The Connected TV landscape is full of surprises. When you think it cannot get more fragmented than it is today (with 15+ active operating systems), you get a left field market entry rumour from a digital adverting giant.

After Telly and its “The smartest TV at the revolutionary price of free” value proposition, here comes The Trade Desk and its “The omnichannel advertising platform built for the open internet” now rumoured to be making an entry into the TV OS ecosystem.

If you are wondering why such a move, you are not alone. Let’s get to the bottom of this.

Today at a glance:

Get To Know The Trade Desk

Welcome To The TV OS World

What Awaits Them?

Get To Know The Trade Desk

You may have heard of The Trade Desk (TTD), and even if you have not, you have almost definitely seen ads sold by them because the Trade Desk is a true giant in the advertising world.

The U.S. digital advertising platform specialises in selling digital ads across a vast number of digital platforms, apps, websites, Connected TV and podcast networks, where consumers engage with ad-supported content. Advertisers can access audiences (and buy ad space) across 400+ inventory partners (e.g. platforms where content is consumed and ads are placed).

Since its founding in 2009, TTD has developed an omnichannel platform which enables advertisers to buy ad placements across multiple channels: Online Video, Native, Mobile, Audio, Digital Out-of-home, and CTV advertising. In a nutshell, the ads are wherever you are.

TTD is an Open Internet proponent meaning they position themselves as an independent buying media tool versus walled gardens which they define as “closed ecosystems controlled by a few tech giants (such as Apple, Amazon, Google and Meta) who own their content and media. They have full control over the technology used to target, place and measure ads”.

Watch here

“We never seer you towards our channels or inventory because we don’t own any”.

For now…

They build a case for the Open Internet and educate advertisers on the missed opportunities to connect with their audiences by focusing their ad spend on walled gardens. To back it up, The Trade Desk Intelligence surveyed 2,000 U.K. adults about their online media habits, attitudes and experiences in April 2023 which showed that:

Nearly 60% of Brits’ time is spent on the Open Internet. And this trend shows no sign of changing: 30% of respondents expect to devote more of their time to the Open Internet in 2024.

But only 30% of ad budgets are following them there. In fact, 70% of advertiser money is spent in walled gardens, even though respondents spend only 43% of their online time there.

How big is their business?

