Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

In case you missed it 🔥

Streaming Made Easy is now on YouTube. In 10 mins or less, I will get you up to speed on a key topic about the European Streaming Video landscape so you can better design and execute your strategy in the region. Check out the 1st video.

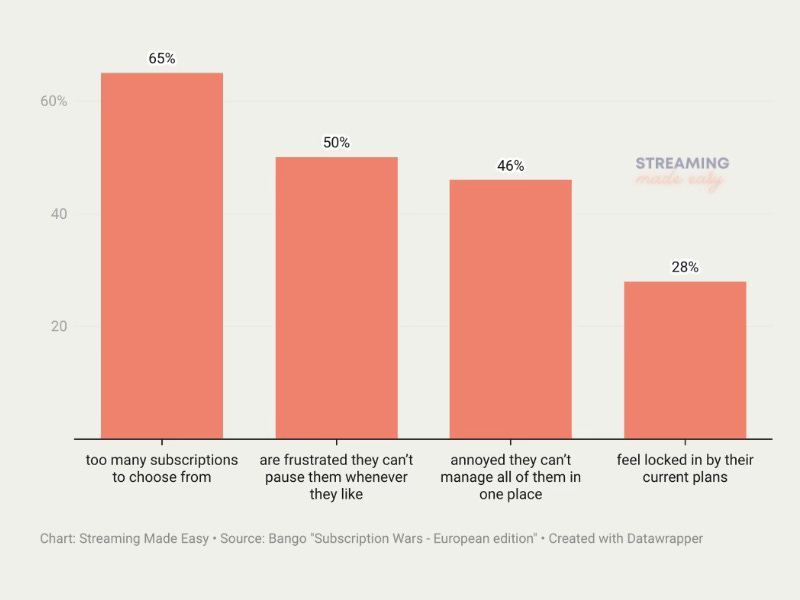

According to Bango’s latest report on super bundling, 58% of European subscribers are demanding one app to manage all of their subscriptions and accounts.

It’s no surprise. Consumers can’t keep up and it triggers all sorts of reactions.

Who can help?

Telcos have a shot as I detailed in a recent piece but they’re not the only ones.

Super Aggregation is all about building ecosystems which foster choice, ease of use, flexibility and who loves ecosystems?

Big Tech.

They all started with one product at first (e.g. books - Amazon, search engine - Google, computers - Apple, operating systems - Microsoft) and have now expanded their product and service suite to make sure you interact with them several times a day in the simplest ways possible.

Let me show you what Super Aggregation by Big Tech looks like.

Today at a glance:

Who’s active in the space?

What’s their edge?

Before I dive in, it can’t hurt to reiterate what a super aggregator is.

It’s a one stop shop where a platform offers consumers:

→ an easy way to consume content across a wide range of services and verticals (Free TV, Pay TV, SVOD, AVOD/FAST, TVOD/EST, gaming, music),

→ facilitated by a single bill where one can manage its subscriptions,

→ and depending on who the super aggregator is, consumers get access to a suite of other services (e.g. broadband and/or mobile subscription, free deliveries, banking & insurance, smart home & security etc.) or get discounts by taking bundles.

Who’s active in the space?

