Welcome to the 1st edition of FAST Times.

FAST Times is my new column about FAST (Free Ad-Supported Streaming TV) and the fruit of a collaboration with Streaming Media, an Information Today Inc. company, a news media company serving and educating the streaming media industry and community.

To get the next edition of FAST Times, sign up to receive Streaming Media 👇

Check out their upcoming event in New York curated by Evan Shapiro from

and use my code (MR25) to get 25% off.So, without further ado, let’s enter these FAST Times together.

As 2024 begins, it is worth taking a quick look at what happened in 2023 in the European FAST landscape, as it informs what lies ahead of us.

It is often said that Europe is three years behind the U.S. when it comes to FAST.

It is true that FAST took off in 2019 in the U.S. while in 2022, we were still debating whether it had a role to play in the European ecosystem.

But by the end of 2022, several players had made their first moves.

2023 got everyone on the same page: FAST should be part of the media mix whether you are a content provider, a broadcaster, or a distribution platform.

The question now revolves more around how we go about it.

The market in Europe bears little resemblance to the U.S. market, which is primed for FAST success with little free-to-watch content, massive pay TV losses, cord-cutters flocking to CTV, and a big and advanced ad market.

This past year shed some light on what a European FAST landscape could look like.

We indeed saw increased interest and activity from a range of European stakeholders.

The region experienced accelerated growth in the number of channel and platform launches; brands got more premium, exclusive deals and live content made their entrance.

Five trends got my attention in 2023 that I believe will fuel the growth of FAST in Europe in 2024.

1. Quality Over Quantity

European FAST platforms will privilege quality over quantity.

During MIPTV 2023 in April, Samsung TV Plus suggested it would place a soft cap in Europe at 120–150 channels, which is far from the 350-plus channels carried by The Roku Channel or Samsung TV Plus in the U.S.

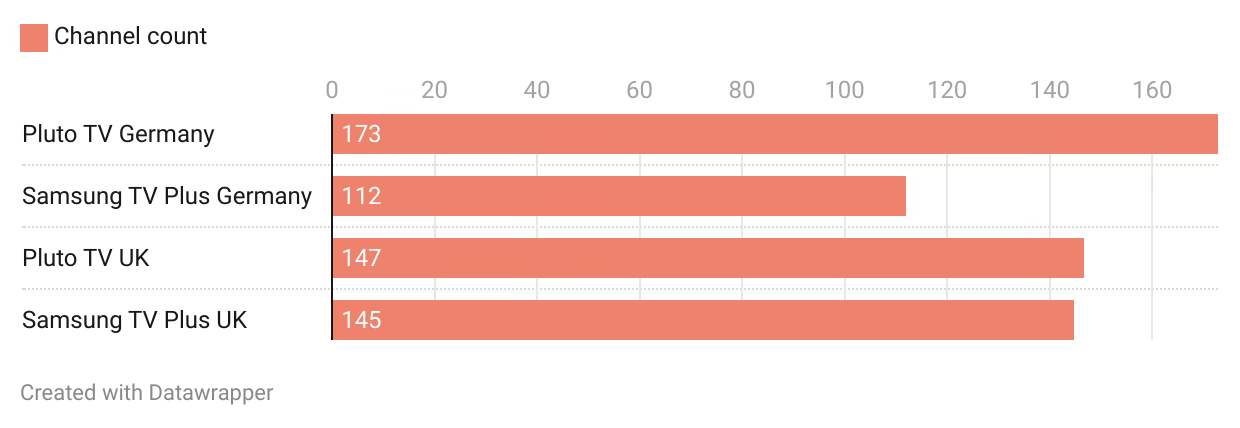

In Q3 2023, Pluto TV carried 147 channels in the U.K. and 173 in Germany (down by 15% in the U.K. and Germany versus Q1 2023), while Samsung TV Plus had 145 in the U.K. and 112 in Germany (Figure 1).

Figure 1. European FAST channel totals as of Q3 2023

The reason behind this quality-over-quantity approach stems from the landscape these platforms navigate, where FAST must find its spot among the extensive free-to-air content available to European audiences. Put simply, we have plenty to go around already.

This quest for quality translated into launches from Tier 1 brands:

Traditional broadcasters: CNN, Altice Group, France 24, France Télévisions, and Zee One are syndicating their linear feeds or creating bespoke FAST feeds.

