis: Disney's back to school churn test

Streamer snapshot: FIFA+ finally gets into FAST

Show of the week: “Breeders” or the struggles of parenting

💡Analysis:

In the footsteps of Netflix, Disney Plus launched its ad-supported tier in Q4’22.

But unlike Netflix (which launched in 12 markets), D+ decided to launch in the US first and so:

a $7.99 per month ad-supported tier was introduced,

while the ad-free tier was bumped to $10.99 per month.

For reference, D+ launch price, back in 2019, was $6.99. It was half the price of Netflix but a way for them to quickly gain subscribers.

Fast forward to today:

Subscriber growth is stalling at industry level (D+ even lost 600K subs domestically since Q41),

Disney’s streaming losses attained huge numbers (4B$ in 20222)

Their content spend is at an all time high (33B$ in 20223),

So ARPU growth (and profitability) is now the focus.

Price hikes are a way to boost ARPU so another one (and not a small one as we’re talking about a 27% increase) is coming October 12th ($13.99) in the US.

Increasing prices is not without its risks as flagged by Rich Greenfield4, Lightshed Partners, after Disney’s Q2’23 earnings:

“Can you raises price by 30% and not increase churn? That’s the big question.”

Has D+ made itself a must have service consumers are keen to keep despite price increases?

Iger seems to think so:

“We were pleasantly surprised that the loss of subs due to what was a substantial increase in pricing for the non-ad-supported Disney+ product was de minimis. It was some loss, but it was relatively small. That leads us to believe that we, in fact, have pricing elasticity.” (Earning’s call)

Between Q4’22 and Q2’23, Q4’Disney lost 600K subs domestically (46M of Q2’23) but Iger implies they can live with that.

Let’s see whether churn will be higher in 2024 with this new price at $13.99.

Another ARPU booster is to get ad dollars in.

In Q2’23, D+ reported a Domestic ARPU of $7.31 vs $ 7.14 (due to the price change) but also due to higher per-subscriber advertising revenue.

During the latest earning’s call, Iger said D+ gained 3.3M ad-supported subs since launch. 40% of new sign ups were for the ad tier.

We have no insights on the % of existing subs who may have downgraded to the ad tier though.

How does it compare to Netflix?

Difficult to say as the Netflix terminology is vague. During the upfront, Netflix said they had 5M monthly active users to the ad tier but users don’t necessarily mean subs, does it?

25% of new subs took the ad tier.

The natural next step for Disney is to go ad-supported internationally.

“The strong momentum of our ad-supported plans in the U.S. demonstrates the importance of providing consumers with choice, flexibility and value,” said Joe Earley, President, Direct-to-Consumer, Disney Entertainment, on the earnings’ call.

“We are excited to expand that offering in more markets across the globe, including in Europe and Canada, and to launch a new premium duo bundle of ad-free Disney+ and Hulu this Fall, as we take steps toward making extensive Hulu content available via Disney+ later this year for Bundle subscribers.”

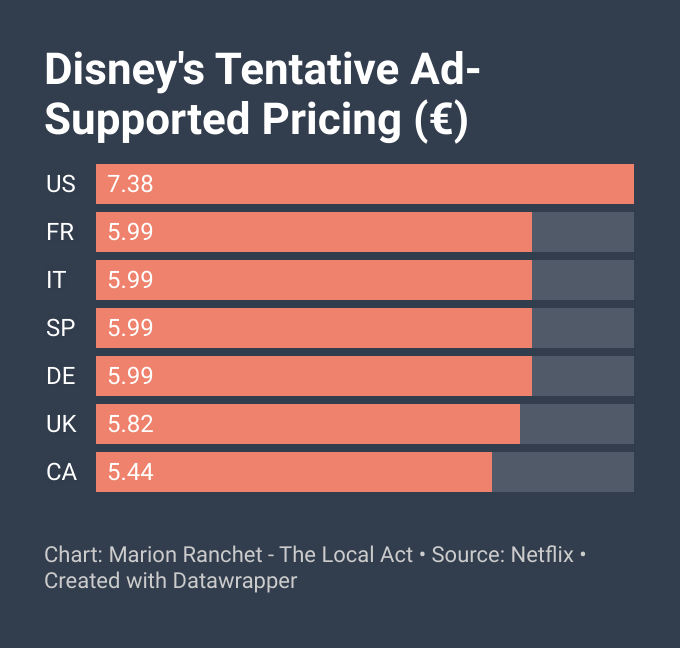

As of November 1st, 2023, consumers in Europe and Canada will have the option to sign up to the ad-supported tier priced:

At 4.99£/5.99€ in Europe

At $7.99 in Canada

Simultaneously, the ad-free tier will get bumped to €10.99 (or the relevant local currency).