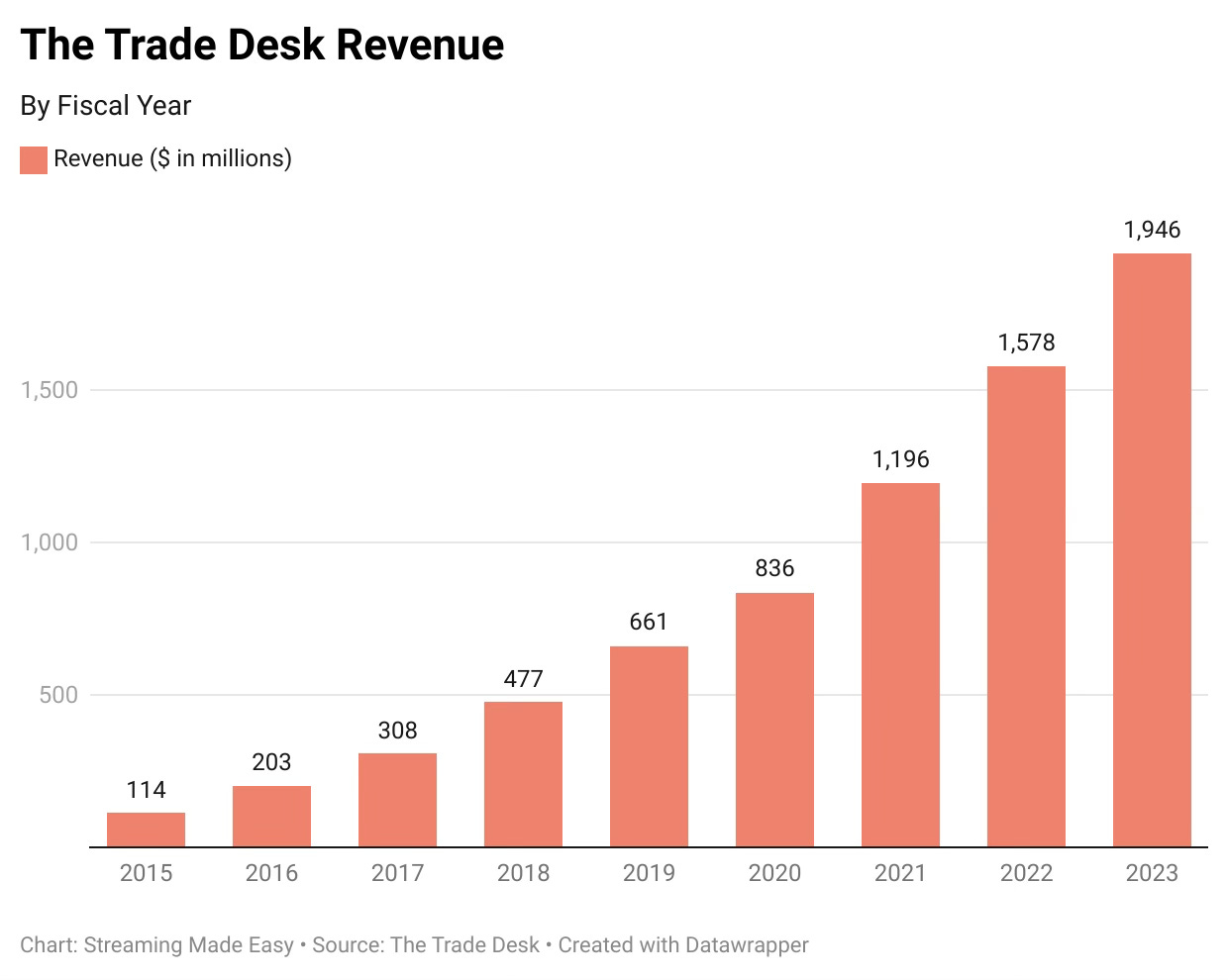

They reported a $1.9B revenue for 2023 and claim they reach more than 90 million households and 120M CTV devices globally.

Yesterday, they posted their Q3’2024 results:

Q3 three-month revenue: $628,016,000 (+27% YoY)

2024 nine-month revenue (ended September 30th): $1,703,819,000

With a 25% Q4’24 guidance, 2024 revenues will total $2,488,839,000 (+27.9% YoY)

In other words, a growing business as an ad technology company. Then why the need to step into the TV OS ecosystem?

📌 “Show me your bundle” is back! This time, we’re going all in on sports. A 1-hour live debate club where each debater imagines their bundle of choice and why theirs would be a winning formula for sports fans and sports organisations alike. Taking place on Zoom on November 26th at 9am PST, noon EST and 6pm CET.

Welcome To The TV OS World

Industry newsletter, Lowpass, surprised us all with this Trade Desk scoop. According to Janko Roettgers, the company began work on its own CTV system as early as 2020 and their first partner is rumoured to be audio device manufacturer Sonos who has been teasing the launch of a TV set top box since 2023. The Trade Desk will create the TV OS, and manage relationships with key apps and advertisers, while Sonos designs the hardware and user interface.

What are they building?

A TV Operating System (aka the brain of the TV but check out this article for a more techy explanation of what an OS is) for manufacturers who don’t want to license their OS from the likes of Roku, Google and Amazon. Hmm … they’re not alone courting hardware makers with that pitch. Whale TV, Titan OS, TiVo, Vidaa, the list goes on (for the full picture, check out my 8-part TV OS series).

Why are they building this?

