Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business. Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

ICYMI 💥

I asked, they delivered: the NBA Roku FAST deal. Only joking but this was THE league I was waiting to see in FAST.

For a contrarian take on Spulu, read Fred Bucher’s piece “Stop trashing Spulu”.

Mark your calendars, next week, I’m moderating a panel on Sports with Scott Young (WBD), Scott Melvin (Buzz16) and Zoe Duffelen (SNTV).

I’m 20 years into my career.

If I were to start from scratch, I would get into the sports media business.

It'’s almost insolent how thriving the sports media industry is with a 2.4% YoY growth of sports media rights value at 56B$ according to SportBusiness Global Media Report 2023.

What does this have to do with streaming?

Every major streamer should be in the sports business too. Not every streamer can though as sports rights, especially for men's sports, come with a hefty price tag. But fear not, there are alternative strategies to include sports content without breaking the bank.

Today at a glance:

The Why behind the need for a sport strategy

The How to get into sports differently

The What else can be done

The Why behind the need for a sport strategy

The numbers speak for themselves:

→ Over two thirds of global consumers (67%) follow sports on a regular basis (i.e. in the last 30 days) via various media platforms according to YouGov’s Global Sports Media Landscape report.

Who wouldn’t want to appeal to 67% of global consumers across all demos and genders?

No one who wants to grow a global and mainstream streaming video business.

According to YouGov, just over a fifth of consumers globally (21%) subscribe to a streaming platform or service specifically to access exclusive sports content. The number goes up to 29% amongst the Engaged Sports Fans segment.

According to Kantar, 1 in 5 new streaming subscribers are motivated to sign-up to see the sports they love.

Which sports drive the most sign-ups?

Sport is also a formidable engagement tool with seven in ten subs reporting that their sports content subscription has encouraged them to consume more sports content.

What does the future hold?

and PCH Insights just dropped a fascinating survey analysing Americans’ sports TV viewing habits and it paints a concerning picture for sports-only streaming services with 50% of Americans very unlikely to sign up to a sports streaming service.Makes sense. Sports subscriptions are expensive (e.g. the average sports bill is around 88€ in Europe) especially as the rights fragmentation requires SVOD stacking.

To me, this screams opportunity for mainstream streamers by adding sports ingredients to their entertainment offerings.

The How to get into sports differently

I said it at the top:

Sports rights are expensive and are expected to continue going up (88B$ estimates by 2033)

Competition is fierce amongst bidders (NBA 👀)

Leading to fragmentation and increasing subscription prices which fuels subscription fatigue.

However, it doesn’t mean there is not a light touch way to be in sports.

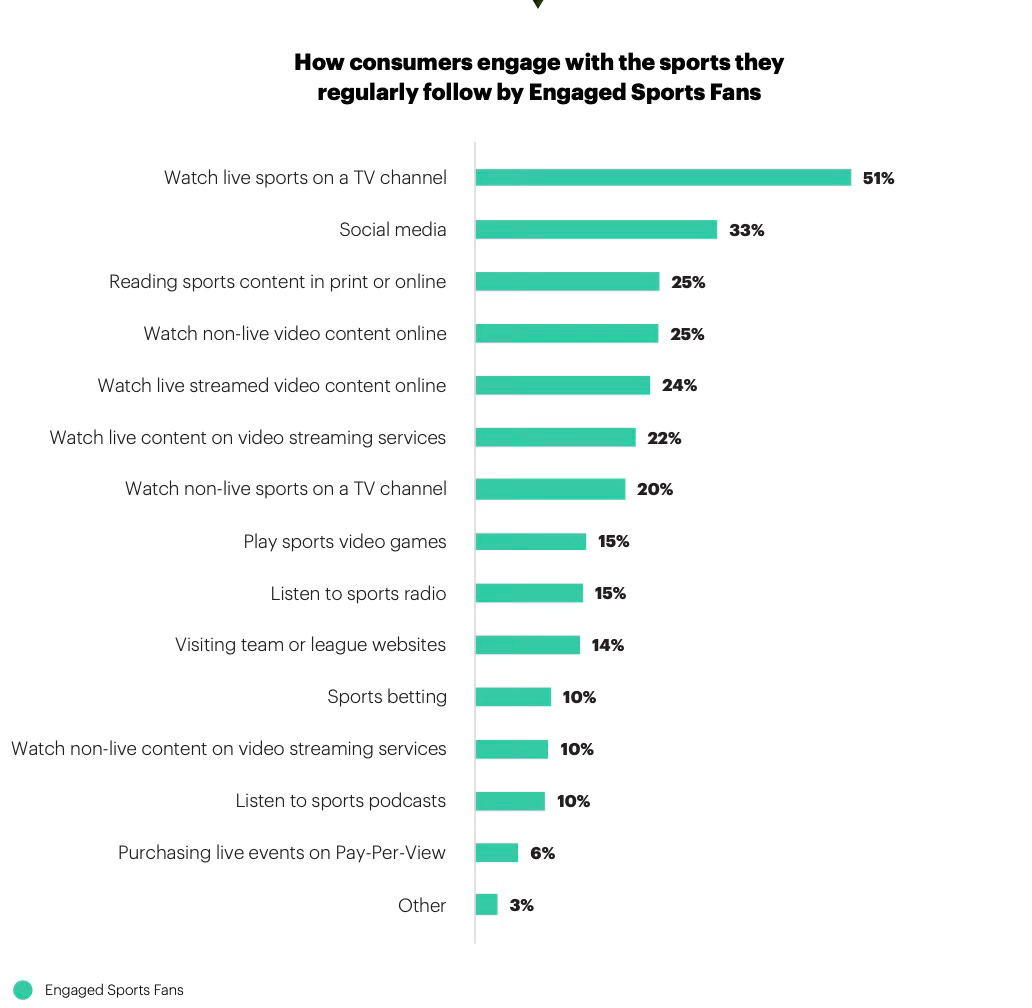

Looking at how engaged sports fans connect with the sports they love, there are still opportunities to attract and engage them in a multitude of others ways beyond Live Broadcast TV and expensive rights.

