Welcome back to Streaming Made Easy. I’m Marion & this is your weekly European take on the Global Streaming Video Business.

Every Friday, you get 1 analysis, 1 streamer snapshot & 1 content recommendation (→ previous editions).

This week brings the 2nd blog of the Summer Series “The Battle for the Living Room: Exploring the TV OS Landscape”.

If you missed the 1st edition, here it is.

Enjoy today’s read and don’t forget to subscribe and share.

© Hisense

Who invented the 1st Smart TV?

It could have been a French company, Fast France Advanced Systems, who applied and secured a patent for an Internet-enabled TV back in 1994.

In 2007, Hewlett Packard developed a first TV: the MediaSmart TV (SL3760).

LG followed suite with a feature called “NetCast Entertainment Access” which gave access to online streaming apps such as YouTube and Netflix.

In 2008, Samsung launched its PAVV Bordeaux 750 TV.

Sony entered the game in 2010 with Bravia TV enabled by Google TV. They’ve been partners ever since.

How many brands exist today?

Over 40 brands: Bang & Olufsen (B&O)Continental, Edison, Blaupunkt, Grundig, Haier, Hisense, Hitachi, Huawei, Hyundai, Insignia, Element, Westinghouse, THTF, Seiki, JVC, Konka, LeEco, LG, Loewe, Motorola, Nevir, Nokia, Oppo, Panasonic, Philips, RCA, Samsung, Sceptre, Sharp, Skyworth, Sony, TCL, Telefunken, Thomson, Toshiba, Vestel, Vizio, Funai, Polaroid, SunbriteTV.

It’s fascinating to see how, through the years, the centre of the TV business shifted from one country/region to another.

In the early 2000s, the leading brands were:

European brands (Philips, Grundig, and Thompson)

Japanese brands (Sony, Panasonic, Toshiba, Sharp)

American brands (Vizio, Magnavox)

Korean brands (Samsung, LG)

Chinese brands were non existent then.

Their entry (with lower quality and cheaper TVs) shook the market. By 2014, many of these brands closed down factories or were sold.

The brand names were licensed to TV Assembly OEMs (Original Equipment Manufacturer). Hitachi is one example of a brand which is now manufactured by a 3rd-party OEM (Vestel).

Fast forward to today and Chinese manufacturers are making headway with TCL and Hisense said to be the next Samsung and LG.

How much is the Global Smart TV market worth?

It was valued at 197.82B$ in 2022 and 211.42B$ in 2023. The segment is expected to expand at a CAGR of 11.4% from 2023 to 2030 to sit at 451.26B$ by 2030 (source: Grand View Research).

The US Market weighed 58.9B$ in 2022 and will weigh US$ 133.4 Billion by 2028 (source: IMARC Group).

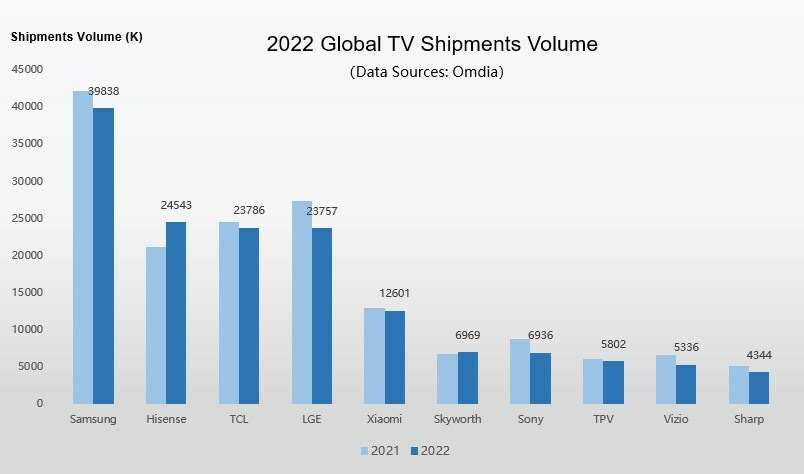

Who shipped the most TVs in 2022?

Here’s the top 5:

N°1 Samsung

N°2 Hisense

N°3 TCL

N°4 LG

N°5 Xiaomi

See why Chinese brands like Hisense and TCL are now seen as the new giants in the space.

