Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

After the 2019s launch frenzy, which saw the launch of Disney+, HBO Max, SkyShowtime, Paramount+ and co, pan-European streaming launches have been hard to come by.

So I rightfully got excited when I saw the news on KOCOWA+ launching in 39 countries across Europe and Oceania.

As much as our industry loves doomsday headlines, there is still room for growth in Europe (EMEA was Netflix's biggest subscriber contributor in Q1 2024 with 2.92M net additions) especially for niche streamers like KOCOWA+ which serve a specific audience who can’t get enough of K-Content.

Today at a glance:

What does the Korean SVOD landscape look like?

What is the demand for K-Content?

What is KOCOWA+?

What to watch?

What’s next?

What does the Korean SVOD landscape look like?

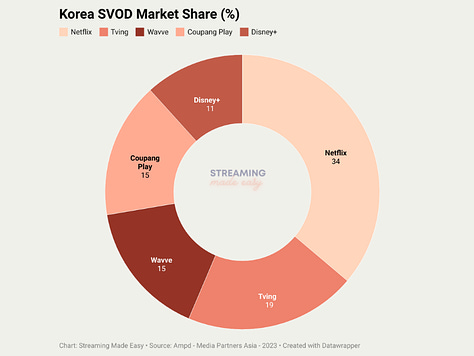

Korea had 19M SVOD subscribers in Q3 2023 (+700K subscribers vs the previous quarter) according to research and consultancy firm Media Partners Asia.

As always, the story goes:

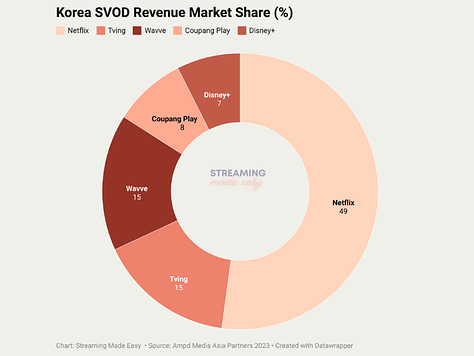

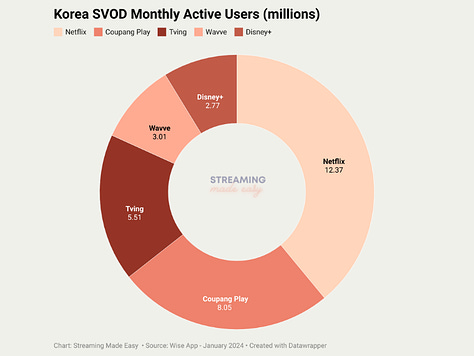

→ Netflix is leading in both subscribers, active users and revenues.

→ Followed by a mix of local players and global players fighting for a top 5 spot.

Insane, Prime Video is not in the top 5 streamers there.

Note: Paramount+ launched in South Korea but opted for a partnership with Tving instead of going solo.

Behind Tving, you have two of South Korea’s largest TV studios, CJ ENM and JoongAng Group’s JTBC.

Wavve is owned by leading Korean broadcasters KBS, MBC, SBS, and telecom operator SK Telekom.

Coupang Play is part of leading e-commerce platform Coupang.

Wavve and Tving are said to have signed a deal to merge in December 2023.

The pair would then match Netflix in terms of subscriber numbers but not in terms of revenues. Netflix Korea is profitable with an annual operating profit of 12.05 billion won ($8.7 million), down 15.6 percent on year. Revenue jumped 6.47 percent to 823.3 billion won. Tving, Wavve and Watcha posted operating losses of 142 billion won, 79.1 billion won and 22.1 billion won respectively.

Let’s leave Korea now to explore how K-Content exports itself globally.

What is the demand for K-Content?

