Turning TVs Into Ad Billboards

How TV OS players finesse their ad strategies to boost their platform businesses

Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

ICYMI 💥

Teads the partner of choice for TV OS players and their CTV Ad units? After Vidaa earlier this year, 8 new markets added to the LG Ads / Teads partnership.

A&E kicked off the 2024 - 2025 Upfronts/Newfronts season. Check out who’s next and grab Nielsen’s guide to the season.

Next week, Amazon will host sessions for brands and agencies ahead of its April 9th launch of Prime Video w/ ads in France, Spain and Italy.

I’m so fond of this black rectangular box in my living room.

Funnily enough I don’t pay too much attention to the hardware technology behind it (what’s that sound? It’s the TV manufacturers in my audience crinching 😬).

I care more about what is inside my TV (the interface, the navigation, the content value proposition) than what my TV is made of. It’s not to say that I don’t care about picture and sound quality, I just take them for granted. That’s just me (or not).

Now TV interfaces have gone through a massive transformation throughout the years but here’s what grabs my attention the most lately:

How our TV home screens are evolving from simple navigation interfaces to advertising billboards.

Ok I’m exaggerating a little but 2024 will be the year where advertising gets more front and centre on most user interfaces.

It signals an acceleration in the monetisation ambitions of TV OS providers.

It does beg questions around viewers’ ad tolerance, advertisers’ adoption and satisfaction, pitfalls to avoid and innovations to bring.

Today at a glance:

The Why behind ad-driven interfaces

The How from three TV OS players

The What to watch out for

The Why behind ad-driven interfaces

The context

I’ve written at length about the shift, from a hardware driven business to a software driven one, we are witnessing in the TV ecosystem.

Samsung and LG have the Roku / Google playbook on their nightstands.

Their respective operating systems Tizen and WebOS used to be fortresses (only their TVs were powered by these OS), now they are available for license by third-party TV manufacturers.

Hisense, Philips used to rely on 3rd-party operating systems and now have their own with Vidaa for Hisense, Titan OS for Philips in a move to mitigate the over reliance on 3rd-party OS from companies like Roku, Google (note: Vidaa and Titan are separate companies meaning they power TVs beyond the Hisense and Philips brands).

In a low margin hardware business, the underlying operating system is where the true value lies.

Instead of getting a one-off purchase from us, it's time to generate recurring platform revenues during the life span of a TV.

The monetisation opportunities

The TV OS playbook looks more or less like this:

→ License fees (if any)

→ Remote buttons

→ Own and operated streaming services (e.g. The Roku Channel, Samsung TV+ etc.)

→ Channel Store / App Store commissions (on new sign ups for SVOD, a cut of ad revenues or ad inventories)

→ Audience development budgets (streamers buy real estate to promote content from their services)

→ Ad placements (brands and agencies buy real estate to promote their brands and products).

Before we look at ad placement implementations specifically, have a read of my CTV series available here.

The How from three TV OS players

CTV treated their home screens as real estate early on by making audience development tools available to content owners.

App or channel owners can buy share of voice on CTV platforms (via self-service platforms and/or one to one buys) to promote their upcoming titles and drive user acquisition and engagement.

What you see on a platform is the product of :

Partnership deal terms

Organic editorial curation by the platforms

Paid audience development tactics

Advertisers’ campaigns

Let’s have a look at 3 players in the space.

N.B: I couldn’t go exhaustive here so if you are a TV OS, a brand or a streamer and you want me to feature some of your case studies or weigh in on this topic, send me an email at contact@thelocalact.com, I have a follow up edition in the works.

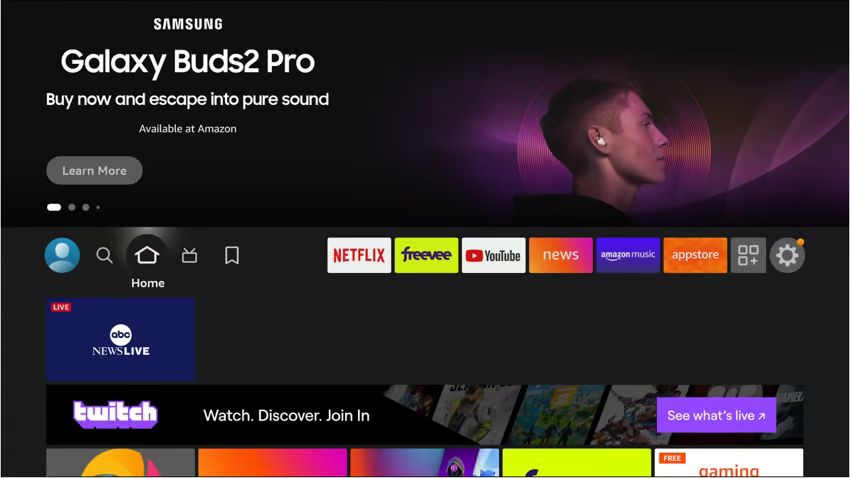

Fire TV

How They Do It:

In stream ads, inline banners, feature rotator, sponsored screensavers, sponsored tiles

Product detail pages, landing pages for Prime Video channels, Fire TV pages

Type of Brands Featured: Chessman, SC Johnson, Starz, Osmo, Hungry Lion Productions, 20th Century Fox, GoNoodle, Planters Kraft Heinz

Examples:

Fire TV homepage with Samsung Galaxy ad:

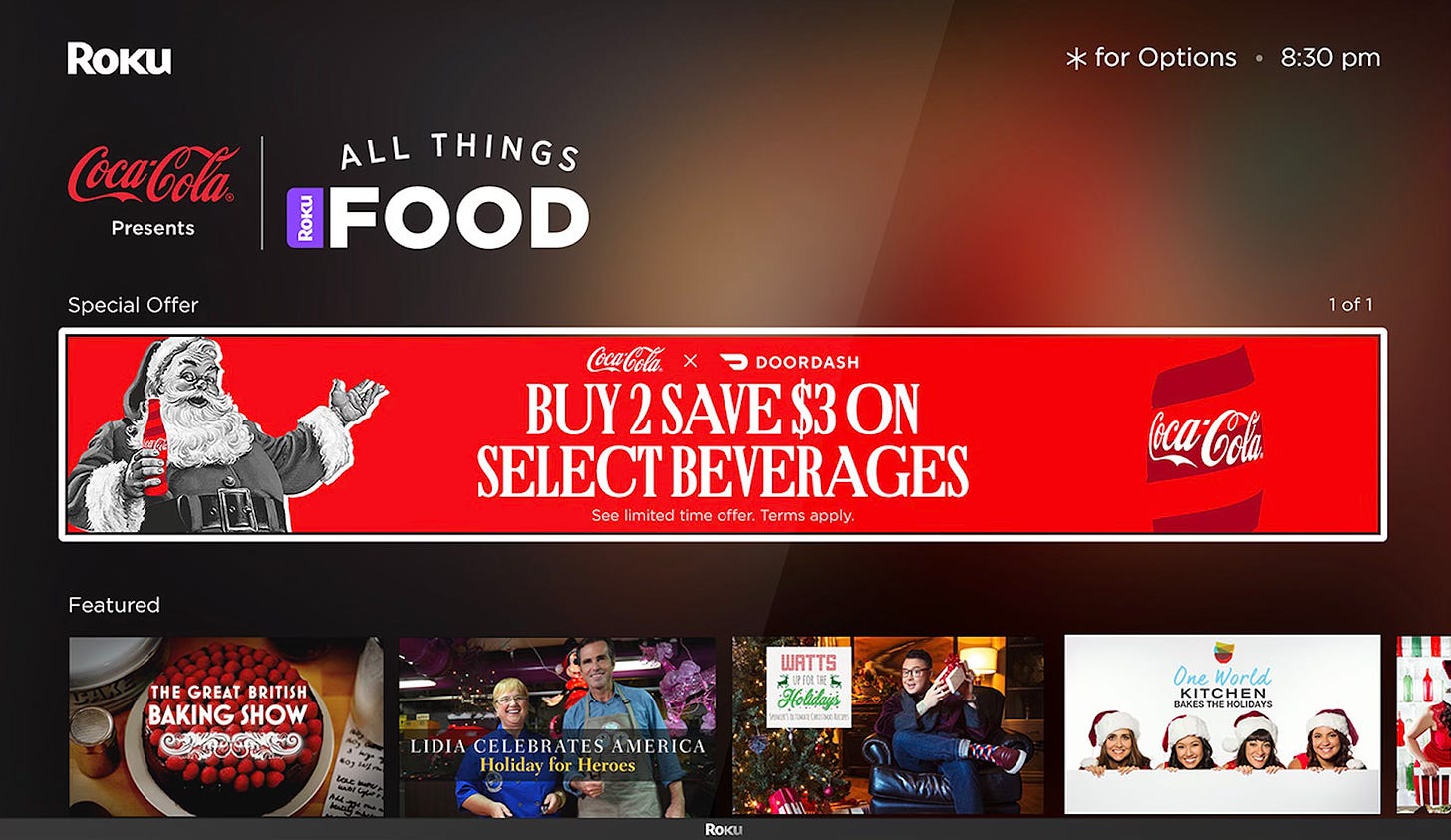

Roku

How They Do It:

Native ads: Roku City screensaver, wallpaper-like branded themes, Home Screen takeovers, banner ads, tiles.