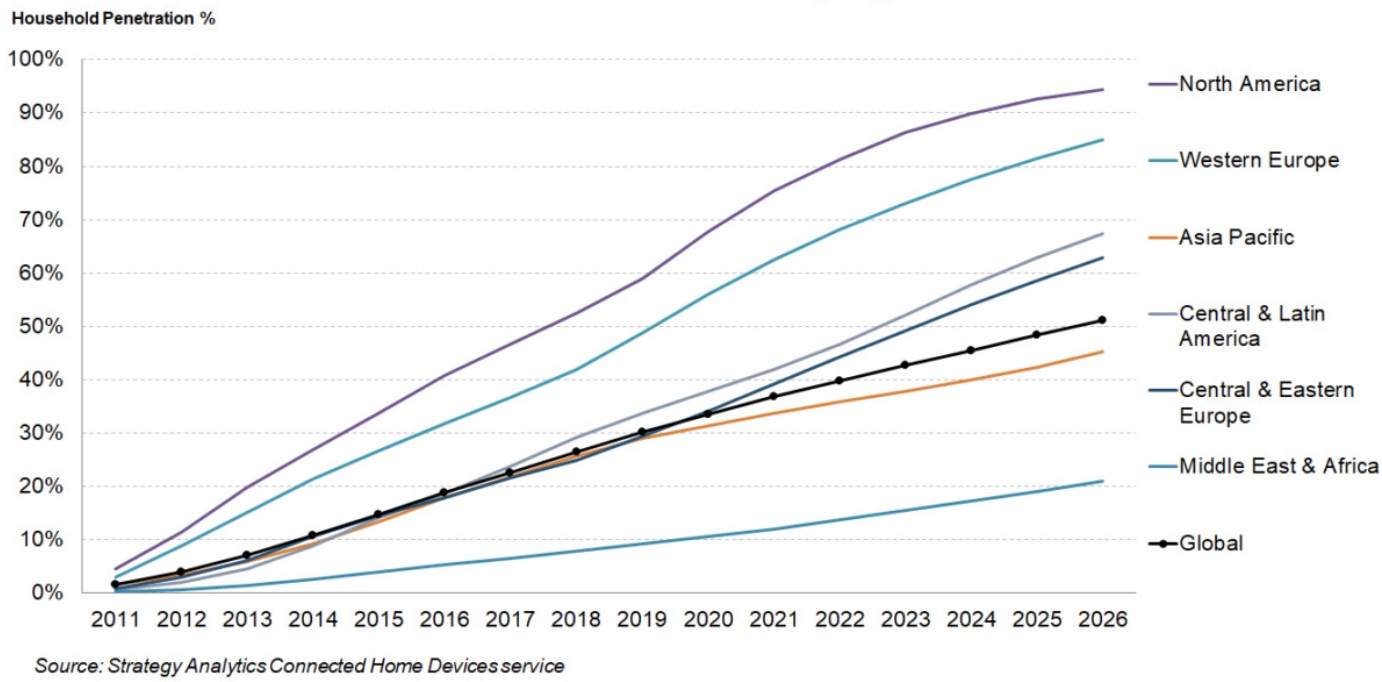

What’s the Global Smart TV penetration?

All regions experience growth but no surprise in North America and Europe, the penetration is already over 80% and 70% respectively.

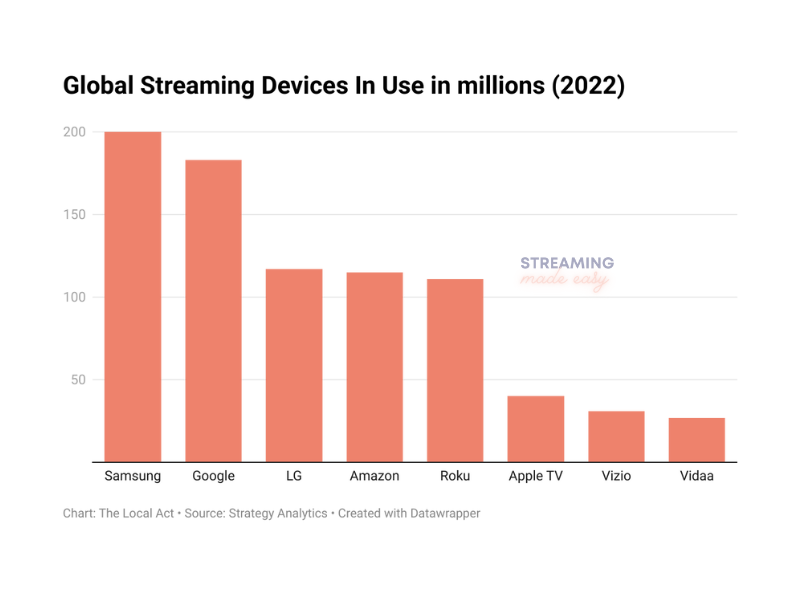

Now, it’s great to sell TVs but how does that translate in active devices?

At this point, we switch to an OS view of the market i.e. Roku powers 15+ Smart TV brands (e.g. TCL, Sharp, JVC), Google 10+ brands (Sony, TCL, Panasonic).

By the end of 2022, Strategy Analytics forecasted the following:

Xbox adds another 45M active devices and Playstation 77M.

And what about engagement?