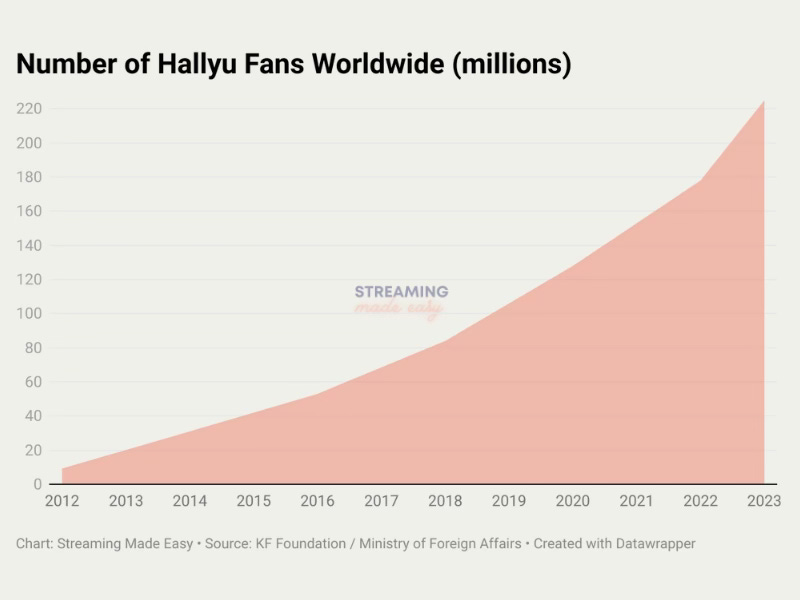

The number of Hallyu (Chinese word for Korean Wave) fans worldwide surpassed the 200 million mark last year for the first time to hit 225M fans in December 2023 according to a survey led by the Korea Foundation (KF) and the Ministry of Foreign Affairs.

