Welcome back to Streaming Made Easy. I’m Marion & this is your weekly European take on the Global Streaming Video Business.

Every Friday, you get 1 analysis, 1 streamer snapshot & 1 content recommendation.

This week brings the 3rd blog of the Summer Series “The Battle for the Living Room” with a Roku edition and we’re going purple for the occasion!

If you missed the previous editions → Summer series.

Enjoy today’s read and don’t forget to subscribe and share.

© Roku

Disclaimer:

I am a Roku alumni 💜 so bear with me as I may be a bit biased this week.

Let’s get started.

The genesis of Roku

Roku, in Japanese, means 6 as it’s the 6th company created by Anthony Wood.

Wood created Roku in 2002 after his previous company, ReplayTV, filed for bankruptcy.

During his ReplayTV days, Wood wanted to solve a problem: record his favorite TV show, Star Trek: The Next Generation, without the frustration of physically taping each episode and managing a growing collection of VHS tapes.

After spotting an ad for hard drives in his local newspaper, Wood was inspired and invented the digital video recorder (DVR).

ReplayTV competed head to head with Tivo but ultimately filed for bankruptcy.

With Roku, Wood had a new vision: one day all TV will be streamed and with that all advertising.

Project Griffin

In 2007, Wood pitched a project to Reed Hastings, later called Project Griffin (in reference to Tim Robbins’ character in Robert Altman movie “The Player”).

The pitch?

Building a streaming video box to bring Netflix to TVs.

Wood became VP of Internet TV at Netflix (while remaining CEO of Roku), Netflix invested 6M$ in Griffin and the team got to work.

A few months later, Hastings & Wood parted ways. Netflix wanted to be a streaming platform (agnostic of devices) and Roku wanted to be a streaming device manufacturer.

The Netflix player never came out. Instead the 1st Roku player launched in 2008 bringing Netflix to TVs for the 1st time. The rest is history.

The Roku device line up

From 2008 to today, Roku manufactured and shipped several generations of its Roku player.

Roku was in the hardware business but not only.

It built an Operating System made for TV from the ground up meaning that the device was not just a device, it became a platform too. One where you could (and still can) access thousands of apps (from US giants Netflix, Disney+, Max, ESPN to European giants BBC, ITV, RTL, ARD).

In 2014, the device line up expanded to TVs and this time around, Roku partnered with TV manufacturers to build a suite of Roku co-branded TVs.

Today, Roku’s OS powers TVs from 20+ brands across the US, Canada, Brazil, Mexico, the UK, Germany and Australia.

In 2023, they designed and built their own Roku Select and Plus Series TVs. These TVs are Roku made from head to toe.

The Roku ecosystem expands as well to Roku branded audio devices and smart home devices.

Roku’s scale

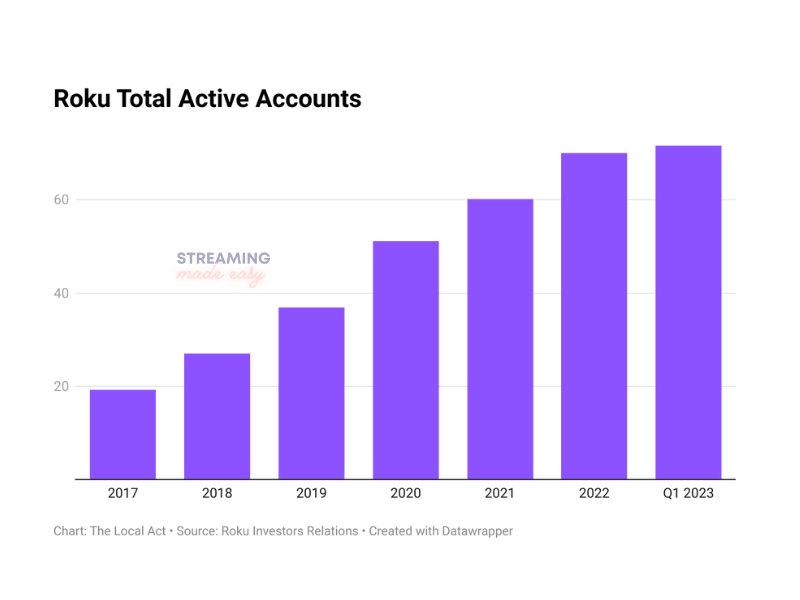

Roku doesn’t look at devices sold as a metric of success. One of the golden metrics for them is Active Account. You bought a device, created a Roku account and you have streamed content in the last 30 days.

Roku had 71.6M Active Accounts in Q1 2023 (source: Investors relations).

They don’t provide a market breakdown but in their Q1’23 shareholder letter, they said that their US Active Accounts are approaching half of all broadband households.

According to Leichtman Research Group, the US had 112,045,865 broadband subscribers (Q1‘23).

Assuming one broadband subscriber = one broadband household, this would then put Roku at around 56M Active Account Base in the US and the remaining 15.6M in International markets (note these are estimates based on the above mentioned sources).

