SME#42: Ads For All In Prime Video

What it says about Amazon's confidence in its streaming & advertising biz

Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

What makes SME different? I dissect the latest news and trends in the streaming video industry through a European lens because I’m inherently convinced that there is no one size fits all recipe for success in streaming.

Who reads SME? Streaming professionals from a wide range of Media, Entertainment & Tech companies (e.g. Samsung, Orange, BBC, TF1, Apple, Amazon and more).

Check out previous editions here.

Enjoy today’s read and don’t forget to comment or share.

© Luca D’Urbino

In the footsteps of Netflix and Disney+, Prime Video will launch its ad-supported tier in 2024.

But unlike Netflix and D+, Prime Video will not introduce a lower-priced ad-tier.

From 2024, all PV subscribers (in select markets) will see ads popping up unless they agree to spend an additional 2.99$.

This move says a lot about Amazon’s confidence in its streaming and advertising business which will dive into in this edition.

Today at a glance:

Recap of Amazon KPIs

Overview of Amazon’s ad-supported launch plans

The Amazon Streaming and Advertising machine

Now let’s brush off on our Amazon KPIs.

First things first, Prime vs Prime Video.

Prime Video lives inside Prime (in markets where Prime exists) but also outside of Prime (as a stand-alone streaming service).

Prime is live in 22 markets (US: $14.99 per month or $139 annually).

Prime Video is live in 200 markets (US: $8.99 per month).

Last number we were given dates back to Jeff Bezos in his letter to shareholders in 20211 where he stated that Prime had more than 200M Prime subs worldwide.

Based on eMarketer2 forecasts, the number of Amazon Prime users in the US is expected to reach 157.4M by 2023 and 168.3M by 2025.

Now being a Prime member doesn’t equal being a Prime Video user. I haven’t found insights into the ratio between the two (have you?).

Let’s talk about money.

Amazon Prime revenue cannot be entirely isolated from Amazon’s overall revenue.

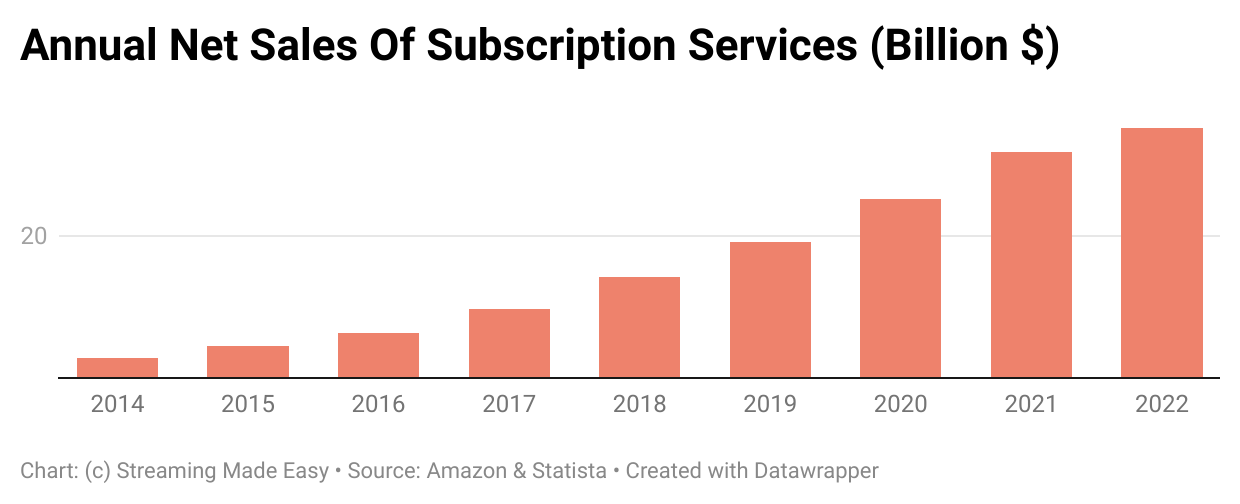

However, Amazon does disclose the net sales of all subscription services (membership fees, digital video, audiobooks, digital music, e-books, and other subscription services).

