Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

Every Friday in your inbox. Check out previous editions here.

Enjoy today’s read.

Spring is here, time to meet IRL 🤩

Alan Wolk will cross the ocean to host an afternoon at MIP TV 2024! You’ll see me up there too for two panels, one on Sports & Entertainment, the other one on Shoppable TV.

Next up, I’ll be in Munich to give a keynote at this year’s edition of MTM Future of Video organised by Medientage München.

Last but not least, I’ll be in New York for Streaming Media East NY 2024 to host a debate club track. We’re working hard with Evan Shapiro and the wider team to build a one of a kind event for you.

Bonus: I got a little something for my readers → a 25% discount on tickets for Streaming Media East, ping me to get it.

Free Streaming TV started as the land of non exclusive library content.

Makes sense.

It was new and performance based (so little to no money to be made upfront).

Tough sell to get the buy in of content sellers (whose job is to extract as much value as possible from their library).

Most closed their vaults, some gave crumbs to test it out.

It was an after-thought while the big bucks were flowing from premium SVOD services building their content library.

This was 2014, the early days of Pluto TV or Tubi which I covered extensively in a previous edition.

10 years later, where are we at then? How do you stand out in a crowded non exclusive ecosystem?

Let’s dig into the differentiation tactics we’ve seen from Free Streaming platforms so far.

Today at a glance:

Why differentiation matters?

What’s happening?

What’s next?

Why it matters?

Much is said about churn in the SVOD world.

Every streamer envies Netflix 2% churn rate.

However, little is said about loyalty in the Free Streaming world.

Because it’s free, it shouldn’t matter?

On the contrary, you spend in customer acquisition too but without the certainty you’ll make a buck on this viewer who could come for a second and never come back.

It is crucial to make them return over and over again, make sure they build an habit with you.

You don’t do that with the same viewing experience and the same programming as every other platform on the block.

Hence why we’ve witnessed new initiatives across the platform ecosystem.

What’s happening?

Key differentiation plays include:

Depth

Platforms must offer consumers choice based on their interests (movie buff, sports fan, game show nut, thriller addict etc.) and their need states (comfort, uplift, immersion, external connection, routine, explore, togetherness, distract).

Check out this fascinating read by the Pluto TV research team who looked at the need states addressed by FAST.

Now depth doesn’t (shouldn’t) mean exhaustivity for an obvious reason: the discoverability headache faced day in day out by viewers in FAST (and beyond), a topic I covered last year.

Two distinct approaches were taken by the US and Europe.

In the US, 1959 unique channels live on 19 platforms in February 2024 with 12 of them trending over 200+ channels.

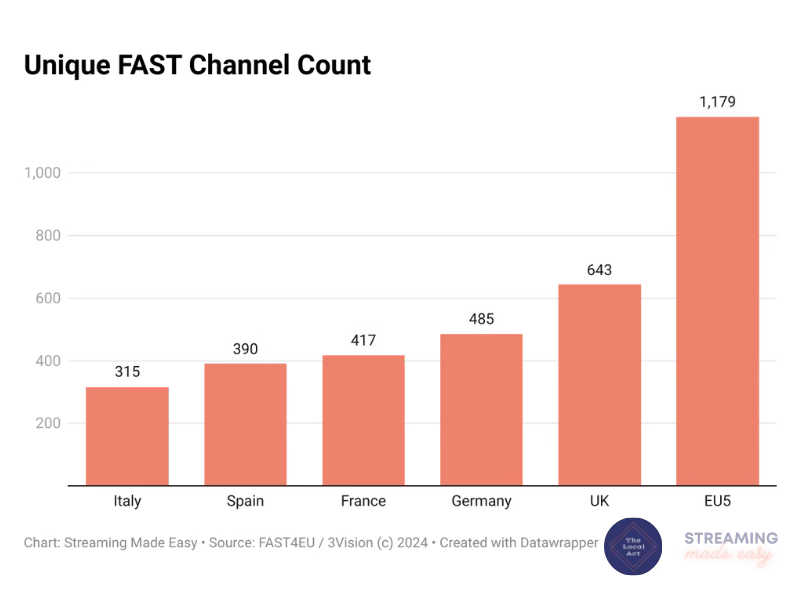

In the meantime, 1179 unique channels were live in EU5 across the platform sample analysed by 3Vision (the graph below includes: Pluto TV, Samsung, Freevee, LG, Rakuten, Molotov, rlaxx and ITVX).