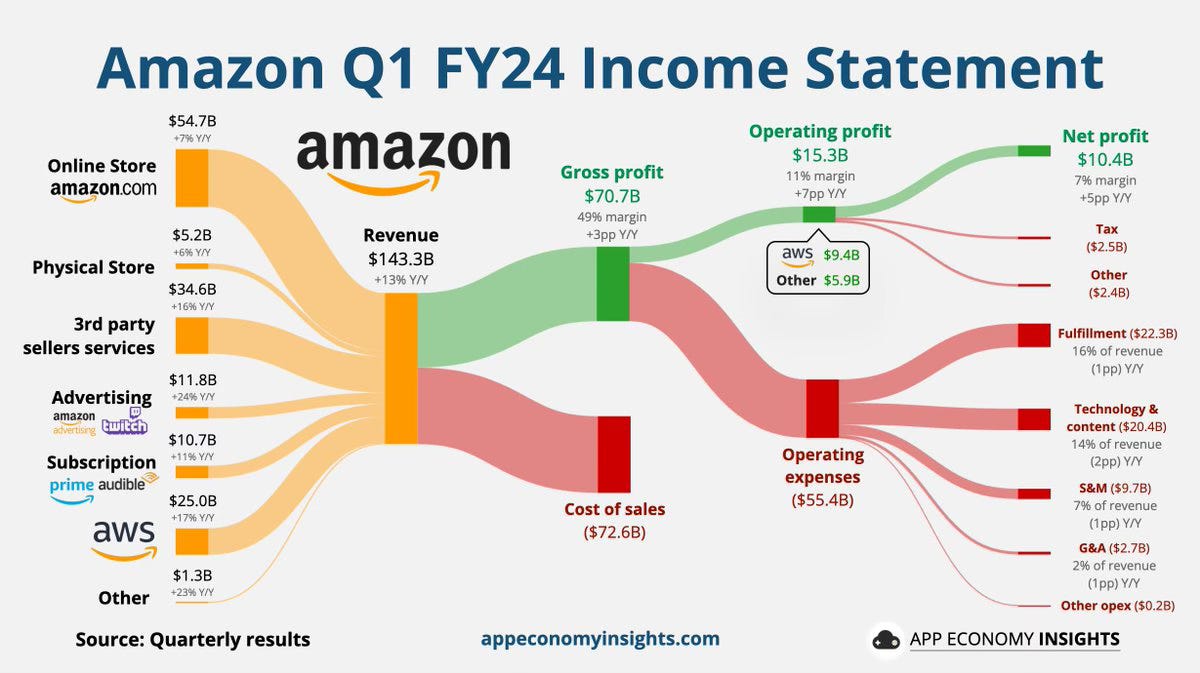

#1 Amazon

Amazon’s subscription business weighed 10.7B$ in Q1’24.

It may seem small in comparison to other revenue streams but it actually fuels the others since as a Prime subscriber you buy on amazon.com; the time you spend on amazon.com, Prime Video or Twitch feeds the ad business, the AWS business etc. It’s the perfect flywheel.

The beauty of Prime is of course the fact it brings shopping and entertainment together.

Within the entertainment vertical, Amazon carries its own services (Prime Video, Prime Music, Prime Reading) but also 3rd-party content and SVOD services (Prime Video Channels or Amazon Channels).

Amazon Channels:

It’s a central hub for premium SVOD streaming services. As a Prime member, you can browse this dedicated section in Prime Video and add stand-alone subscriptions to streaming services other than Prime Video.

The sign up process is facilitated (as Amazon already has all your bank details) and later on you will have all the content from your subscriptions in one spot.

It was launched in the US in 2015 and now available in 17 markets (USA, Canada, UK, Germany, France, Italy, Spain, Netherlands, Austria, Australia, Japan, Mexico, Columbia, Chile, Brazil, India, Sweden).

The “channel” line up varies from market to market. In the US, 80 streaming services are available. In the UK, 57 including big household names (Paramount+, Discovery+, Britbox) and highly curated niche services (Studio Canal presents, Crunchyroll, Acorn TV, Curzon).