It’s all about finding your zone of genius and here are 4 examples of that:

→ The Docu-Series way

For Netflix, it has been about building a slate of docu-series like Drive to survive.

They then pulled the original programming thread and produced live events around Drive to survive, Full Swing and Break Point.

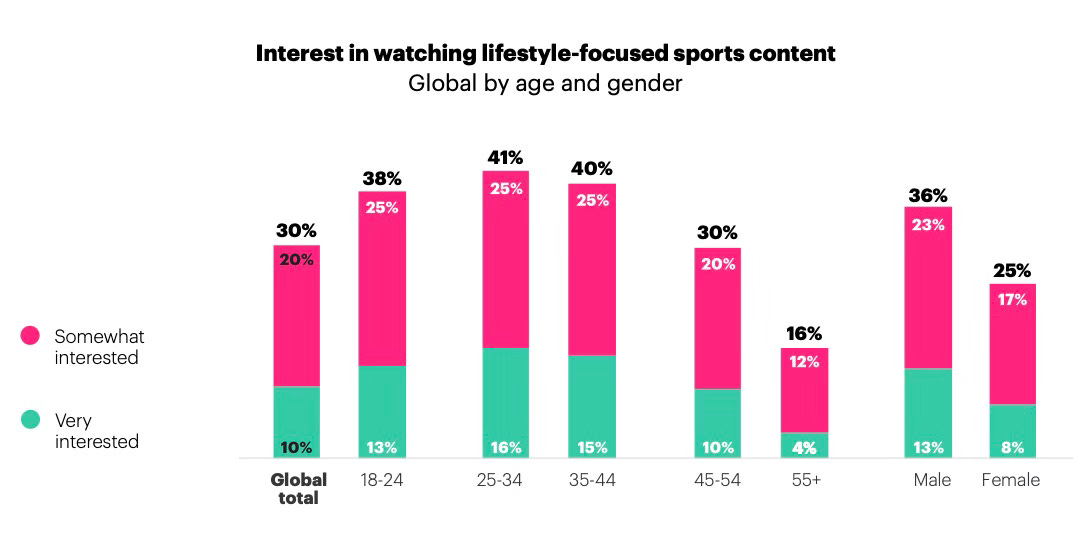

YouGov data reveals that 30% of global consumers are interested in watching lifestyle-focused sports content, increasing to 41% of 25-34s and even 43% of the Engaged Sports fans.

Netflix will take it up a notch in 2025 with its WWE deal.

→ The Sports Hub way

With the exception of Formula E rights, Roku hasn’t invested much in sports rights. Instead, it took the approach of being the best aggregator out there. Here’s how they go about it:

They make available every streaming service in market.

They build a sports hub which facilitates content discovery.

The hub also includes Roku Zones dedicated to certain sports. See the latest zone:

They distribute Sports FAST Channels:

They offer shoulder original programming (e.g. Talk show “The Rich Eisen show”; “NFL Draft: the pick is in”).

→ The Gen Z way

Bleacher Report: 4 college kids and a blog which became an online community for sports fans driven by user-generated content. It was acquired in 2012 by Turner for 175M$.

Today, it claims a 250M+ reach, the n°1 sports app for millennial males from 18-34 years old. Since 2023, B/R is also bundled with Max until it can be offered as a paid add-on (once they’ve resolved technical challenges).

Overtime builds new sports leagues aimed globally at the next generation of sports fans and athletes. Understand: traditional media is broken, let us do it our way to attract young audiences and they do: 83% of their audiences is under 35 years old.

They generate 2.5B+ views per month, they have 95M+ followers across 7 platforms.

→ The Content Creator way

25-year old YouTuber Jesse Riedel, best known as Jesser, reaches 18.7M subscribers with his Youtube channel focused on basketball.

Since its launch in 2013, the channel garnered 4,716,064,182 views. In October 2022, he had 249M monthly views while the NBA YouTube channel had 189M.

The What else can be done

Here additional ways to get into sports:

Don’t want to get into sports then bundle your entertainment service with a sports focused one (e.g. Netflix + Setenta Sports);

Diversify your shoulder programming. As evidenced above, fans consume multiple formats to follow their sport;

Organise virtual watch parties and fan meet-ups to enhance the viewing experience (e.g. Tennis Channel);

Incorporate interactive features such as betting, polls, quizzes, and interactive storytelling elements;

Invest in niche local sports;

Go after women’s sports. This is actually one of my 2024 predictions. Deloitte projects the sector will surpass $1 billion in revenue in 2024 (a 300% increase versus 2021). Bidding for Men’s Tier 1 Sports rights is the reserved domain of a happy few in each market. It’s a reasonable investment (e.g. Women's World Cup worth a 1/4 of Men's World Cup), the perfect timing to get in early and a great way to differentiate yourselves.

Mainstream streaming services have a wealth of opportunities to engage audiences without relying on expensive sports rights. They just have to think outside the box.

That’s it for today.

Enjoy your weekend and see you next week for another edition of Streaming Made Easy. Before you go:

Very interesting! I agree that sports are definitely a great industry to get into, and as I'm starting to look into colleges and careers I'll keep this in mind! Keep up the great work! (If you want to read some of my writing, here's my most recent post: https://sportsandstuff.substack.com/p/ranking-mlb-uniforms-by-color )