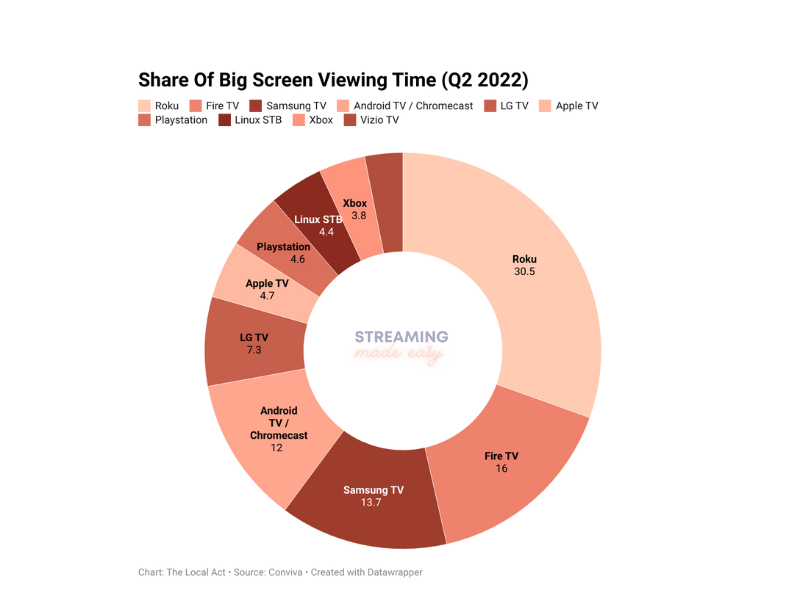

I haven’t come across 2023 numbers (tell me if you have in the comment section) so my go to for now is Conviva State of Streaming Q2 2022 which shares viewing market share:

What does that tell us?

The power plays shift when we move from TV sales, active TVs and platform engagement.

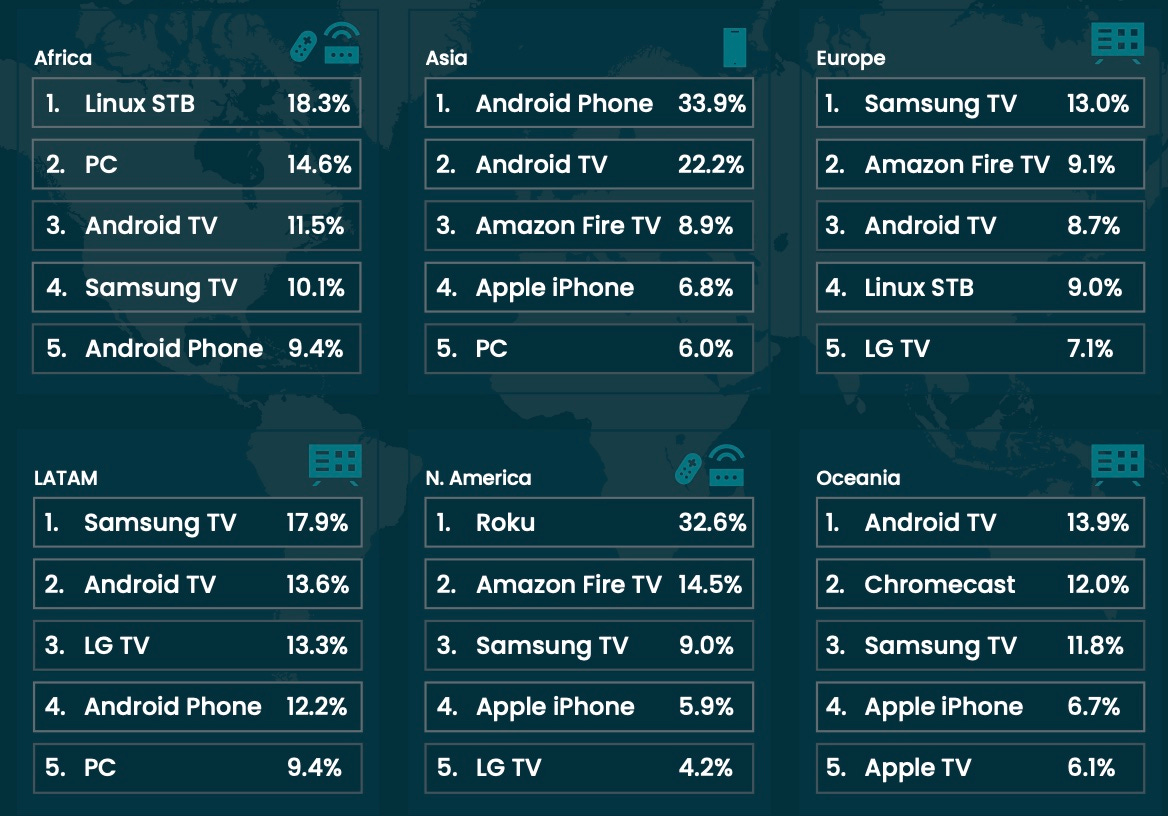

As you can see Roku, despite a more limited market presence (vs a Samsung or a LG), boasts the best platform engagement but the picture changes if you go at regional level with Samsung leading in LATAM and Europe.

That’s it for today.

Next week, Streaming Made Easy will turn purple (Roku’s brand color) as I discuss the Roku playbook.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

The European FAST Tracker: 1700+ FAST channels in the US alone but what is happening in Europe? What are the leading genres? Who are the active content providers and platforms? With this Tracker, I lead masterclasses & workshops, draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until September 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).