SME#34: "The Battle For The Living Room" Series - The Samsung & LG Edition

Streaming Made Easy #34 - The Samsung & LG Edition

Welcome back to Streaming Made Easy. I’m Marion & this is your weekly European take on the Global Streaming Video Business.

This week brings the 5th blog of the Summer Series “The Battle for the Living Room” with an edition dedicated to Korean manufacturers, Samsung and LG.

If you missed the previous editions, head over here → Summer series.

Enjoy today’s read and don’t forget to subscribe, comment and share.

© Samsung - The Frame model

After two editions focused on OS Providers (Roku & Google), it’s time to focus on TV manufacturers, direction: Korea.

LG and Samsung did not launch the 1st Smart TV (Hewlett Packard did in 2007 with its MediaSmart TV SL3760) but they quickly followed with their own TVs to become the global market leaders they are today.

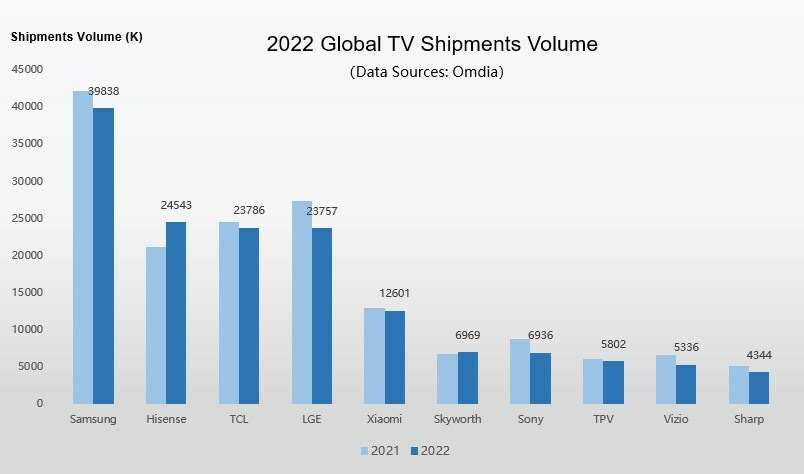

This year again, Samsung was the n°1 selling TV brand (source: Omdia) for the 17th year in a row.

In 2022, Samsung shipped a total of:

39,83M TVs,

9.65M units of QLED and Neo QLED TVs,

Samsung also dominated the ultra-large TV market segment in 2022, reporting a 36.1% and 42.9% market share for TVs over 75-inches and 80-inches respectively,

For the premium TV market priced over $2,500, Samsung retained the largest market share by revenue at 48.6%.

As for LG, they grabbed the 4th spot with 23,75M TVs shipped in 2022.

How did they get here?

Check out this infographic covering the 2008-2015 history of Samsung Smart TVs.

It’s an easy way to see how TVs got smarter and smarter, how technology evolved from LCD → LED → OLED → QLED → Micro Led, to refine TV picture quality

If you’re like me and don’t know the difference between all of these technologies, I advise you to watch this video by Dan Barker:

Besides picture quality, Samsung innovated with its Lifestyle series (one of these will be mine by the end of 2023!):

