SME#39: Who will drive growth for FAST in Europe?

Count on Telcos & Pay TV providers to play their part

Welcome back to Streaming Made Easy. I’m Marion & this is your weekly European take on the Global Streaming Video Business.

Every Friday, you get 1 analysis, 1 streamer snapshot & 1 content recommendation (→ previous editions).

Enjoy today’s read and don’t forget to comment or share.

Today at a glance:

Analysis: Who will drive growth for FAST in Europe? Count on Telcos & Pay TV providers to play their part

Streamer snapshot: The “Rabbids” FAST channel

Podcast of the week: The Amp - “Exploring the rise of FAST channels”

💡Analysis:

In January 2023, I wrote a post on LinkedIn about how Telcos & Pay TV providers will be instrumental to FAST's growth in Europe and questioned my audience as to who would be 1st movers in the space.

8 months later, we’ve seen who that is.

Let’s find out more but first let me answer this:

Why are European Telcos & Pay TV providers important FAST stakeholders?

When it comes to FAST, the US growth has been fueled by CTV platforms and cord-cutters in need of a linear viewing experience.

Comcast Advertising indeed found that 70% of Xumo users were cord-cutters1.

A major difference between the US and Europe is that, for now, cord-cutting hasn’t taken the region by storm.

The Western European pay TV market has been more resilient. While the U.S. shed 5.9 million pay TV subscribers in 2022 alone2, estimates by Digital TV Research3 put us at a 7 million sub loss by 2027. Revenues will decrease faster though with 22B€ by 2028, down by 5B€.

Now changes are on their way so the Pay TV market needs to learn from its US counterparts and reinvent itself.

FAST could be one way to achieve that. They should get into FAST quicker than US Cablos did (only in 2023 did we see big moves from Comcast, Fubo, Sling and the likes when FAST has been killing it since 2019).

What do they bring to the table?

They will bring scale (100M+ Pay TV subs in Western Europe alone) and make a major difference in the engagement metrics.

How so?

They excel at aggregating and driving viewers to their TV offers. They have done it with TV channels, then Transactional Video on Demand and finally with SVOD for the past 10 years.

FAST is just the streaming version of their TV bouquets.

It makes sense for them to complement their existing channel line up but more importantly build a business where they are interested to the channel’s performance (e.g. Free TV Channels tend to keep 100% of their ad revenues while FAST is inherently based on revenue-sharing or inventory sharing).

Who’s active in the space?

Here are a few examples of companies who launched FAST Channel hubs:

→ Waipu, Zattoo and Molotov smoothly integrated channels within their existing EPG. The main difference being that Molotov went the Own & Operated route with its 6 channels while Waipu and Zattoo focus on aggregating 3rd-party FAST Channels.

→ Orange España kicked off 2023 with a FAST hub launch.

More recently:

→ Deutsche Telekom - Magenta signed a distribution partnership with Pluto TV.

→ Virgin Media did too but also launched a bouquet of FAST channels during the summer:

Inside Crime

Real Wild

Mystery TV

HauntTV

History Hit

Baywatch

Homes Under the Hammer

Great British Menu

Tastemade

NextUp Live Comedy

The Chat Show Channel

Deal or No Deal USA

Fear Factor

Wipeout Xtra

Partners include: A+E Networks EMEA, All3Media International, Banijay Rights, Blue Ant Media, Extreme International, Fremantle, Little Dot Studios and Tastemade.

What’s their unfair advantage in FAST?

The edge all these companies have is their existing EPG made of Free to Air, Pay TV channels and now FAST channels.

To the consumer’s eye, these FAST channels are just additional channels in the EPG. They benefit from this ease of access plus the aura of long-standing traditional broadcast TV channels.

Let’s see what results they get but I would be surprised if it goes bust.

And so by the end of 2024, I expect most Western European Telcos & Pay TV providers to have either signed with a platform like Pluto TV and/or launched their own FAST bouquet of channels.

Simply turning FAST into TV.

📺 Streamer snapshot:

“Bwaaah”

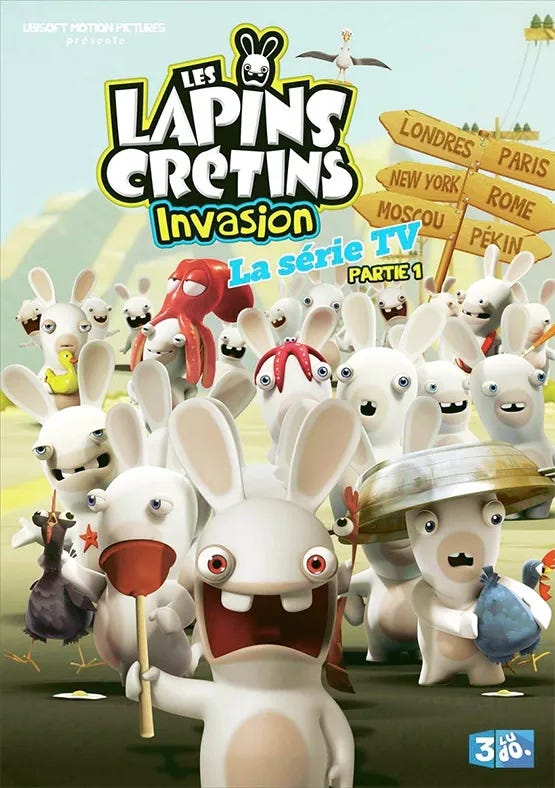

If this sound doesn’t ring a bell, even in writing, it means you’ve got to watch this new FAST channel by Ubisoft, Animaj and OTTera.

It’s called the “Rabbids” (aka Lapins crétins in French) and the channel went live in 13 markets on Samsung TV+.

A perfect example of a recognisable single-IP channel that should do wonders.

🎬 Podcast of the week:

This week, I shared my 7 favourite podcasts on Linkedin while I had the opportunity to take part in one from the team at Ampere Analysis.

It’s called “The Amp” where the team covers a wide range of Media and Entertainment topics. I particularly liked the one they did on European streamers a few months back.

The fact that it’s a pod from a research company means the team shares some cool nuggets from their research reports. Guess what they have in store for you this week?

→ FAST and the results of a US survey looking into consumer behaviours,

→ Valerio Monti, VP FAST at Fremantle sharing his insights,

→ Yours truly rambling about one of my favourite topics.

Go have a listen.

That’s it for today.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

The European FAST Tracker: With this Tracker, I lead masterclasses & workshops, draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until October 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).