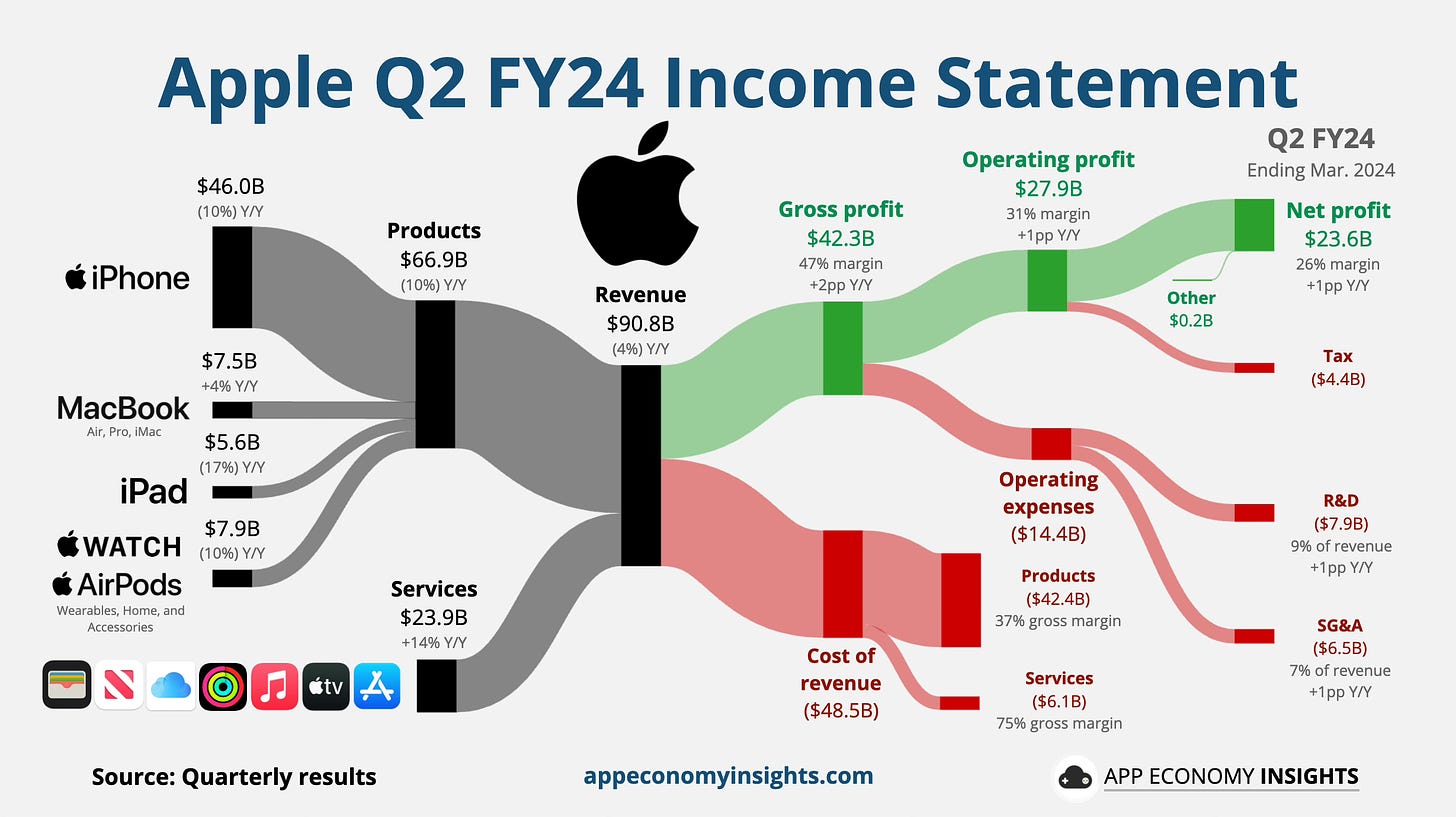

#2 Apple

Apple’s Services business is worth a 1/3rd of its Products line and is a 75% gross margin stream. Expect this stream to grow, grow, grow.

Apple likes to do its own thing. It carries Spotify but built Apple Music, Netflix (and every streamer on the horizon) but launched Apple TV+.

They are masters at aggregating their own services (within Apple One starting at 19.95€/month) but haven’t made the leap to become a true super aggregator.

The Apple TV app does surface content from 3rd-party apps but with deep-linking so you still have to hop from app to app.

The Apple Channel business is limited to TV+, MLS and 3 services (lucky MUBI, Explore by Mediawan and Paramount+).

It makes me wonder: is it a lack of focus or faith in the model?

It’s a shame because:

Apple users could definitely use a central hub instead of app hopping (provided the UX/UI of the entertainment hub is better than it is today);

Niche streamers would have another subscriber acquisition channel like they do with Amazon Channels.

Only stopping by? Consider subscribing to receive Streaming Made Easy 📫

Want to watch or listen on the go? Consider subscribing to my YouTube Channel 📹

#3 Alphabet

Let’s put aside YouTube for now as the giant requires its own edition. There’s indeed no doubt that it is the biggest competitor to any platform operating in the video space given it is:

The world largest video platform with its 114M channels with over 1 billion hours of video watched on the platform each day across 114M channels.

The 2nd largest search engine with over 2.5 billion logged-in users per month.

The channel membership features available to creators facilitate paid subscriptions, perks etc.