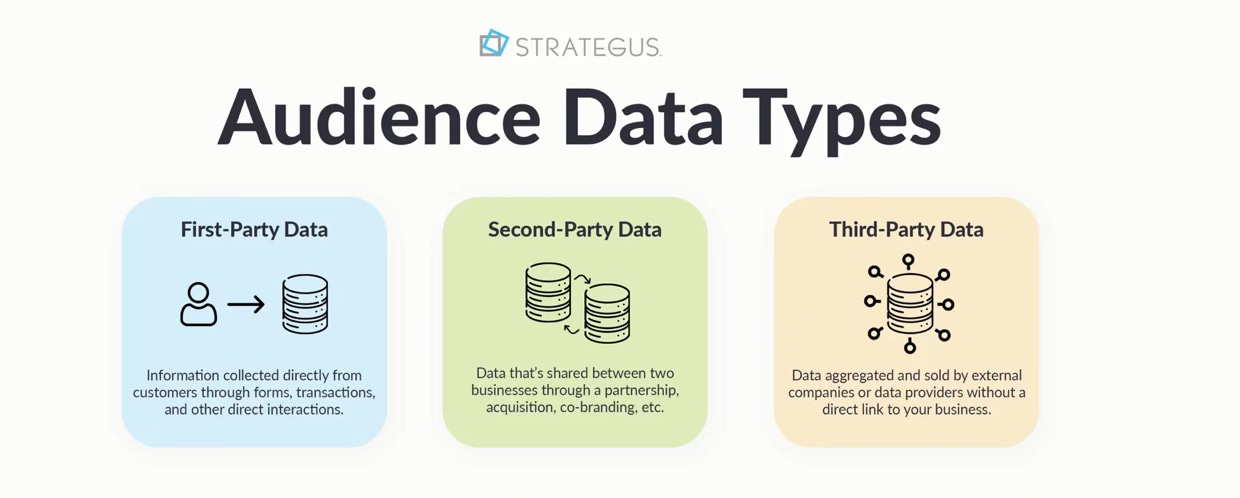

Data. First party data to be exact.

By becoming a TV OS in its own right, TTD aims to build a direct consumer relationship from which it will extract proprietary data on who they are and how they behave on their TV OS platform (including ACR data which is a technology built in Smart TVs which identifies what is playing on screen whether it’s content or ads). Simply put, the more data, the more personalised the content and ad experience can be, the more valuable the inventory.

TTD will also own prime real estate on its platform and could go back on their pitch to “never seer you towards our channels or inventory because we don’t own any”. Priority and/or exclusive access could be given to its clients.

