SME#35: Who are the next Samsung & LG?

Streaming Made Easy #35 - "The Battle For The Living Room" Summer Series

Welcome back to Streaming Made Easy. I’m Marion & this is your weekly European take on the Global Streaming Video Business.

This week brings the 6th blog of the Summer Series “The Battle for the Living Room” with an edition dedicated to Chinese manufacturers, Hisense and TCL, who are poised to become the next Samsung and LG.

If you missed the previous editions, head over here → Summer series.

Enjoy today’s read and don’t forget to subscribe, comment and share.

© Vidaa

After a trip to Korea, we’re off to China as two manufacturers are determined to take over Samsung and LG.

Who are they?

Hisense and TCL.

A brief history

→ Hisense

Founded in 1969 as a small radio manufacturer

In 1993, it was rebranded Hisense

In September 2007, Hisense TV LCD module production line was put into production, which is the first LCD module production line in China's color TV industry, breaking the history of foreign monopoly.

Live in X markets

90.000 employees worldwide

→ TCL

Founded in 1981 from audio-cassette manufacturer to TV manufacturer (and much more).

TCL stands for "Telephone Communication Limited" but the three letters now have a new meaning: "The Creative Life", the core value to its customers.

Live in 160 markets

75,000 employees worldwide

Samsung and LG have been hogging the industry news (and the top performers’ spots) for the past 17 years but the duopoly has been challenged these last few years.

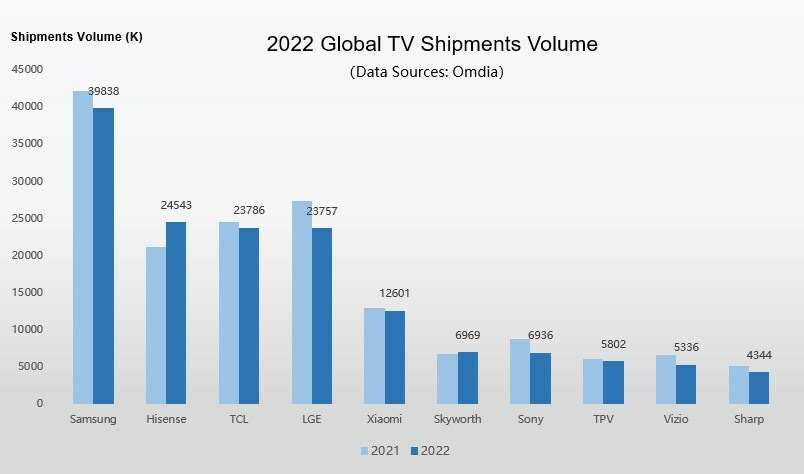

Case in point with the 2022 Global TV Shipment Volume where Hisense and TCL respectively took 2nd and 3rd spot with 24.5M and 23.7M TV shipped. Hisense outperformed its 2021 volume while TCL experienced a decline.

The trend continues in 2023.

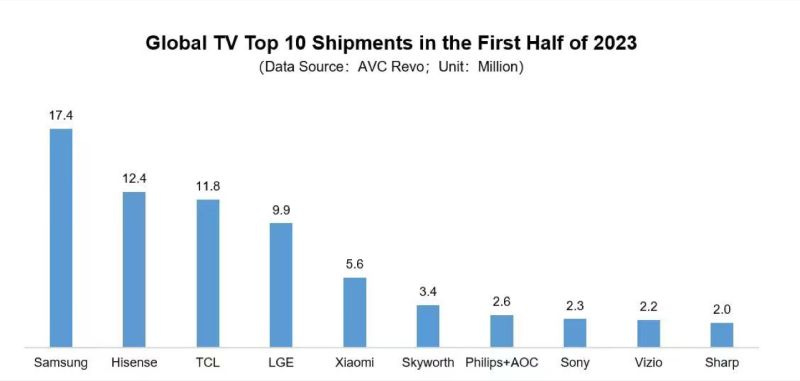

On August 1st, AVC Revo released "Global TV Brand Shipment Monthly Report" showing that in the first half of 2023, global TV shipments totaled 89.189M units, down 1.7% YoY.

“Hisense shipped 12.434M sets worldwide, up 22.3% year on year, continuing to lead the industry with the highest growth rate in the world, ranking second in the world. Global shipments share increased to 13.94%, a record high”

Guy Edri, President of Vidaa International.