Commercial entities of broadcasters: Channel 4, ITV Studios, BBC Studios, ZDF Studios, and UKTV are grabbing the opportunity to get out of their home market or their own hubs to grow their brands on third-party platforms.

Tier 1 sports brands: FIFA+, La Liga+, DAZN, SPORT1, and Tennis Channel Spain are entering the space.

Sports and news are often cited as the two genres holding down the fort for linear broadcast TV. It was about time we saw major sports and brands crossing over, and with sports came live, a new development with little precedent in the U.S. FAST landscape, which has mostly focused on shoulder content sports programming (pre- and post-event) rather than the game itself.

Channels like DAZN, La Liga+, and the Tennis Channel feature several live events a week now. Sports has also brought exclusivity plays by Samsung and Pluto TV, with partners like DAZN showing us they see sports as a differentiator worth investing in.

2. Platform Diversification

In the U.S., FAST has been the purview of pure players like Pluto TV or Tubi and CTV platforms like The Roku Channel, Samsung TV Plus, and Freevee. In Europe, FAST brings together a more diverse set of players, with telecom operators/pay TV providers and broadcasters launching FAST hubs.

For telecom operators, FAST is a natural extension of their existing channel lineups. Companies like waipu.tv, Zattoo, Molotov, Orange, or Virgin Media understood that early on. For broadcasters, adding FAST channels is about super-serving their audience and increasing time spent on their platform. ITVX, TF1+, and Joyn (part of the ProSiebenSat.1 Group) reference 20-plus channels each (a mix of owned-and-operated channels and a few third-party channels).

3. Partnerships

In the fight for viewers’ attention, it is easy to think that going it alone is the way to win. Here are two reasons you should think twice before you do:

It’s costly, at a time when the search for profitability prevails.

It’s lengthy and potentially ineffective in markets you don’t know well.

It has been fascinating to see companies taking a different approach, and here are three examples that caught my eye:

Hisense and VIDAA signing partnerships to power the FAST hub VIDAA Free in European markets

Samsung Ads brokering a deal with TF1 PUB (the ad sales house of French commercial broadcaster TF1) to boost monetisation

Pluto TV widening its device coverage with distribution partnerships with telecom operators like Virgin Media, Bouygues Telecom, and MagentaTV (Deutsche Telekom)

4. Awareness

Educating consumers to turn them into viewers is still a top priority for FAST stakeholders. It is not so much a question of consumers understanding what FAST is as them realising they have access to 100-plus channels for free.

The marketing playbook for FAST got a first design with Samsung TV Plus and Pluto TV investing in out-of-home activations, but I am eager to see more initiatives to boost awareness. Pluto TV’s campaign on the Sphere in Las Vegas makes me excited about what is yet to come. Once consumers are in, the next challenge is channel discovery. Ideas abound for improving discoverability, but whatever approach we take, it’s time to accelerate on this front, which is central to overall platform engagement.

5. Show Me the Money

We still have little data about adoption and penetration in Europe, but what we crave most is data around the revenue potential of FAST. Research outlet Omdia was the first to provide numbers outside of the U.S., with a 10:1 ratio between the U.S. and the rest of the world (Figure 2).

Figure 2. Source: Omdia Understanding FAST report, Blue Ant, 2023

In the absence of actual platform data, it is hard to say if these estimates have a grip on the true potential of FAST in Europe. What this tells me, though, is that we should not expect a FAST gold rush in Europe like in the U.S. for a simple reason: The two regions are too different. Does that mean we should we forego the model entirely? Of course not. We must write our own success story for FAST in Europe—a story in which FAST becomes:

A solid revenue stream in companies’ flywheels

A retention tool to bring added value to viewers

An alternative to SVOD at a time when wallets tighten

A way to boost time spent and lure in light TV viewers

A space to showcase underserved content and communities

A playground to experiment in and build a stellar advertising experience with the best of digital and TV combined

I will play my part in building this story.

Come with.

That’s it for today but before you go:

If so, you know where to go 👉 Streaming Media.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

On top of Streaming Made Easy, I run The Local Act, a streaming video consultancy catering to Streamers, Distribution Platforms and Technology Vendors.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. Check out past testimonials from companies like Studio Canal, MIPCOM or EGTA.

→ Content Marketing: Explore how I can put my 6.3K LinkedIn following + my 4.5K Newsletter subs to work for your company like I do for mine.

Ping me to see if we’re a fit.