Early 2023, I wrote a piece about the State of Sports in Free Streaming. At the time, I diagnosed:

→ A supply vs demand mismatch.

→ The slow rise of premium brands.

→ A lack of live programming.

→ A business model still in need to prove itself.

Then the 2nd half of 2023 saw the launch of numerous premium brands, the rise of exclusive deals.

What happened in the FAST Sports Landscape since then? Let’s find out.

Today at a glance:

What's happened?

What's coming next?

What’s happened?

→ The launch of sports focused aggregators.

Former Sports Tribal executives, Joe Nilsson and Amory B. Schwartz, launched C15 Studio, to build a multi-channel network of FAST channels in partnership with leading global sports properties. The venture is back by KB Partners, Raptor Group, Sharp Alpha Advisors, and most recently Eberg Capital.

Their channel roster includes Formula 1, One Championship, Triton Poker Series and the Professional Squash Association (with Squash TV).

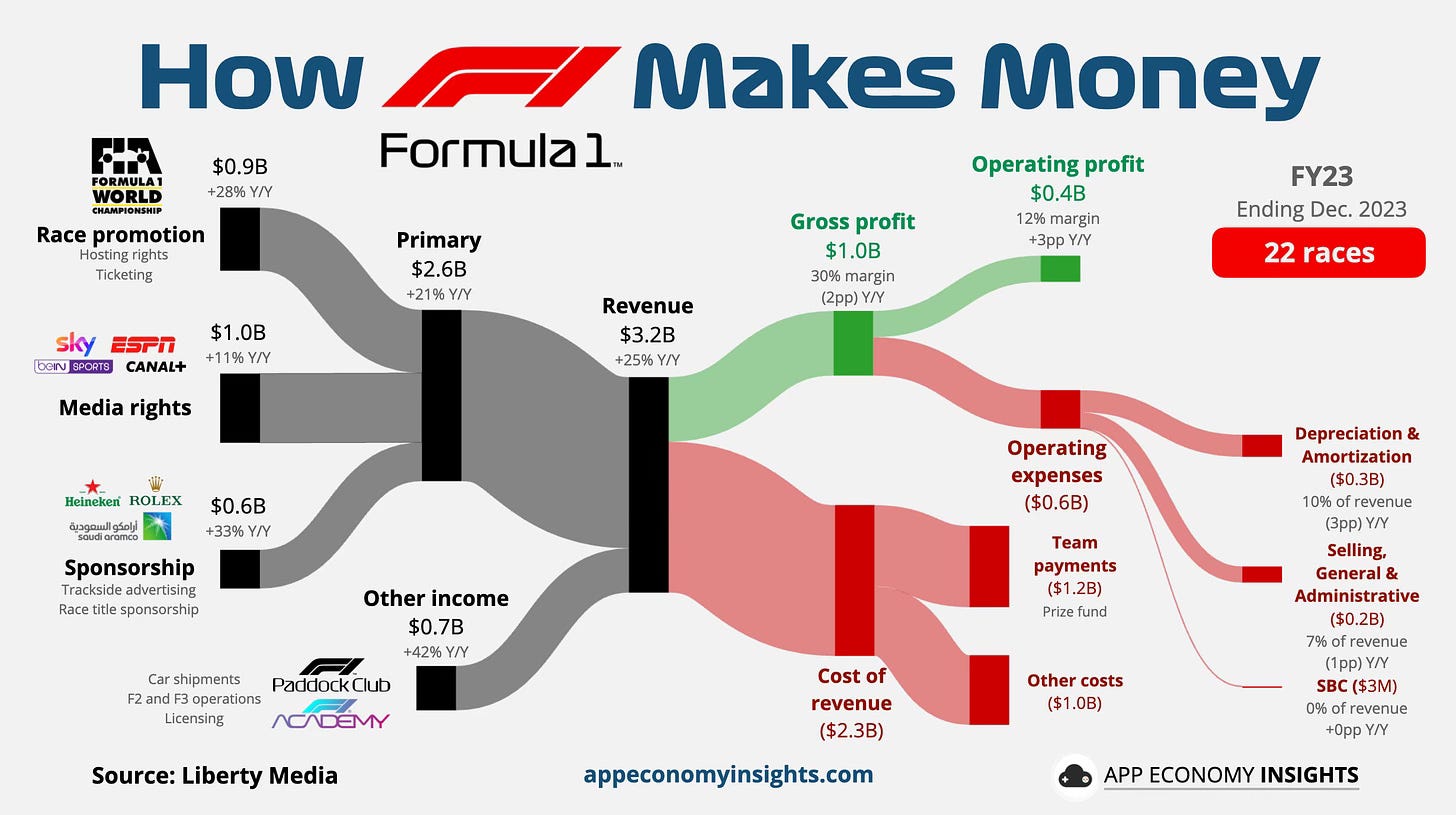

Free Streaming has played a minor role (so far) in sports right holders revenue mix (e.g. here’s how F1 makes money).

Hence why it makes sense to rely on a channel production company like C15.