Hubs: playlists, passes (sponsor a free movie), zones, details pages.

Videos ads: in-stream ads where brands can take over an entire ad pod, tell a sequential brand story, subsidize an ad-free experience, and more.

Action ads: scannable videos, interactive vignettes, overlays.

Type of Brands Featured: H&M, Coca Cola, Best Buy, Wendy’s, Toyota, Headspace, Philips Sonicare and more

Examples:

Only stopping by? Consider subscribing to receive SME every Friday morning

Loving it? Consider sharing SME with your network

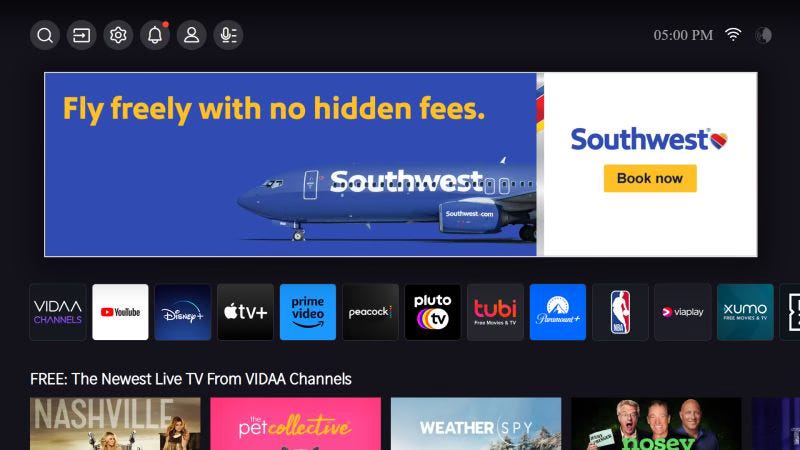

Hisense Vidaa

How They Do It:

In stream video ads within ad-supported services and channels.

Vidaa announced a partnership with Teads at the beginning of the year. Teads will sell their CTV native ad units across 180 countries.

Type of Brands Featured: BYD, Coca Cola, Unilever, Mastercard, Hisense themselves

Examples:

The What to watch out for

Advertising is everywhere.

When it comes to TV, the advertising was mostly limited to the viewing experience though.

Now, it’s here when you switch your TV on (so before you actually watch something).

This trend comes with a set of potential risks around:

ad overload

user frustration

potential decreased platform engagement or abandonment of the service

privacy, safety, diversity concerns

What to expect:

→ On platform surveys to gather viewer feedback.

→ More performance related insights at industry level.

→ A peak into whether (and how) they do audience segmentation to avoid irrelevant ads (a personalised ad experience in short).

→ User preference settings to allow viewers to customise the level of advertising they wanna see on their home screen.

→ Creative ad formats which surprise, delight but most importantly do not disrupt the user navigation and content discovery experience (we really don’t need that).

→ An ad-free or a bespoke ad experience for children. TVs are family devices. They shouldn’t see what we see. Could profiles help?

→ Transparency as to what constitutes an ad vs what is editorial. Content ads are tricky as I doubt viewers know content partners paid for the placement.

As the Streaming landscape expanded, the importance of a seamless and user-friendly TV operating system grew stronger.

TV OS not only determine how users navigate and access content but also play a crucial role in shaping the future of entertainment and the digital living room.

In that respect, they have a duty to balance user experience, content discoverability, content and partner diversity, children’s protection with revenue generation.

They should innovate responsibly ensuring that their home screens serve the interests of both their businesses, partners and viewers.

That’s it for today.

Enjoy your weekend and see you next week for another edition of Streaming Made Easy.

Before you go:

By night, I write Streaming Made Easy and also on LinkedIn.

By day, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my 6.2K LinkedIn following + my 4.4K Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.

I understand how operators need to make money, but to do this to the detriment of the user experience at the level of Amazon Fire TV as you show here is the clear enshittification of the platform...