Their device line up

Like all manufacturers, Hisense and TCL offer dozens of new models (in different sizes) each year.

Both initially focused on low entry price points (>500$) but they are gaining market share in the <500$ segment.

On what OS do Hisense and TCL TVs run?

Unlike Samsung and LG, both companies license 3rd-party OS and depending on the model, you will find Hisense Roku TVs, Hisense Google TVs, TCL Roku TVs, TCL Google TVs.

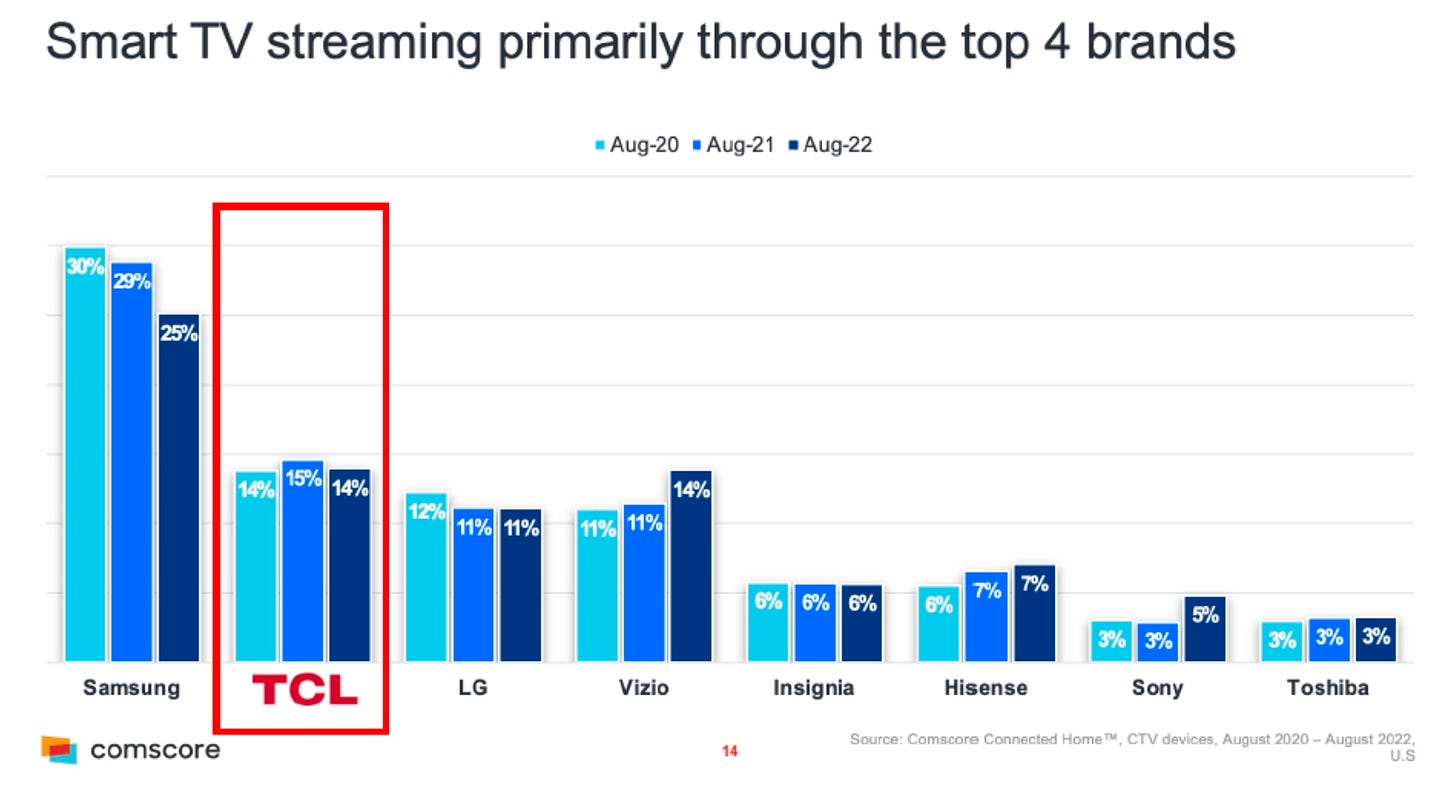

The incredible growth of TCL in the US is the fruit of the TCL / Roku partnership signed in 2014 when Roku started its Roku TV strategy. Roku became the n°1 OS in the US while TCL became the 2nd biggest TV seller (prior it enjoyed only a 6th spot).