Their device line up

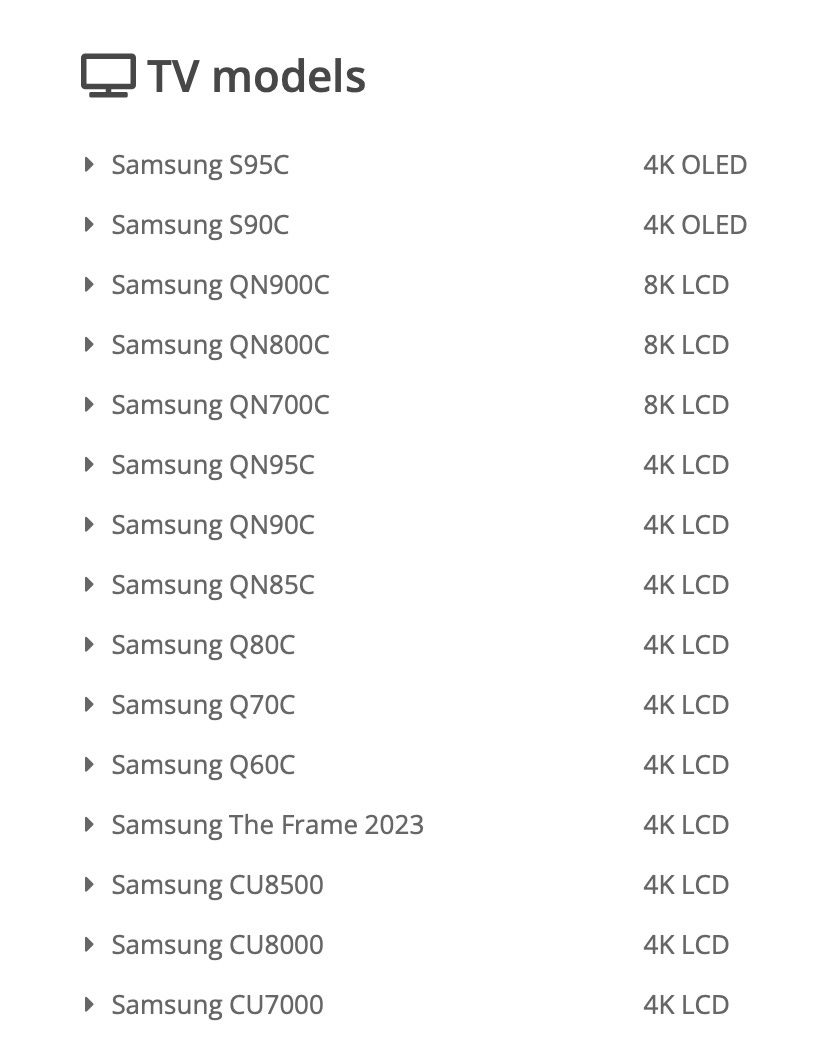

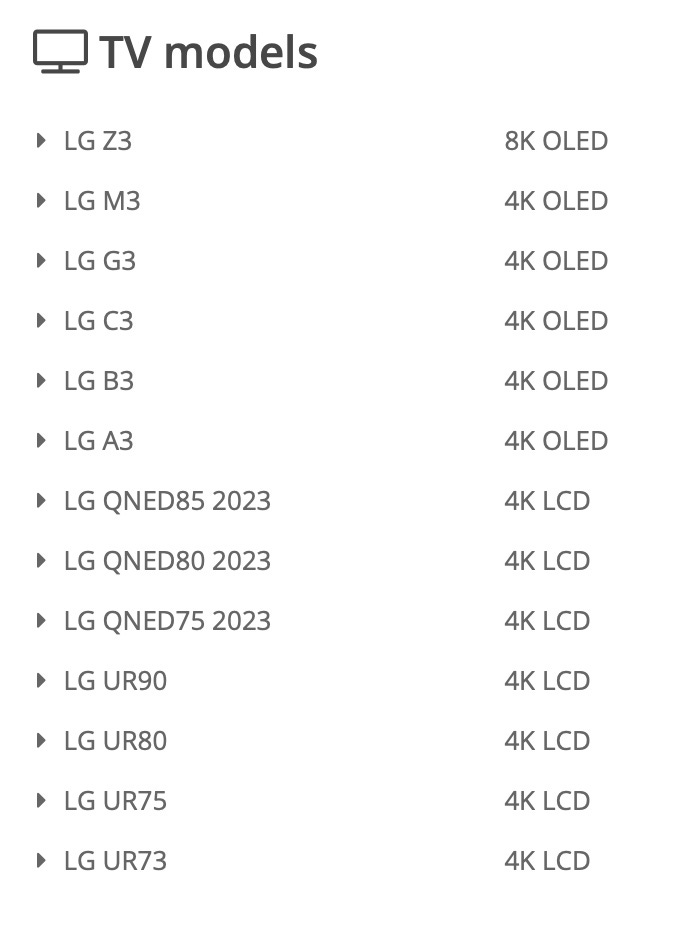

Both Samsung and LG offer dozens of new models (in different sizes) each year.