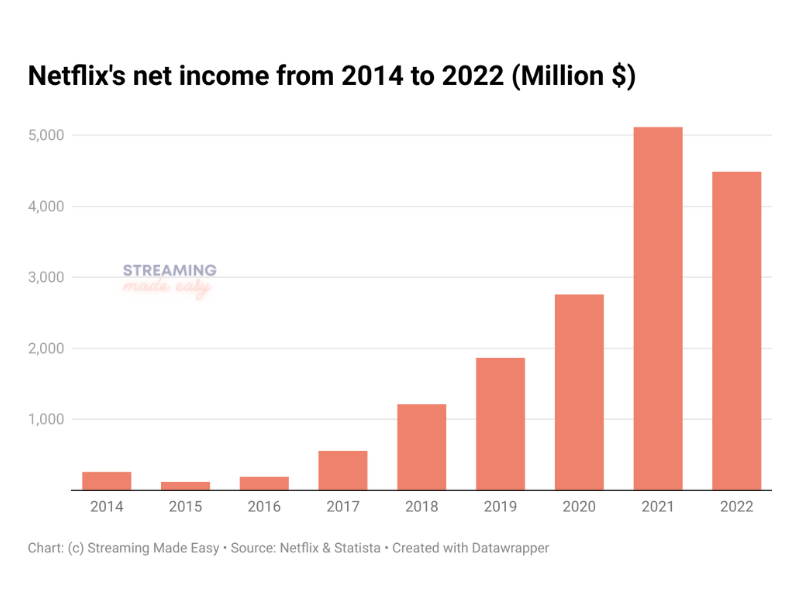

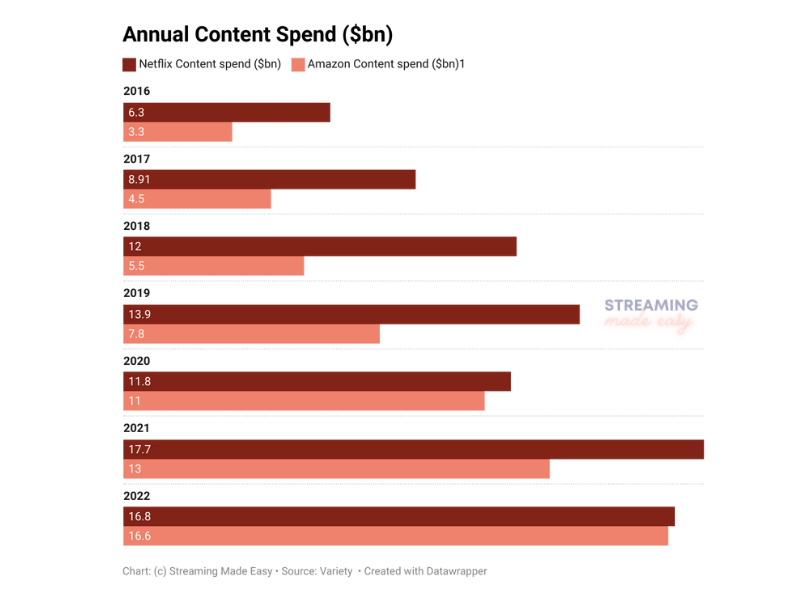

How does that compare to a Netflix? It’s a ratio of Billions vs Millions

For a similar Annual Content spend in 2022.

Ad-supported launch plans

Amazon’s announcement gave us little to chew on but we’ll make do with it:

→ Countries: US, Canada, UK & Germany (wave 1), France, Italy, Spain & Mexico (wave 2).

→ Pricing:

No change to the Prime membership in 2024

Introduction of an add-on priced at 2.99$ (price points outside of the US weren’t disclosed)

→ Ad load: less than Broadcast TV & fellow Streamers.

For reference, here are the ad loads of key players (a mix of streamers and 2 European commercial broadcasters) in the space:

Why does Amazon feel comfortable introducing a higher-priced ad-free tier?

3 reasons.