Roku’s platform engagement

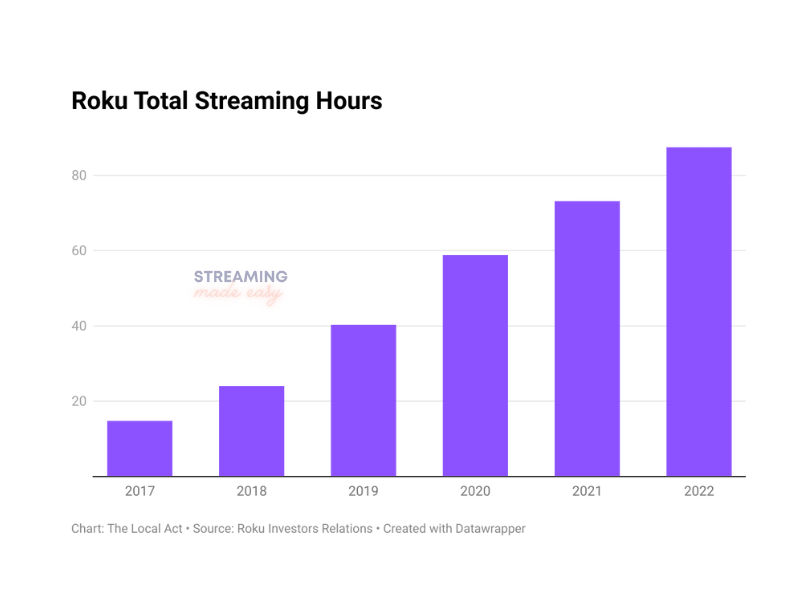

Ease of use is a pillar of the Roku value proposition and it shows in the numbers.

Roku users spent 87.4B streaming hours in 2022, which is a 14.3B hours increase from 2021.

Globally, our users streamed 25.1 billion hours in Q1’23, representing a record high of 3.9 Streaming Hours per Active Account per day.

In Q1, viewing hours on traditional TV in the U.S. were down 10% YoY (Nielsen), while global Streaming Hours on the Roku platform grew 20% YoY.

Last week, we looked at how TV OS compare when it comes to devices in use and big screen viewing time. Samsung leads in Active Devices but Roku leads in Viewing Time.

Roku’s Platform Revenue & ARPU

The scale and engagement wouldn’t mean anything if it wasn’t monetised.

Roku understood that early on and became the blue print for TV OS looking to grow Platform revenue.

They generate Platform revenue through advertising sales, the distribution of streaming services, the distribution of FAST channels, Roku Pay, and their Media & Entertainment (M&E) promotional capabilities.

Platform revenue was $635M in Q1’23, down 1% YoY, and ARPU was $40.67 (on a trailing 12-month basis), down 5% YoY.

Device revenue was $106.4M, up 18% YoY.

In the end, Roku is now a platform more than ever and as mentioned in a previous edition, hardware is a low margin business (3.4% gross margin Q1’23), software isn’t (52.6% Q1’23).

The Roku Channel Store

The Channel Store is an App Store where you can find thousands of apps (or channels in Roku’s platform lingo). Roku is an open ecosystem where any company can launch a streaming app.

The UI is an app first experience where you see tiles of apps you download (Netflix and co).

There is something for everyone.

The Roku Channel

The Roku Channel (aka TRC) is an app/channel which offers 80K titles in AVOD, 350 FAST Channels, 50+ Premium subscriptions (think SVOD services built in TRC) and Roku Originals (Weird Al, Die Hart, they recently bought Formula E rights in the US).

TRC is live in the U.S., Canada, Mexico, and the U.K.

The Roku Channel remains a top-five channel on the platform by both Active Account reach and Streaming Hour engagement. Q1’23 Streaming Hours were up 65% YoY.

In the US, it reaches 100M users (Q4’22).

Within just six months of launch, it became a top-five channel in Mexico by Active Account reach.

TRC was initially launched as an own and operated service exclusive to the Roku OS.

The app is now available on Samsung, Fire TV and most recently Google TV.

What does that tell us?

Additional scale is needed or wanted.

It’s fascinating to see how the lines blurry.

Who would have thought that a streaming player maker would become an OS provider, a channel store, an advertising powerhouse and a D2C streaming service producing originals and buying exclusive rights?

Now, the TV OS race is a global one and Roku must grow faster and bigger internationally.

Tune in to their Q2 2023 Earnings Conference Call on Thursday, July 27, 2023 at 5:00pm EDT.

That’s it for today.

Next week, Streaming Made Easy will display Googleyness as it digs into the Google TV & Android TV ecosystem.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

The European FAST Tracker: 1700+ FAST channels in the US alone but what is happening in Europe? What are the leading genres? Who are the active content providers and platforms? With this Tracker, I lead masterclasses & workshops, draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until September 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).