We don’t have details about the exact European markets, nor the price differences but EU5 markets at 5.99€ would make sense. Will the Nordics and the Benelux see the launch of an tier too?

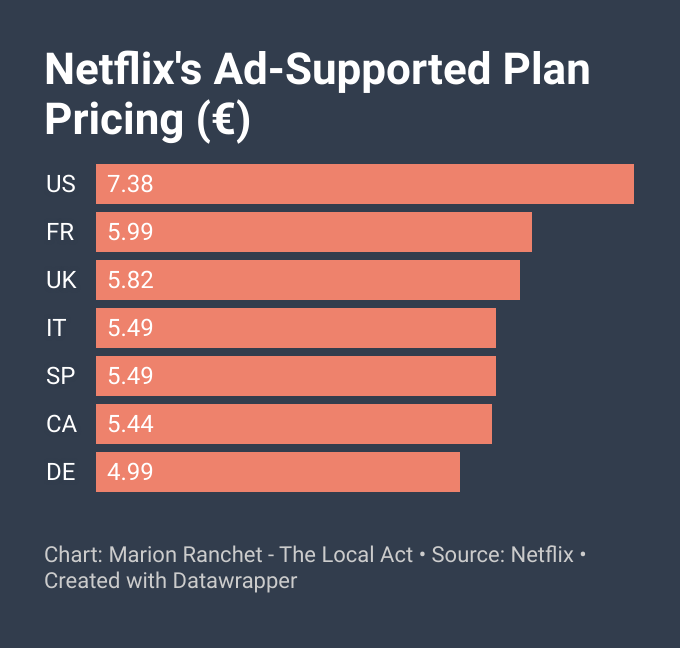

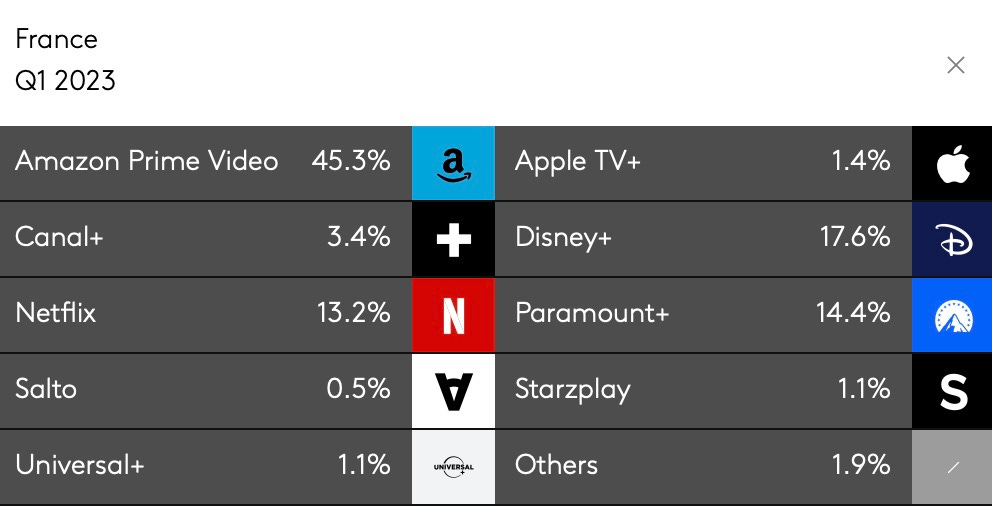

For reference, this is where Netflix is at today and as you can see they chose to do bespoke pricing with France at €5.99 when Germany is at €4.99.