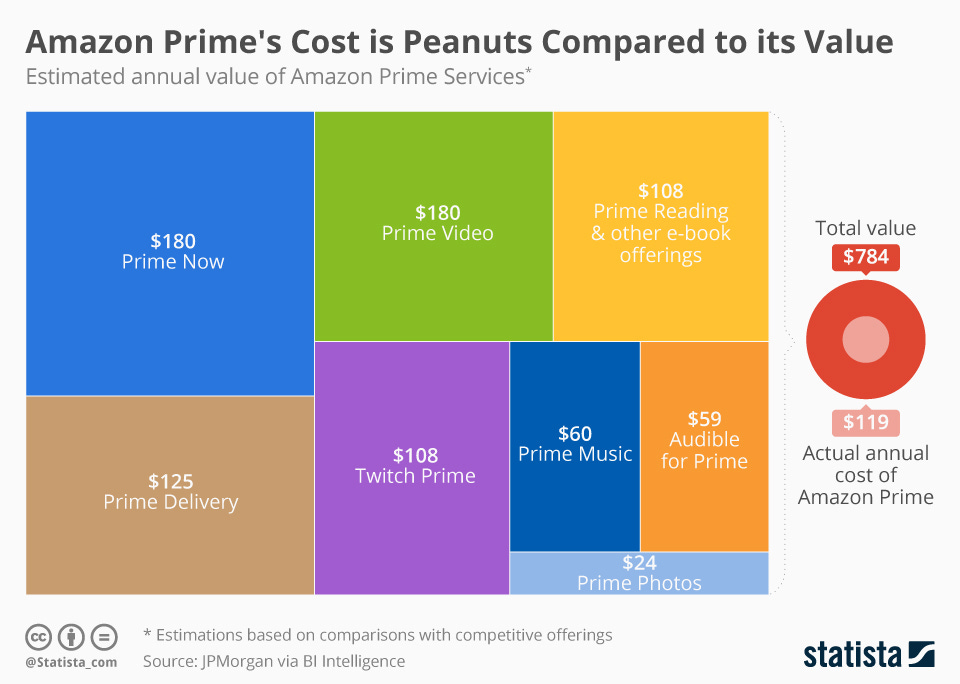

N°1 - The value behind Prime is insane.

So there is room for price increases.

N°2 - Their subscriber growth is solid.