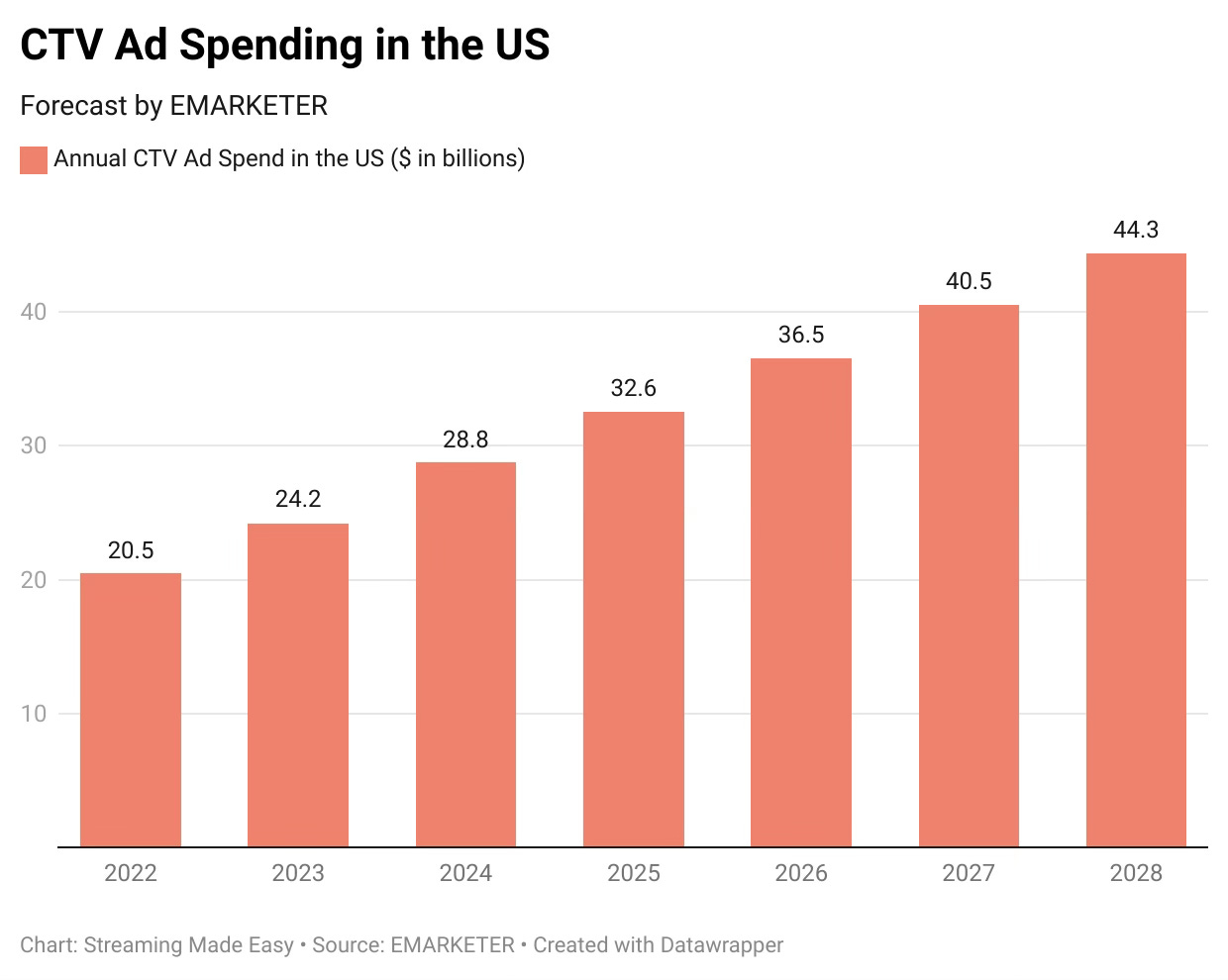

With this move, TTD positions itself higher in the food chain to ensure they get a piece of the CTV ad action (in the US alone CTV is estimated to weigh 44.3B$). Today, CTV “is our largest and fastest growing channel and will be for the foreseeable future” (no revenue breakdown by channel, nor growth rate of CTV specifically, were provided).

Creeping in the background, there is a legitimate concern that existing TV OS gain the know how and means to bypass TTD by selling most, if not all, of the ads running on their platforms. Roku’s new Ads Manager, announced September 18, 2024, is marketed as a one-stop buying solution for advertisers which could undermine the need for a third-party buying advertising platform like The Trade Desk (worth noting that the pair have an ongoing partnership to enable TTD’s advertisers to leverage Roku’s data).

TTD sees new walled gardens forming within the CTV ecosystem and wants to future-proof its business by being a buyer platform, a seller platform (with Open Path which enables them to be plugged straight into publishers’ inventories) and a content platform, the ultimate playground.

Thing is, all of the above is moot without scale.

What Awaits Them?

Building a TV OS and scale it takes time, it is capital and resource intensive.

TTD isn’t building one from scratch (thank goodness!). Its OS will be a forked version of Android (like Fire TV when it first stepped into the TV OS game). It’s smart because app partners won’t have to develop their apps for a new proprietary operating system. It will require some customisation though and Android or not, TTD will need to build an App Store from the ground up meaning they will need to contract with 3rd-party apps. This will take years because:

→ They have zero active devices and Netflix and others won’t lift a finger until they do (even platforms with existing scale struggle to get Netflix’s attention).

→ It’s one thing to have the global apps, it’s another to build a line up of must have local apps (not a week goes by without Vidaa announcing new local partners for example). It took Amazon Fire TV 3 years (from the launch of Fire sticks in France) to convince Canal+, the biggest Pay TV platform, and they too were a forked Android.

→ As far as I know, they don’t have a content team from deal makers to content marketers, nor do they have teams to support their partners to promote and sell TVs in stores and online (e.g. a TV packaging with content partners featured requires partners’ approvals, a job for the TV OS).

TTD just stepped into the chicken and egg race in the most competitive and fragmented device ecosystem. To win over TV manufacturers, they need an App Store. To win over content partners they need TVs in market.

To convince the former, they are rumoured to be offering more say on the interface’s look and feel and a bigger piece of the platform revenues than competitors do.

To convince the latter, I don’t see what they have to offer. A reduced distribution commission won’t suffice (90% of little is still little $$). Could they buy their way in with MGs? Forego their cut? They will still be treated as David and not Goliath for at least 3 years.

Why do you think Telly put a Google streaming dongle in its TV? It was a shortcut to get an App Store out of the gate.

TTD are spreading themselves too thin if you ask me. Making moves from the buy side to the seller side is one thing, going for the CTV Platform bucket feels like a stretch.

Isn’t there be a better path forward here with an industry-wide partnership outside of Big Tech? They have the ad technology expertise, leave the TV OS conception to Vidaa, Whale TV, Titan or TiVo to compete against the Google and Samsung of the world.

Just my 2 cents.

That’s it for today but before you go:

Writing this newsletter is one of the highlights of my week. Even better is reading the replies. I love hearing feedback on my work and stories about how it's helped you. If you have something to share, never hesitate to hit reply and let me know.

Enjoy your weekend and see you next week for another edition of Streaming Made Easy!