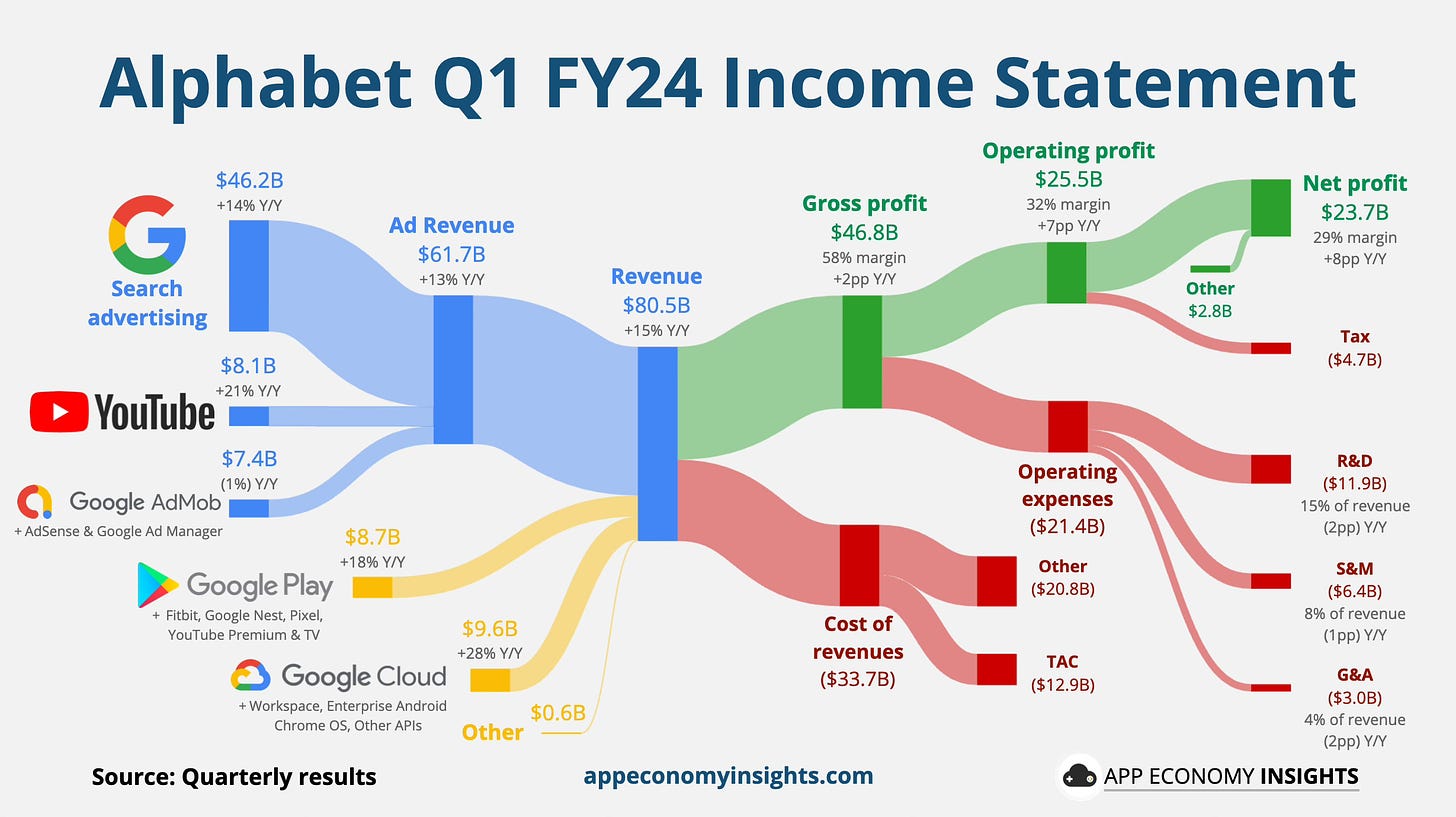

When it comes to premium subscriptions, Youtube Premium, Youtube TV and YouTube Primetime are worth a closer look (the Google Play banner totals 8.7B$ revenues in Q1’24).

With the acquisition of the NFL Sunday Night ticket, YouTube TV proved they were serious about their Pay TV business. YouTube TV is the 1st vMVPD in the US (and the 4th Pay TV player) with 8M+ subscribers.

Now the Pay TV business is a tough one, especially in the US where the segment lost 2M subs in Q1‘24 alone and is expected another 10M by 2029. I therefore don’t see Youtube launching YouTube TV globally so this is where YouTube Premium & Primetime come into play.

YouTube Premium:

With a YouTube Premium membership (plans start at 7.99£):

You can watch ad-free videos on YouTube and download videos to watch offline.

YouTube Music Premium is included.

You can also watch videos on the YouTube Kids app without ads.

YouTube Primetime:

It’s YouTube’s version of Amazon channels.

It’s live in the US (45 services), UK (5) and Germany (20).

It’s hard to find: Homepage < Explore < Movies & TV.

Why is YouTube creating sub-services with different branding? YouTube and YouTube Premium would suffice, there’s no need for this level of fragmentation within their own ecosystem.

What’s their edge?

Here’s what makes Big Tech powerful super aggregators:

→ Habits

Amazon, Apple and Alphabet are so integrated into our lives. We buy from them, we have their phones in our hands, we search via them.