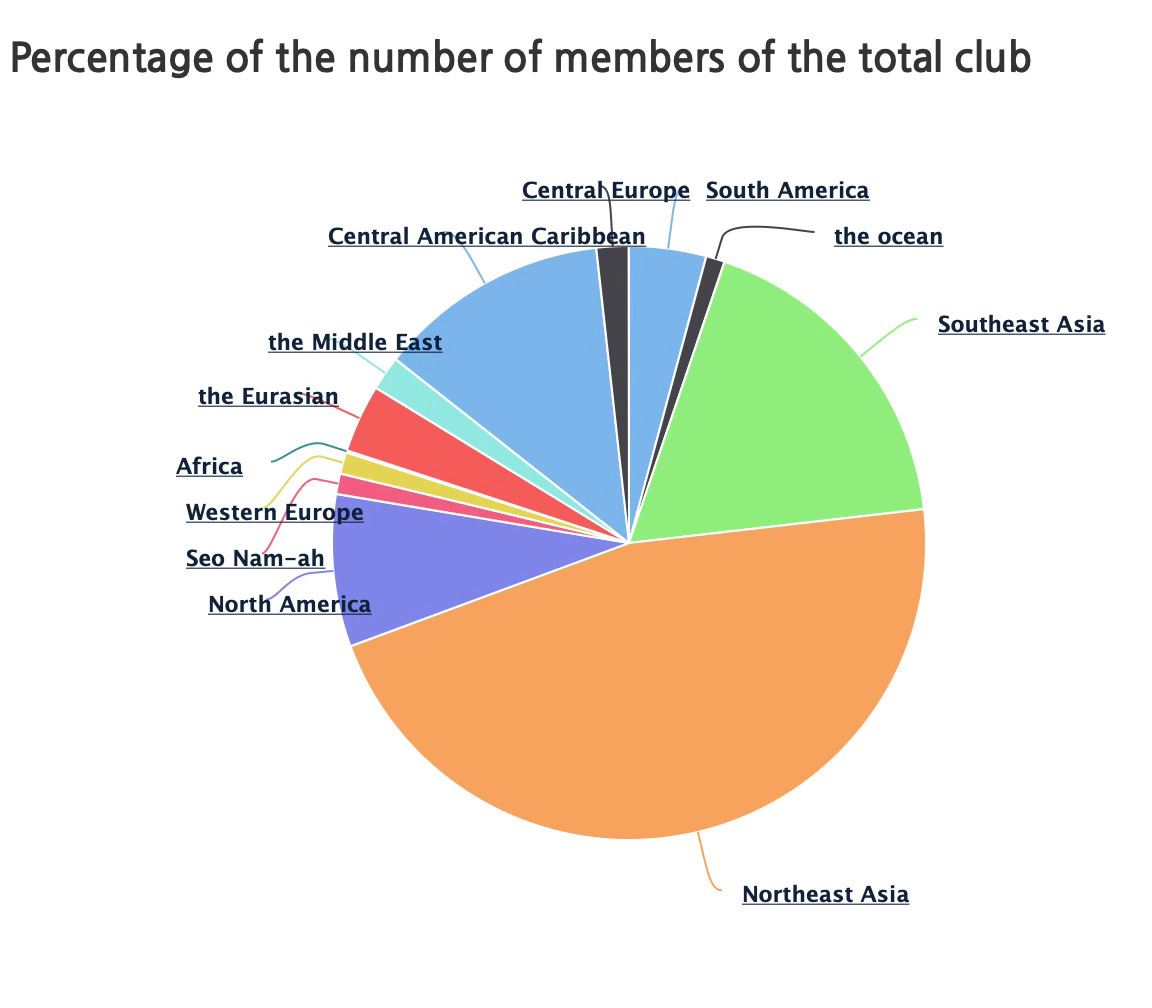

By region, Asia and Oceania account for the most fans with 64%, followed by the Americas with 25.1%. Central Eastern Europe and Western Europe bring a combined 2.93% of fans.

You can look at the European numbers and think there is limited appeal or untapped opportunities.

The Korea Foundation opted for the latter:

"Hallyu has gained a strong foothold across Asia, so we need to develop a strategy to reach a much wider audience outside of Asia. We could utilise Europe as a bridgehead for expanding Korean wave to the West in the future."

Korea Foundation

And Kocowa+ did just that.

“As the home of the largest Korean Content library outside of Korea, we are honoured to bring the first 100% Korean streaming platform to Europe and Oceania.”

KunHee Park, CEO and CPO, KOCOWA+.

Only stopping by? Consider subscribing to receive Streaming Made Easy 📫

Loving it? Consider sharing it with your network ❤️

What is KOCOWA+?

KOCOWA stands for Korean Content Wave.

The company was created by leading Korean broadcasters KBS, MBC, SBS, and telecom operator SK Telekom in 2017, in a move to bring K-Content to global audiences.

In 2023, Wavve bought 40% of the company for 70M€ in a move to grow beyond the Korean market.

Kocowa+ in a nutshell:

Model: SVOD

Markets: 74 countries incl. United States, Canada, Mexico, Brazil, and now expanding into Europe and Oceania.

Content Depth: over 30,000 hours encompassing Korean Dramas, Movies, Reality, K-Pop content and webcomics.

Live: Taste24HR brings all new programs are made available within eight hours of their broadcast in Korea, all fully equipped with subtitles.

Co-viewing/Fan engagement features: A curated KocoCraves feature will comprise a mix of live viewing parties and selected content that encourages fan engagement and access to easy-access fan favourite content.

AI Keytalk: This feature lets you find your favourite KOCOWA+ content in a flash, just by using fun and descriptive keywords like “absolutely adorable,” “noteworthy cast,” or “dazzling visuals.”