Samsung 2023 line up:

LG 2023 line up

On what OS do Samsung and LG TVs run?

Tizen for Samsung and WebOS for LG.

Unlike other TV manufacturers, Samsung and LG have built a fortress around their devices meaning that only their own OS run on their TVs. They don’t license 3rd-party OS like TCL, Hisense or Sony do.

How about running their OS on 3rd-party devices?

Samsung recently announced it would license Tizen to 3rd-party TV manufacturers, a clear move against the growing influence of Roku and Google.

Since then, Samsung signed partnerships with:

→ Tempo for 3 brands (Akai, Bauhn, Linsar).

→ Atmaca

→ HKC

LG did the same with webOS and is said to have signed partnerships with 20 brands.

→ Seiki

→ Eko

→ Stream System

→ Konka

→ Aiwa

→ Hyundai

Why this move?

Bringing Tizen or WebOS to more TVs means competing more actively against OS providers, growing the active device footprint and expanding the platform revenue playground (as all Entertainment services are operated by Samsung and LG).

Their scale

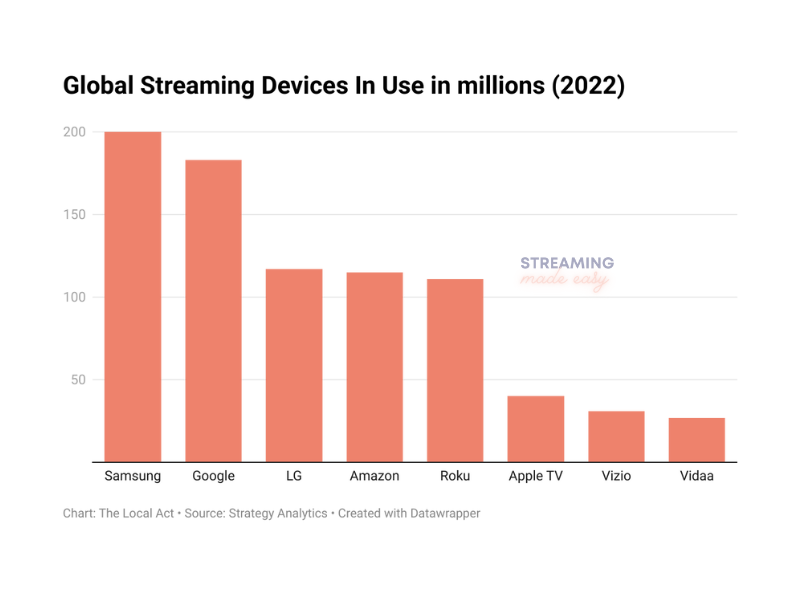

Talking about the active device footprint, Samsung and LG combined run on over 300M+ monthly active devices worldwide.

In Q1 2023, Samsung had 22% of market share (n°1), LG 12% (n°3 after Google at 21% (source: Omdia).

Their Platform Engagement

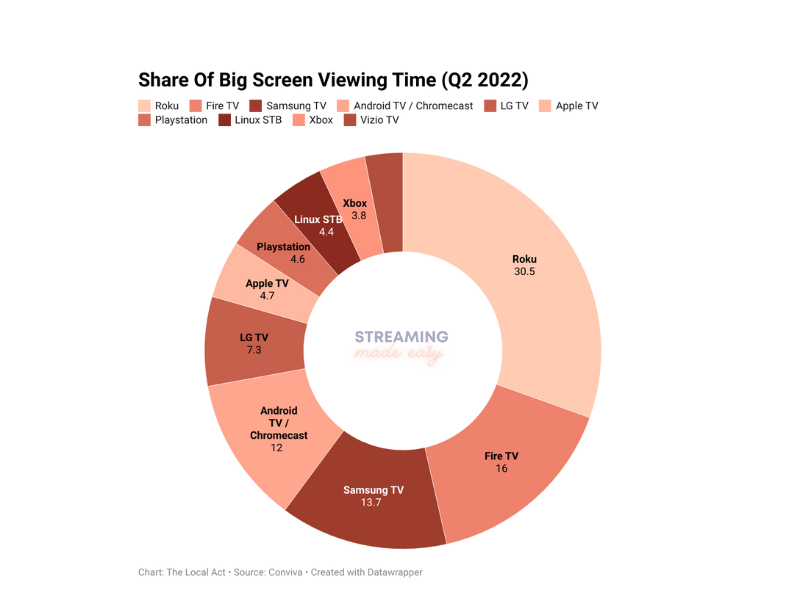

Engagement seems to be lagging behind its competitors at a global level:

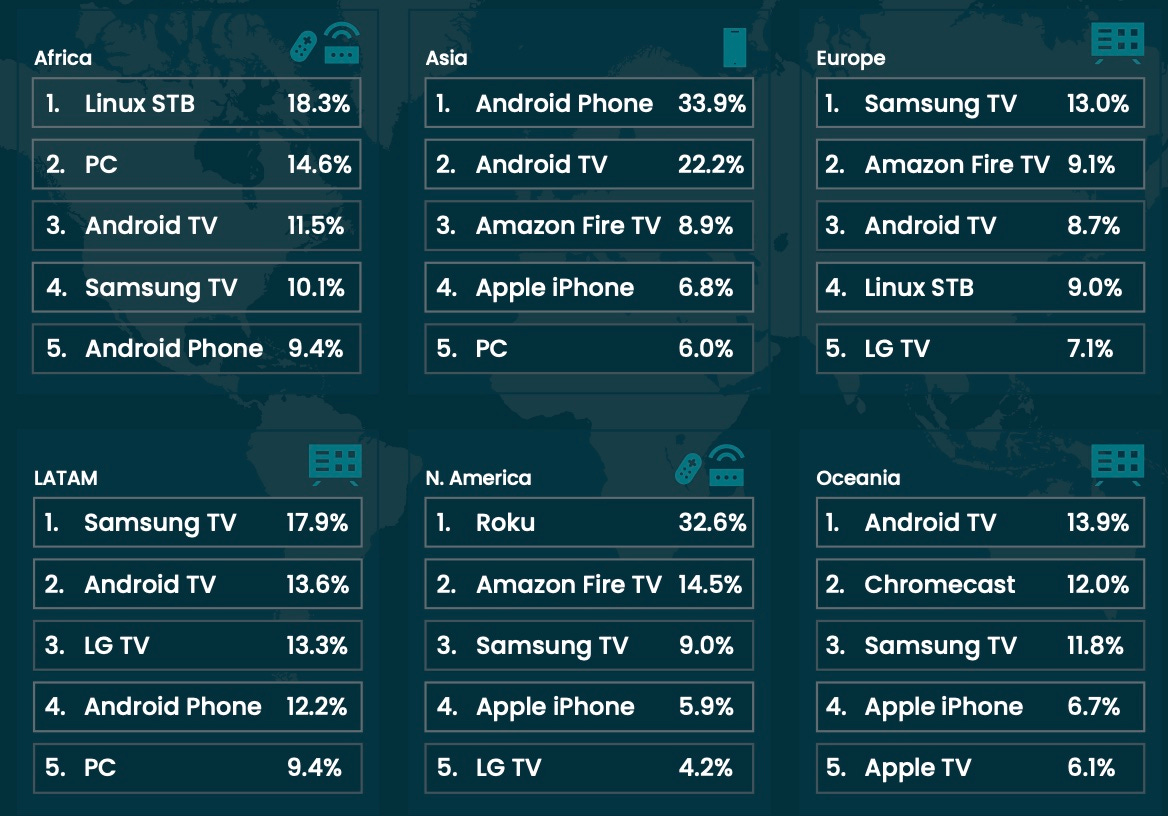

And again at a regional level, the pictures changes for both TV manufacturers:

Samsung leads in LATAM with 17.9% and Europe 13%.

LG sees its highest engagement in LATAM with 13.3%.

From hardware to software

As mentioned above, both manufacturers saw the need to focus not only on hardware sales but also on building a platform business.