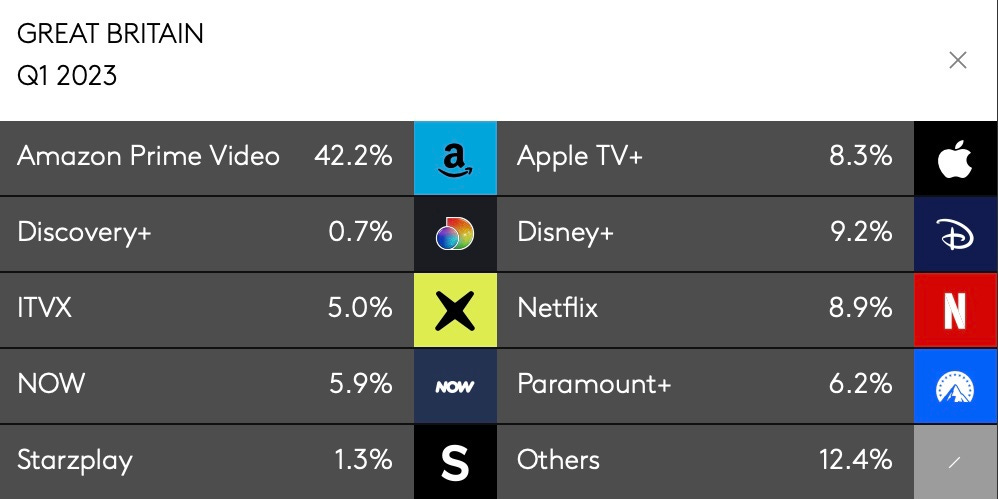

Let’s see how the ad tier and price hike will impact the service take up in key European markets.

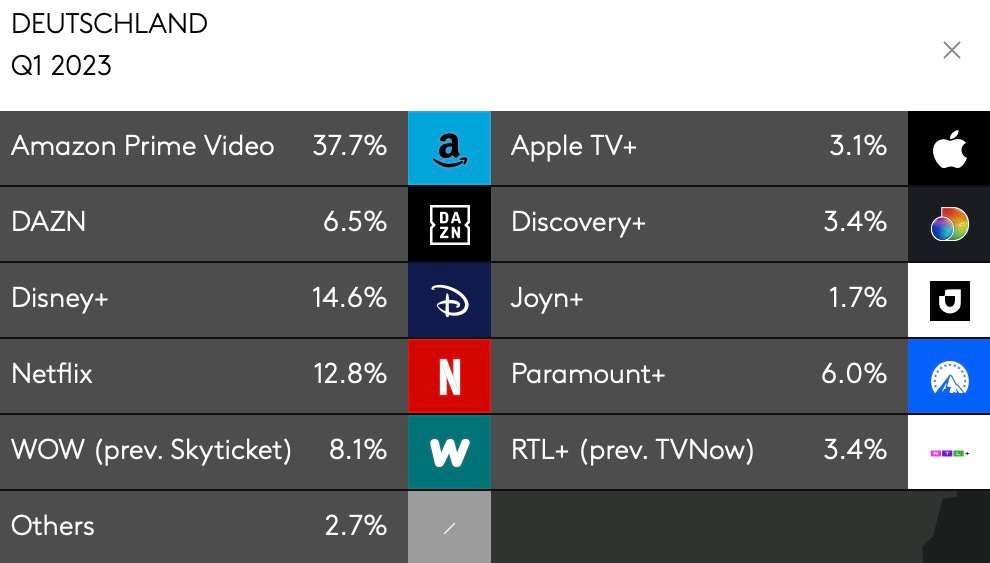

For reference, in Q1 2023, Disney grabbed between 9% and 17% of new sign ups in in the UK, Germany and France.

Will we see the service take up increase or witness the same levels but with a different price mix?

Finally, I’m looking forward to the first informations about the D+ ad value proposition (CPM, ad formats, ad loads).

Exciting quarter ahead of us.

📺 Streamer snapshot:

Besides selling the competition’s rights to broadcasters and streamers globally, FIFA needed a central destination of its own.

Here came FIFA+ ahead of the Men’s World Cup and it was a key component of the Women’s World Cup this month.

FIFA+ is a web, mobile and Smart TV app where fans can watch highlights, long-form content (originals and archived games), track stats, buy merch or play games (quizzes, pronostics).

It’s free to watch with a small ad load (most ads I saw were actually FIFA promos).

When FIFA+ launched, my 1st reaction was “Why didn’t they launch a FAST Channel?”.

They just did this summer.

If distributed widely, I believe the FAST channel has a better shot at boosting engagement. Why? Because a linear experience suits sports much better and the segment is getting more and more active in FAST which wasn’t so much the case until now as detailed in my Sports FAST Landscape piece.

See for yourself what the FIFA+ app is like.

🎬 Show of the week:

It’s about time Breeders makes it as show of the week in Streaming Made Easy. The show is indeed in its 4th season and I can’t get enough of it.

It’s funny, disturbing and it’s the perfect antidote to the parenting guilt trip we can be on.

We follow Martin Freeman and Daisy Haggard on their daily struggles as parents.

It’s a Sky original but Disney+ has it in The Netherlands so check out your D+ app in your market.

👉 Breeders

ICYMI (in case you missed it), check out the wrap up edition of my Summer Series on the TV OS landscape.

Oh and one more thing:

That’s it for today.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

The European FAST Tracker: I lead masterclasses & workshops, draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Business. Book a call to discuss (booked until October 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).

Includes Hulu & ESPN - The Motley Fool