Platforms like Pluto TV and Samsung seem to be playing with the 150 channel mark in their core EU markets.

Premium

Free Streaming TV may have started with cats on skateboards and old library movies but as time went, the model proved itself and programming became more premium.

Titles are now more recent (e.g. Narcos live on Samsung TV Plus), IPs are more recognisable (e.g. Pluto TV with its Mission Impossible Pop up FAST channel), brands launching channels too (e.g. US majors like Warner, NBC; Tier 1 broadcasters like ITV, BBC getting into FAST).

Programming remains second-run (or beyond) windows, although we’re starting to see titles launching in Free Streaming as a first window.

Originals

One way to do this is for platforms to produce originals to premiere on their services.

Tubi has produced 100+ originals.

The Roku Channel even won awards for one of their originals (the Weird Al movie with Daniel Radcliffe).

Live

Live events are now part of channels’ programming:

→ Award ceremonies like the upcoming MTV European Music Awards on Pluto TV.

→ Sports competitions featured each week (e.g. the World Cup 2023 on Tubi, DAZN, Tennis Channel, LaLiga featuring live events every week). For more on Sports and FAST:

Only stopping by? Consider subscribing to receive SME every Friday morning

Loving it? Consider sharing SME with your network

Exclusivity

Exclusivity plays by Samsung and Pluto TV with DAZN show they crave for differentiation.

Samsung UK just launched music channel GIGS with Mercury Studios.

Beyond exclusive channels, buying rights is another logical move:

→ Pluto TV Sweden will the home of returning factual TV program “Paradise”.

→ The Roku Channel the home of Formula E in the US (alongside CBS).

Own and Operated Channels

FAST platforms also launched their own and operated channels (O&O).

Pluto TV took this approach of building its own network of channels from Day 1. As a Viacom company, a true global content powerhouse, it got easier for them to tap into great content and manage their channels end to end.

Other platforms (who operate outside of a content conglomerate) didn’t have this unfair advantage and focused mostly on aggregating 3rd-party channels.

Now once you’ve done this for a few years, it only makes sense to take it one step further and start your own channels. You’ve seen what works, what doesn’t, time to build it yourself.

Samsung UK and Germany launched several O&O channels e.g. Comedy Mix, Crime Mix, Terra X (through a brand & licensing partnership with ZDF Studios) plus another 20 channels are in the works, Entertainment Mix etc.

Rakuten TV has several O&O channels living within its platform and on third-party FAST platforms like Samsung & LG. catering to drama, comedy, romcom, documentaries.

I expect more and more platforms to follow this path.

The consequences of that?

Platforms will be even pickier when it comes to channel selection. They will ask themselves: is this a channel I could build myself? If the answer is yes, then some channel providers may be left stranded.

What’s next?

Most tactics described above are content focused.

We will likely see a widening gap between platforms who can go more premium and those who can’t (financially speaking) which could lead to a consolidation of the market (through platform closures).

What I’m keen to see more of are initiatives across:

Distribution: ubiquitous making Free Streaming TV front and center alongside Broadcast TV and SVOD. In Europe, it means having Pluto TV and others on more Pay TV platforms.

Curation: I love a human touch, it makes a difference in how I engage with a platform. Anything to feel like I’m not in a content supermarket.

Product improvements: on discoverability, personalisation, ad experience (ad formats, effective frequency capping, channel look and feel, innovative promo bumpers), interactivity features.

Marketing, brand awareness: there’s still work to be done to educate consumers on the vast library of content available at no cost to them. I wanna see Pluto TV, Samsung TV+ and others household brands like Netflix and others.

Unlike SVOD, I feel no Free streamer (besides Youtube) is ahead of the curve (and uncatchable like Netflix is) which means: all bets are off!

That’s it for today.

Enjoy your weekend and see you next week for another edition of Streaming Made Easy.

Before you go:

By night, I write Streaming Made Easy and also on Linkedin.

By day, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my 6.2K LinkedIn following + my 4.4K Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.