They generate revenues like any other company in the space i.e. by charging a licensee fee for the OS, App Store commissions, On Platform advertising and more recently revenues from their own and operated channel hubs.

Going the Own and Operated Route with Samsung TV+ & LG Channels

After years of aggregating 3rd-party services (across video, music, gaming), both manufacturers launched their own content hub.

Instead of going the premium and exclusive route, they chose to operate a FAST channel platform with a sprinkle of AVOD content.

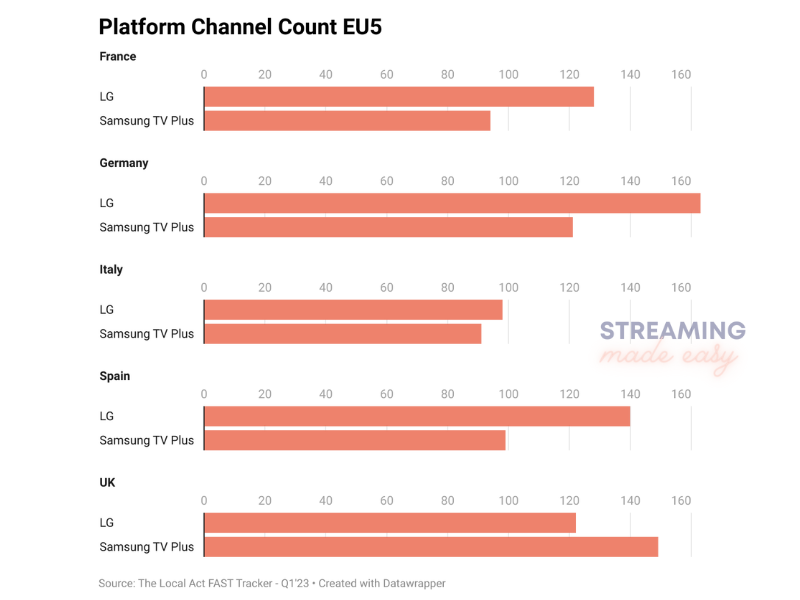

Samsung TV+ is live in 24 markets and LG Channels in 25.

In EU5 markets, each platform offers 90-160 FAST channels.

Top trends

Line ups used to be global with mostly US-originated FAST Channels.

Times are changing though.

Both companies hired local talents in Europe to build a local channel proposition and it’s starting to show: RTVE Samsung TV+ Spain, Satisfaction & Newen, L’Equipe, Le Figaro on Samsung TV+ France, Starke Frauen or wedo movies in Germany.

Exclusive deals made an appearance with DAZN+ exclusive to Samsung Germany or American Idol and American got talent on Samsung UK.

Samsung TV+ also started building its own and operated channels (by opposition with the ones acquired from 3rd-parties).

Once the channel proposition is here, you need eyeballs. I’m eager to see more marketing on/off platform to educate TV owners that they have 100+ channels when they buy a TV. Fixing channel discovery is a must too.

The whole model wouldn’t work without ad sales capabilities so both are building a sales force with bespoke entities (Samsung Ads & LG Ads).

Both services are exclusive to their owner but not for long as Samsung is said to be looking for distribution opportunities for Samsung TV+ (a move Roku made already with Amazon, Samsung and Google).

What’s next?

Habits die hard though. Samsung and LG are still focused on selling TVs.

They launch new TVs every year without providing older generations of TVs the latest software update.

e.g. you buy a 2023 TV, you get Tizen 7.0 and the UX/UI that goes with it which is different from the 2022 TV models.

This lack of retro compatibility is a problem and one that Roku or Google doesn’t have as they thrive to be device agnostic.

Roku does two updates a year and you have the same experience across all their devices (old and new).

→ As a viewer, it brings stability.

→ As an app partner, your app evolves as your partner’s platform evolves.

If both are serious about growing platform revenues, they will need to look beyond the device sale and see that over time more value can be extracted by upgrading old and new devices.

That’s it for today. Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

The European FAST Tracker: 1700+ FAST channels in the US alone but what is happening in Europe? What are the leading genres? Who are the active content providers and platforms? With this Tracker, I lead masterclasses & workshops, draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until September 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).