It’s an easy lift to upsell us to additional paid services (in video and beyond).

→ Data

They know us better than we know ourselves. Amazon knows what you buy, Meta who you are, Google who you want to be.

This fuels personalisation on existing services and drives the creation of new ones.

→ Billing

Frictionless payment process, flexibility.

→ Flywheels

They shouldn’t spend carelessly but they can invest in content at a loss and make up for it with their other revenue streams.

→ Technology

One thing they need to work on: UX/UI. They should be superior to their competitors, to me they’re not.

It’s hard to assess their impact as a distribution channel for 3rd-party SVODs. Data is indeed scarce.

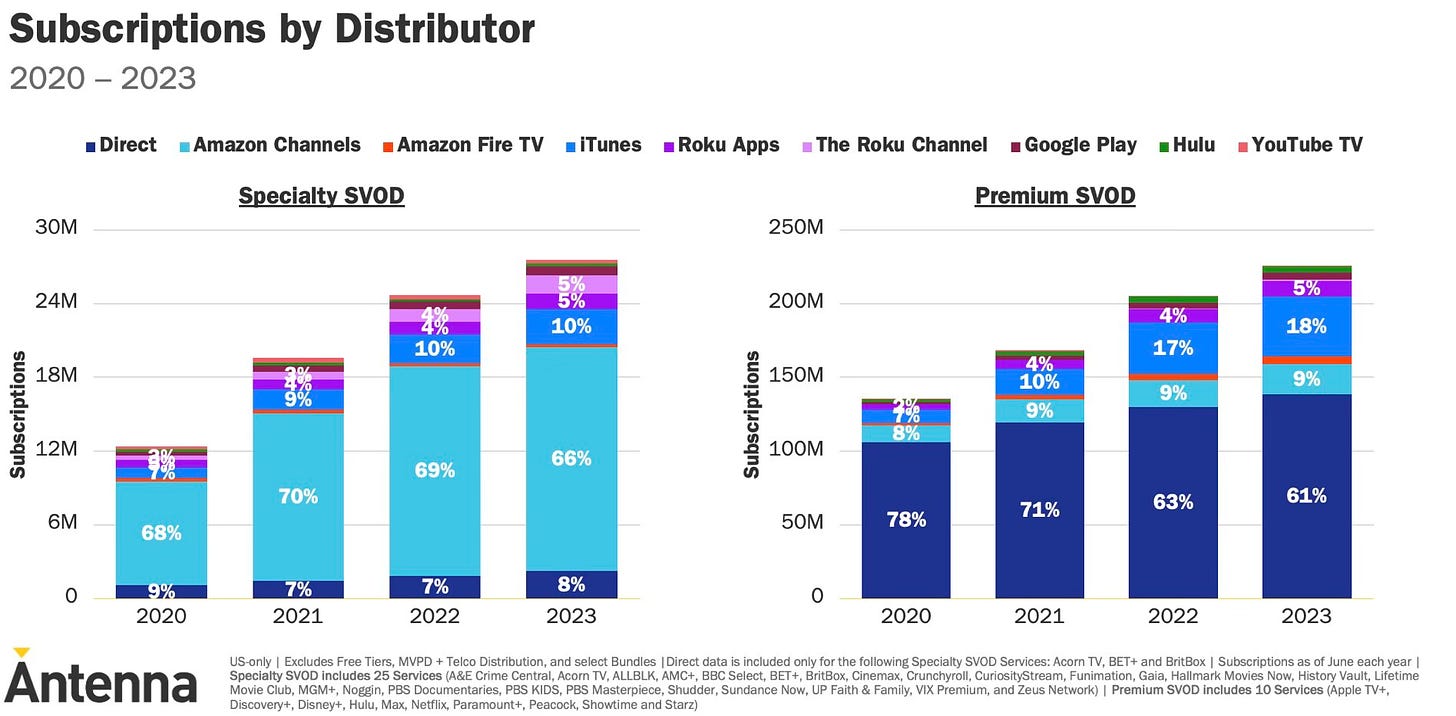

According to Antenna, Amazon Channels is the main acquisition channel for Niche SVODs with up to 66% of subscribers acquired via Channels in 2023.

Can Apple & YouTube catch up? Perhaps but with the right focus and investment to grow the line ups and footprint, improve the user experience.

Do they want to? I’m unsure about Apple but I have no doubt about YouTube.

As the traditional media players go ad-supported, the past year shows that YouTube is getting serious about going premium.

That’s it for today but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

On top of Streaming Made Easy, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my LinkedIn following + my Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.