Languages supported: English, Spanish, Portuguese, Chinese

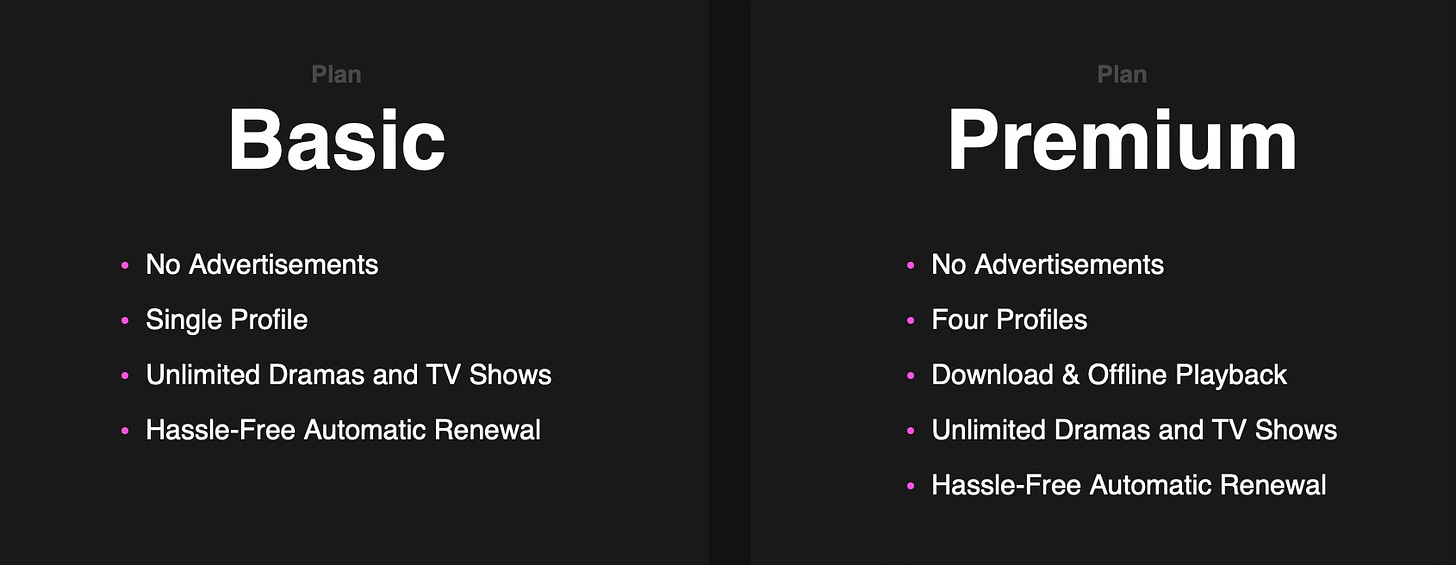

Pricing:

6.99€ per month / 69.99€ per year “Basic plan”

7.99€ per month / 79.99€ per year “Premium plan”

Distribution: the platform is live on web, mobile, CTV (Samsung, LG, Roku, Android TV, Apple TV, Fire TV etc). In the US, they are also an Amazon channel, a Roku Channel premium subscription, an add-on on Verizon +play.

I expect to see new platforms launching in a move to mirror the US distribution strategy. I’m also curious to witness the customer acquisition tactics they’ll put in place. The streamer needs to build brand awareness to the local fan community and beyond. Finally, will they need to support more languages? In France, Italy and Germany, English subtitles are a tough sell but perhaps not for Hallyu fans.

What to watch?

I have a confession to make, my K-Content education is pretty limited (with Squid Game, Parasite or Past lives) so I will leave you in the expert hands of the Kocowa+ team for content recommendations on the platform:

👉 Overview for the European Launch

What’s next?

It’s no secret that K-Content is not the purview of Korean companies anymore (in and outside of Korea).

Netflix has spent over a trillion won (750M$ between 2016 and 2021 and plans to spend an additional 2.5B$ until 2027. Another Korean drama “Queen of Tears” (produced by CJ ENM) was Netflix’s most viewed TV show globally in April 2024 with 279M viewing hours.

Now, one might argue that:

→ Netflix is best placed to grow the K-Content casual fan base given their global scale.

→ Niche / expert streamers like Kocowa+ can take fandom to the next level.

Either way bright days ahead provided the K-Content ecosystem can grow internationally with the right distribution strategy and without breaking the bank.

That’s it for today but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

On top of Streaming Made Easy, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my 6.6K LinkedIn following + my 4.K Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.

This is such a great article. Thanks a lot.