Other examples of this trend include Lights Out Sports TV (launched in May 2024) and Free Live Sports. The latter was launched by co-founders and partners Cathy Rasenberger (Rasenberger Media, LLC), Geoff Clark (acTVe) and Ryan James and James Patrick of OTT Studio, LLC. Together, they’ve formed the joint venture Sports Studio, Inc., and recently acquired the UK-based Sports Tribal platform. The partners are utilizing that EU-centric free sports streaming platform to build Free Live Sports.

Free Live Sports launched as a stand-alone app in 75 markets. The initial launch includes Roku and Fire TV with more ecosystems in the works (e.g. Vizio, Apple, Android etc). 68 channels are live with 34 more coming.

Speaking of aggregation, DAZN was historically focused on subscription business models but made several moves in Free Streaming with the launch of a free tier, the launch of its own suite of FAST channels, and most recently the aggregation of 3rd-party FAST channels.

📺 Wanna know the 5 trends shaping the European Broadcasting landscape? Watch my latest YouTube video ↓

→ Fewer new channel launches.

After a busy 2023, it’s been quieter on the new launches’ front. Existing channels are focused on growing their distribution networks.

We still witnessed 1st time launches:

NBA: Boy I was waiting for this one. Europe next please.

AHL: where you can watch live American Hockey League games through the Los Angeles Kings affiliate, the Ontario Reign.

ATP Media’s Tennis TV launched Tennis TV Classics on Samsung TV Plus in 7 markets.

College sports conference, Big 12, aims to widen national coverage with its channel.

Sportworld launched FAST Channels for Euro 2024 (Insight Zone: EURO 2024 and Insight Zone EURO 2024 – Team Germany).

Sky Sports launched its 1st FAST channels : Sky Sports Stories, Sky Sports Classics and Sky Sports Vault in August 2024.

The Roku Channel launched an Own & Operated FAST Channel focused on sports: Roku Sports Channel.

FanDuel rolled out a sports betting FAST channel.

“Launching ‘FanDuel TV Extra’ was another important step in expanding distribution for FanDuel TV content and reaching new audiences. Our research showed a large portion of our target audience already consume content on FAST. Airing over 12 hours of live sports a day that can be wagered on significantly differentiates our channel in the market and allows us to reach a new cohort of passionate sports fans and bettors.”

Kevin Grigsby - Executive Producer and SVP of FanDuel TV

→ More Free Streaming platforms buying sports rights.

Roku landed exclusive rights to Major League Baseball (MLB) Sunday Leadoff (which used to sit with NBC).

“With free games available to anyone, MLB games on Roku will be widely accessible to fans,” said Noah Garden, MLB Deputy Commissioner, Business and Media. “Since Roku serves as an entertainment gateway for millions, this partnership offers a valuable new promotional and distribution platform for MLB games and content.”

📌 Speaking of Free Streaming, I will be the MC of MIPCOM’s AVOD & FAST Summit taking place on October 22nd. If you can’t make it, then fear not,

from and I will be sharing our hot takes from MIPCOM 2024 during the next Streaming Made Easy live webinar on October 29th. Register here.→ Sponsorships

We’ve seen the first sponsorship deals between sports, teams and Free Streaming platforms in a move to build brand awareness amongst sports fans, as evidenced by Pluto TV’s sponsorship deal with German football team BVB.

→ AI

The demand for sports is global with over two thirds of global consumers (67%) following sports on a regular basis (i.e. in the last 30 days) via various media platforms according to YouGov’s Global Sports Media Landscape report.

Going global is hard for sports given how fragmented rights are. You need to launch localised channels from a rights’ perspective (with a different set of programs and live events) then comes the content localisation work.

Tennis Channel struck a deal with Lingopal.AI to have its live matches dubbed into Spanish in real time for viewers of its channel in Spain. Here’s an example of a dubbed match (click on “Languages” at the bottom of the video to toggle back and forth between English and Spanish).

The impact of AI in the Sports landscape will go beyond localisation. The trend didn’t go unnoticed by industry media Sportspro Media which launched its first AI Summit in September (with another edition set to take place in New York in 2025). Get up to speed on AI & Sports in their latest podcast episode:

What’s coming next?

To boost channel launches, increase viewership and improve monetisation, Platforms must put more focus on their sports category. Here’s how:

Bridging premium and free offerings. If your ecosystem carries subscription sports applications, why build a wall between the app and the channel? Free Streaming will always be only one piece of the equation for sports organisations. It’s time to build ecosystems regardless of the business model.

Prominence. More often than not the “Sports” category is the below the fold. I get it, platforms may not have enough channels yet to showcase the category prominently but you have to start somewhere.

Marketing. Platforms must figure out how to create appointment viewing habits when it comes to live events. We’ve started seeing this on Samsung TV Plus with promo visuals with a day and time included.

It’s great to see the sports category growing and experimenting because the genre will be key to the growth of Free Streaming TV as a whole (just like it is vital for Broadcast TV). However, the model still needs some finessing to become a bigger piece of the revenue mix for sports organisations.

That’s it for today but before you go:

Enjoy your weekend and see you next week for another edition of Streaming Made Easy!

Until then, check out Streaming Made Easy on YouTube. In 10 mins or less, I will get you up to speed on a key topic about the European Streaming Video landscape so you can better design and execute your strategy in the region. Check out the 1st videos.