SME#36 - Apple TV vs Fire TV: The Ultimate Showdown

Streaming Made Easy #36 - "The Battle For The Living Room" Summer Series

Welcome back to Streaming Made Easy. I’m Marion & this is your weekly European take on the Global Streaming Video Business.

This week brings the 7th blog of the Summer Series “The Battle for the Living Room” with an edition dedicated to Apple & Amazon.

If you missed the previous editions, head over here → Summer series.

Enjoy today’s read and don’t forget to subscribe, comment and share.

© Apple TV+ on Fire TV

Apple and Amazon are an odd pair when it comes to the Smart TV landscape.

Both made moves early on with their respective streaming dongles and boxes.

The resemblance stops here as Apple never went all in on the TV front while Amazon adopted an OS licensing strategy similar to its competitors, Roku and Google.

Let’s look at where they are at today.

Fire TV

The 1st generation device branded Fire TV dates back to 2014 to compete with Apple and Roku. It was priced at 99$.

Several generations of Fire TV followed with the line up expanding to Fire TV Cube and Fire TV Stick.

These devices run on the Fire OS which is a forked version of Android.

Like their competitors, Amazon partnered with TV manufacturers to launch co-branded Smart TVs.

Their partner line up gathers brands like Toshiba, JVC, Grundig, Element, Westinghouse, Insignia and Onida.

As of March 2023, they have sold 200M Fire devices (across all device types) globally.

“We continue to hear from customers that most smart TVs just aren’t all that smart—and they’re turning to Fire TV to deliver a truly intelligent and intuitive TV experience.

With over 200 million streaming players and smart TVs sold globally, our relentless focus on making TVs actually smart is resonating with customers around the world. In fact, televisions are the fastest growing segment in the Fire TV business,"

Daniel Rausch, VP of Amazon Entertainment Devices and Services.

In 2022, Amazon grew its US share of the smart TV and SMD market by 0.4% YoY according to S&P Global (for reference, Google grew by 2.1% within the same period).

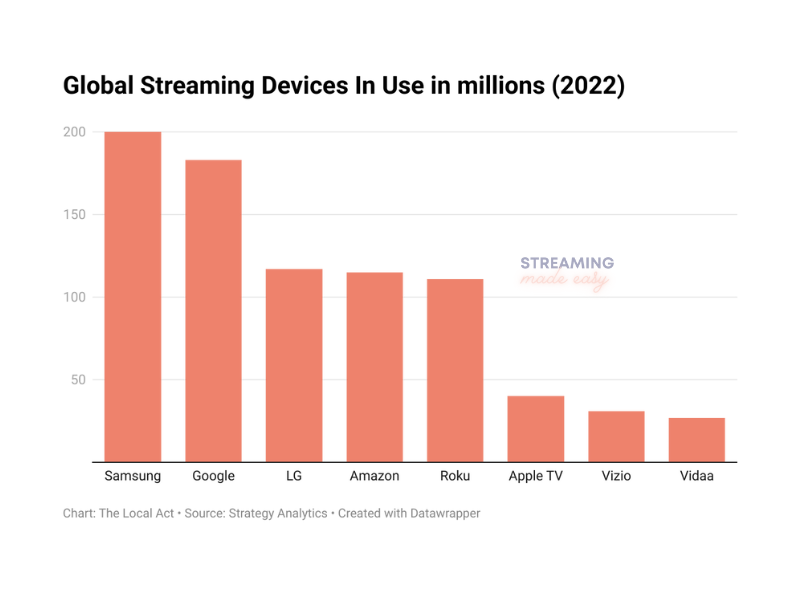

If devices sales stand at the 200M mark, the active devices are estimated to be over 100M according to Strategy Analytics putting Amazon in the top 5 players.

