Welcome to the 3rd edition of FAST Times, my column about FAST (Free Ad-Supported Streaming TV) for Streaming Media, a news media company serving and educating the streaming media industry and community.

To read FAST Times and more, sign up to receive the Streaming Media newsletter👇

When it comes to Free Streaming, the US growth was initially fueled by Pure players (like Pluto TV, Tubi, Xumo) and Connected TV platforms (like Roku, Samsung) looking to offer free alternatives to US audiences.

63% of Tubi streamers are cord-cutters and cord-nevers (according to MRI-Simmons’ November 2023 Cord Evolution Study) but today, FAST actually appeals more widely as a recent survey led by Xumo & FASTMaster/CRG Global showed that:

47% MVPD or vMVPD subscribers say they watch regularly;

46% cord-cutters;

35% cord-nevers.

These first movers have had a head start and a clear path to test and learn for years. However, in the past 18 months, Pay TV players have decided they, too, have a role to play in Free Streaming.

Why the move?

If alternatives to Pay TV flourish and bring more and more premium content with the flexibility (and ease) to navigate between AVOD, FAST and SVOD offerings, then Pay TV must take a hard look in the mirror and rethink its value proposition.

It’s clearly imperative to stop the bleeding as they lost 2M subscribers in Q1’2024 and are estimated to lose another 10M by 2029.

Free streaming offers more value for money to existing subscribers and boosts time spent on the platform. It can also be used to acquire new subs or keep churners close by to then upsell them to the premium tiers or win them back. Finally, it provides a new revenue stream with advertising.

Who’s active in the space then?

All the US vMPVDs have gotten into Free Streaming by now.

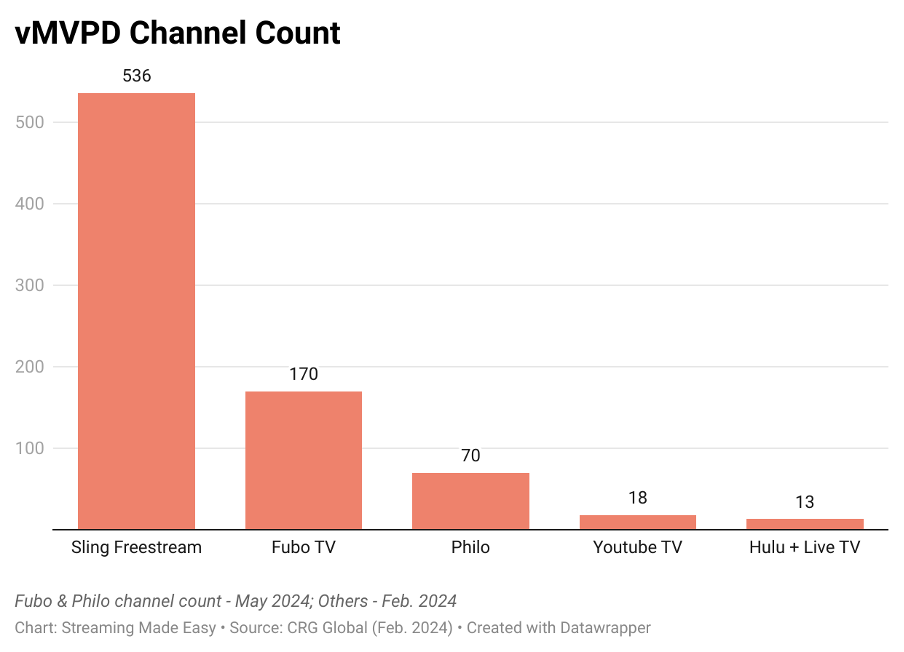

The channels are either included in their basic tiers or in a standalone free tier. Philo announced in a blog post that all you need now is a registered account to access the 70+ FAST channels and save programs in a cloud DVR for 30 days. Fubo launched Fubo Free, a free tier with 170+ channels (without a DVR function) in a move to keep churners somehow engaged with the Fubo platform.

Comcast’s FAST arm is Xumo Play (following their acquisition of the FAST service in 2020), a service you can find and outside of the Comcast ecosystem. Instead of building everything from the ground up, Comcast went for a pure player which pioneered the space.

Only stopping by? Consider subscribing to receive Streaming Made Easy 📫

Want to watch or listen on the go? Consider subscribing to my YouTube Channel 📹

How about Europe?

So far, cord-cutting has not taken Europe by storm (thanks to affordable and aggressive bundle strategies) but disruption is on its way in Europe too.

Digital TV Research estimates Europe will lose 9M subscribers by 2029. Revenues will decrease faster though with 22B€ by 2028, down by 5B€. In the meantime, Smart TVs penetration is rising rapidly in Europe, with 65% of European viewers who have now connected their TV to the internet, directly through Smart TVs, an increase of 5% since 2022.

European Pay TV stakeholders learnt from their US counterparts and knew they had to make their move in Free Streaming.

Here are a few examples of companies who launched FAST Channel hubs in UK and Germany:

→ German vMVPDs Waipu and Zattoo smoothly integrated channels within their existing EPG.

→ UK operator Talk Talk powered by Netgem TV

→ Spanish operator Orange Spain

→ Virgin Media UK launched a bouquet of FAST channels during the summer of 2023. Launch partners included: A+E Networks EMEA, All3Media International, Banijay Rights, Blue Ant Media, Extreme International, Fremantle, Little Dot Studios and Tastemade. The line up has grown since then with some great additions in May 2024.

Others like Bouygues, Deutsche Telekom opted for the distribution of Pluto TV as an app on their STBs.

What do Pay TV players bring to the table?

Despite headwinds, they bring scale (71.3M in the US according to Leichtman Research and 100M+ Pay TV subs in Western Europe according to Digital TV Research).

They excel at aggregating and driving viewers to their TV offers. They have done it with TV channels, then Transactional Video on Demand and finally with SVOD for the past 10 years. FAST is just the streaming version of their TV bouquets.

What is their unfair advantage in Free Streaming?

The edge all these companies have is their existing EPG made of Free to Air, Pay TV channels and now FAST channels. To the consumer’s eye, these FAST channels are just additional channels in the EPG. They benefit from this ease of access plus the aura of long-standing traditional broadcast TV channels.

They can also offer cloud DVR features.

By the end of 2024, I expect most, if not all, U.S. and Western European Pay TV providers to have their own Free Streaming channel hubs.

Simply turning FAST into TV.

Fancy catching up on previous editions of FAST Times ?

👉 2024 is the ultimate election year, FAST won’t stand by

That’s it for today but before you go:

If so, you know where to go 👉 Streaming Media.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

On top of Streaming Made Easy, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, Pathé or EGTA.

→ Content Marketing: Explore how I can put my LinkedIn following + my Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.