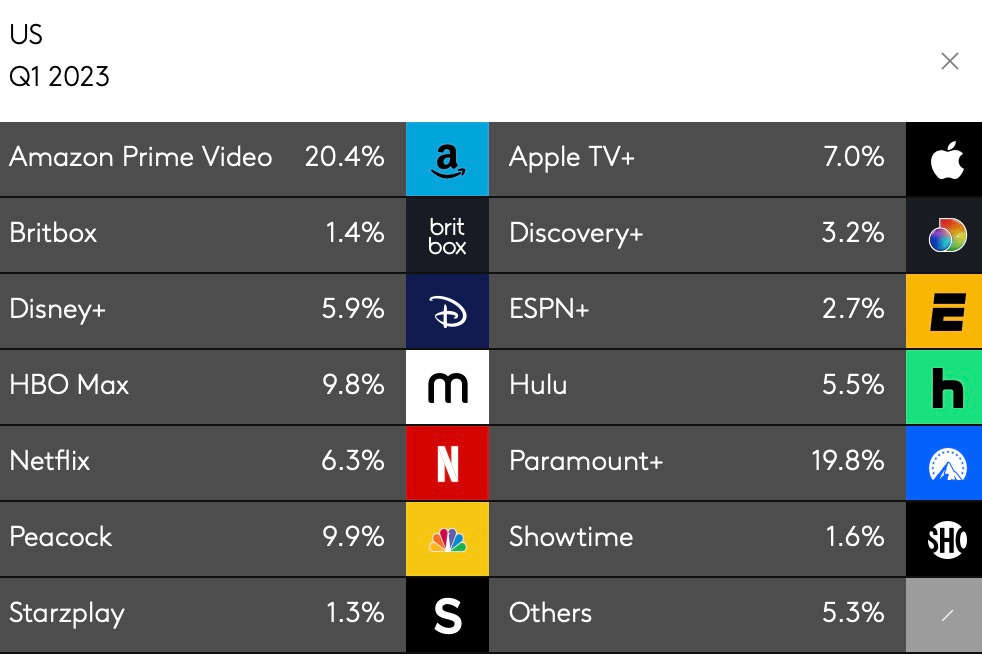

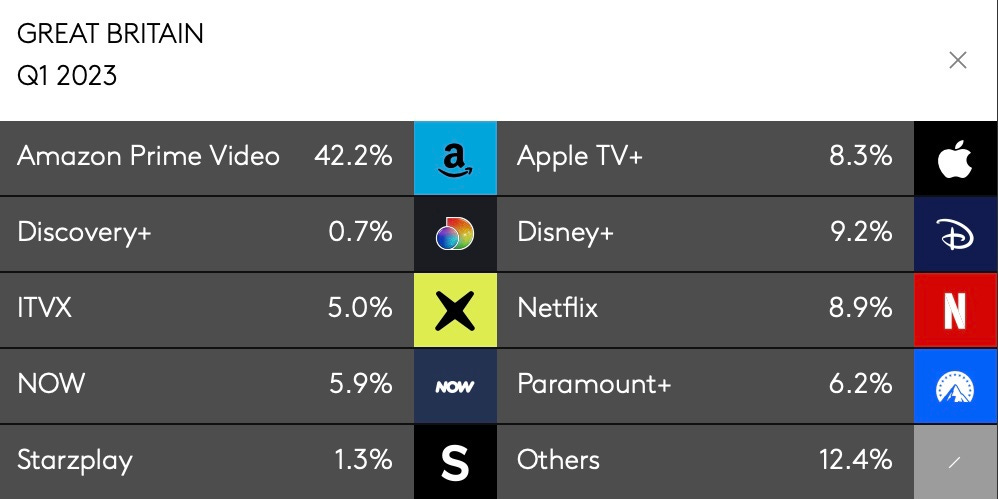

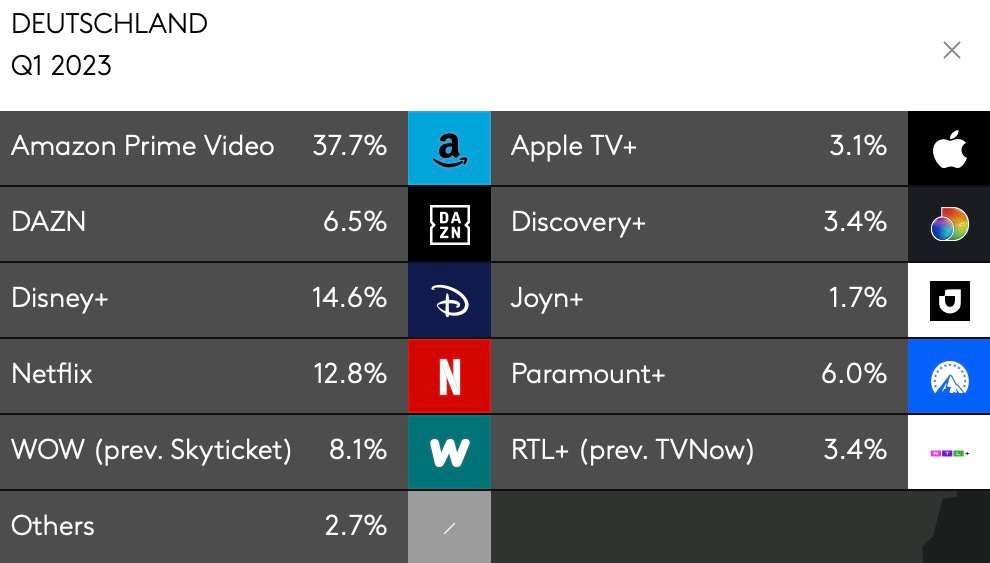

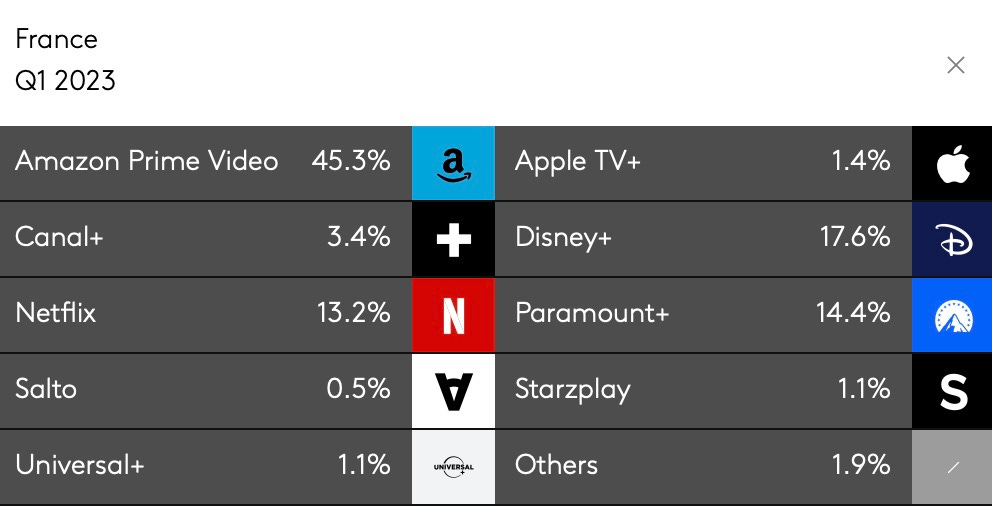

Look at how they lead new sign ups in Q1 2023 across US, UK, FR and DE3

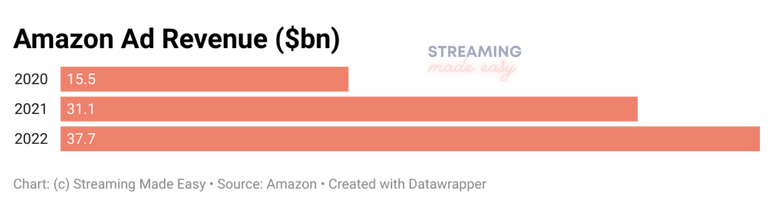

N°3 - They already have a powerful ad business.

Unlike Netflix who had to partner with Microsoft and build in-house advertising expertise, Amazon has everything ready to go.

Imagine the value for brands to build a 360 advertising strategy across all Amazon touch points now with instant access to 200M+ Prime members.

Amazon will likely be unstoppable.

That’s it for today.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. My “FAST Made Easy” masterclass has been in high demand.

→ Content Marketing: Explore how I can put my 5.3K LinkedIn following + my 2.5K Newsletter subs to work for your company like I do for mine.

I cater to Streamers, Distribution Platforms and Technology Vendors.

Book time to see if we’re a fit.