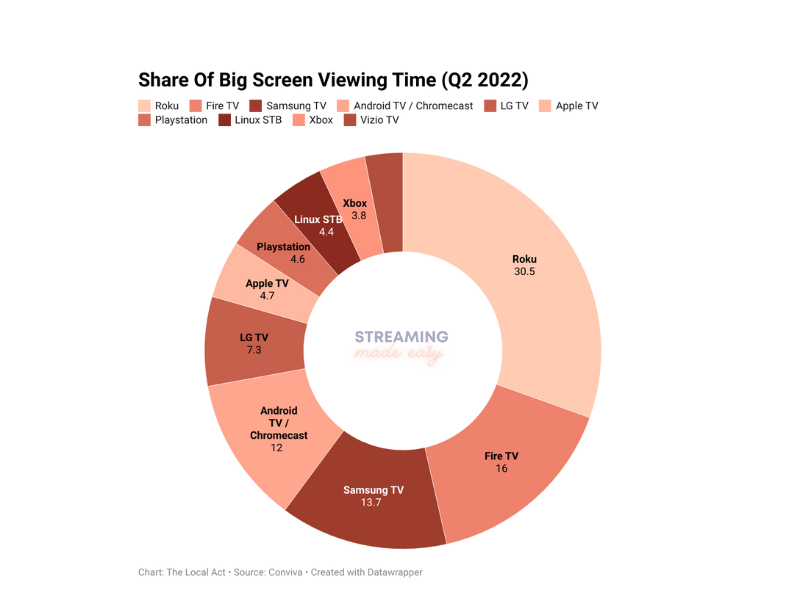

Engagement wise, Amazon comes in second (although the data is over a year old) which isn’t surprising as Amazon has a little something working well for them called: Prime Video which they can prominently put forward within their UI.

Amazon is the perfect example of a fantastic flywheel.

You can buy a TV on their website, plug it in, watch Prime Video and more which generates subscription revenues and ad dollars.

I just wonder if they won’t get bored of the device business at some point as we know it’s a low margin one.

Apple TV

It’s a long story between Apple & TV.

From the Macintosh TV in 1993 to the 1st generation Apple TV launched in September 2006, several generations of Apple TVs saw the light between 2006 and 2022.

Steve Jobs called the TV hardware business a hobby at first. In 2014, Tim Cook said it wasn’t a hobby anymore and yet a year later they closed down their TV hardware department. Fast forward to 2022, Apple discontinued the Apple TV HD model and now sells only one model: the Apple TV 4K model (3rd generation). It seems we’re back in hobby mode.

Since its inception, we’ve heard numbers here and there from Apple themselves or Research Firms:

During the Apple Watch Conference in 2015, Cook announced 25M Apple TV sold since launch;

In 2019, Research Company Loup estimated 53 million active Apple TVs worldwide;

Finally, in 2022, Strategy Analytics estimated ~10M US households use tvOS in 2022 (8% of all US HH).

It’s definitely not a commercial success and even more so when you compare it to their iPhone success story and its 1B iPhone users.

So how come a device with:

powerful components (A15 chip, 128-256GB internal storage),

high end technologies embedded (4K, HDR10+, Dolby Vision, Siri),

a suite of Apple services (incl. 3-month of Apple TV+ for free) and 3rd-party apps,

doesn’t sell more devices globally?

To me, it’s simply too pricey.

It doesn’t make sense to pay 129-149$ for a device which does exactly what competitors’ devices do (e.g. Roku Ultra is priced at 99.99$). I would rather buy a Smart TV and plug a 4K dongle at 49.99$.

In addition, the remote isn’t super user friendly (although Siri isn’t bad for discovery) and the app offering is still limited.

For the Apple hardcore fans (I’m partly one too), I get it, you have it all under one roof but even the design isn’t the best class design we’ve been used to, don’t you think?

Apple isn’t totally giving up on Apple TV devices but clearly their strategy has shifted towards the integration of the Apple TV interface within third-party TV manufacturers. It says a lot that they got out of their own and operated ecosystem to ensure Apple TV+ reaches global consumers.

Hardware company love their devices though and with the expensive sports rights they are acquiring, could they give it one last try with their own branded Smart TV? Time will tell…

That’s it for today.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

The European FAST Tracker: 1700+ FAST channels in the US alone but what is happening in Europe? What are the leading genres? Who are the active content providers and platforms? With this Tracker, I lead masterclasses & workshops, draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until September 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).