TCL works more and more with Google TV.

Hisense didn’t stand still and developed its own OS called Vidaa.

Hisense and Vidaa are two separate companies within the same group. Vidaa services Hisense but not only.

For the past 18 months, Vidaa has been pitching its OS to other TV brands: Schneider, JVC, Hyundai, Eklyps, Smarttech, Edenwood, FPS, Saba, Engel, Kruger&Matz, Nei, Vortex, Akai, Schneider, Allview, Starlight, Vision.

They made the move from hardware to software, from 3rd-party OS licensing to pushing their own OS on 3rd-party devices.

Their scale

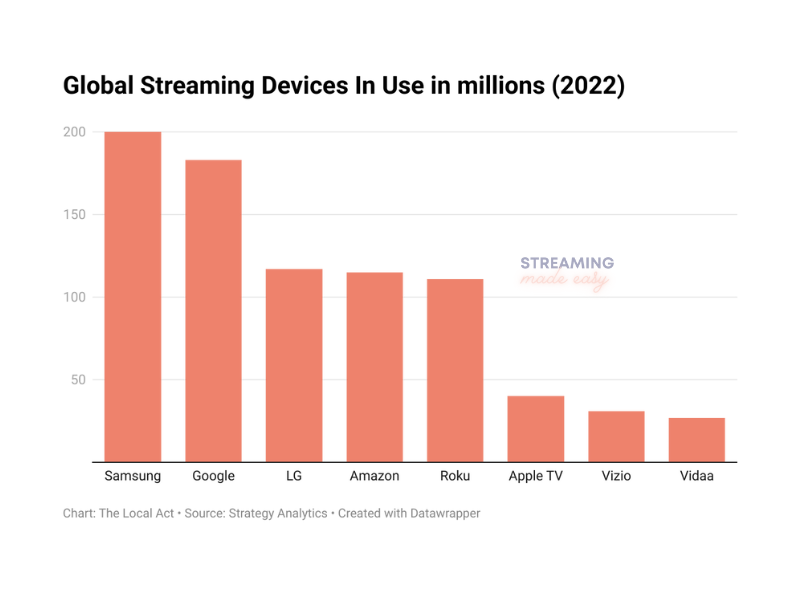

As they historically focused on OS partnerships, it’s hard to know how much they weigh in monthly active devices. Their active devices are within the Google TV and Roku TV pool of devices.

Vidaa’s aggressive push starts to show though as they get close to Vizio (US only TV manufacturer) which has 17.5M monthly active devices (as of Q1 2023).

Their platform engagement

The same challenge applies to their engagement metrics. For now, it’s drown within the Google TV and Roku TV numbers.

Going the Own and Operated Route with Vidaa Free and TCL TV

Again aggregating 3rd-party services is good, launching your own and operated hub is even better.

Both companies chose to invest in AVOD & FAST Hubs. Today, TCL is live in the US only. Hisense started Vidaa Free in the US and the UK with more markets in the works.

Watch that space.

Brand building

Both brands invest heavily in brand building and one way to go about this is via their sponsorship deals.

Hisense sponsored the Euro 2020 as well as the World Cup 2022. They sponsor Paris Saint Germain.

TCL sponsors the NFL, the French Rugby team for the 2023 World Cup and many more.

What’s next?

The move, by Samsung & LG, to license their OS to 3rd-party devices was clearly a response to the growing influence of Hisense and TCL.

The move, by Hisense and TCL, to build their platform businesses is clearly a way to limit the dependency on Google TV and Roku. Time to take matter in their own hands.

These 6 companies fight for market domination and I don’t see any consolidation on their horizon unless they decide to acquire smaller players in the space.

That’s it for today.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

The European FAST Tracker: 1700+ FAST channels in the US alone but what is happening in Europe? What are the leading genres? Who are the active content providers and platforms? With this Tracker, I lead masterclasses & workshops, draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until September 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).