Welcome back to Streaming Made Easy. I’m Marion & this is your weekly European take on the Global Streaming Video Business.

Every Friday, you get 1 analysis, 1 streamer snapshot & 1 content recommendation (→ previous editions).

This week brings a different format with the 1st installment of a Summer Series called “The Battle for the Living Room: Exploring the TV OS Landscape”.

While the mobile industry boasts two dominant operating systems, the TV ecosystem presents a contrasting picture.

This series aims to deep dive into this ecosystem, shedding light on the strategies employed by key players and unraveling the complexities it brings to streaming services looking to grow on these devices.

Enjoy today’s read and don’t forget to subscribe and share.

© LG

Today at a glance:

Introducing the Series

Blog 1 - Overview of the TV OS ecosystem

Introduction:

This series has been on my mind for a while and reading the news about Roku acquiring US Formula E rights was just the push I needed.

Why?

It’s yet another example of the lines getting more blurry in the TV ecosystem.

Gone are the days where Roku was a streaming stick hardware company only or Samsung was building a fortress around its TV OS.

Every company in the ecosystem is tweaking its playbook and launching new business verticals with one element underlying everything: their OS (Operating System).

What’s the impact on Streaming?

In a decade, Streaming services have revolutionised the way we consume content, offering unparalleled convenience and a vast array of choices.

As the Streaming landscape expands, the importance of a seamless and user-friendly TV operating system has grown exponentially. TV OS not only determine how users navigate and access content but also play a crucial role in shaping the future of entertainment and the digital living room.

Against this backdrop, I aim to provide a comprehensive analysis of the TV OS market, examining the strategies and innovations behind each player's approach to capturing a slice of this lucrative market.

Blog 1 - Overview of the TV OS ecosystem

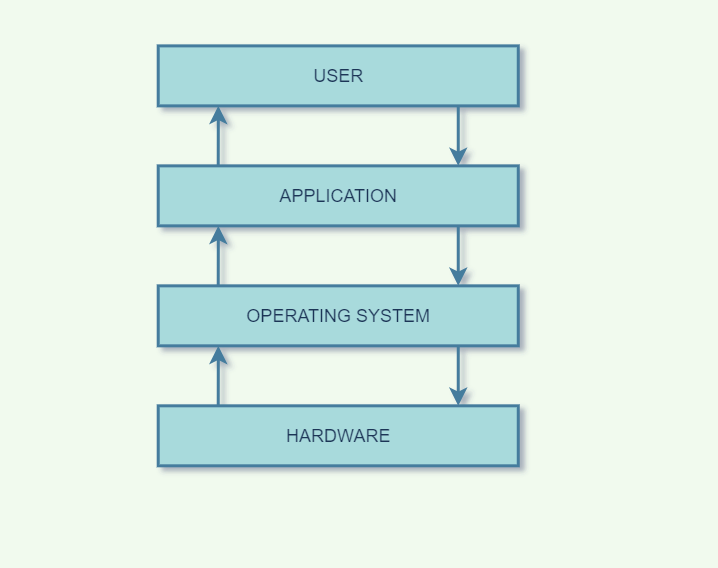

What’s an OS?

OS stands for Operating System.

It is the program that manages all of the other application programs in a hardware device.

The application programs make use of the operating system by making requests for services through a defined application program interface (API).

Source: www.mygreatlearning.com

What are the different OS available in market today?

→ On Mobile, it’s simple, your device either runs on Android or iOS. In the “Other” bucket, you have Samsung, Linux, Windows, KaiOS.

Source: https://www.bankmycell.com/blog/android-vs-apple-market-share (June 2023)

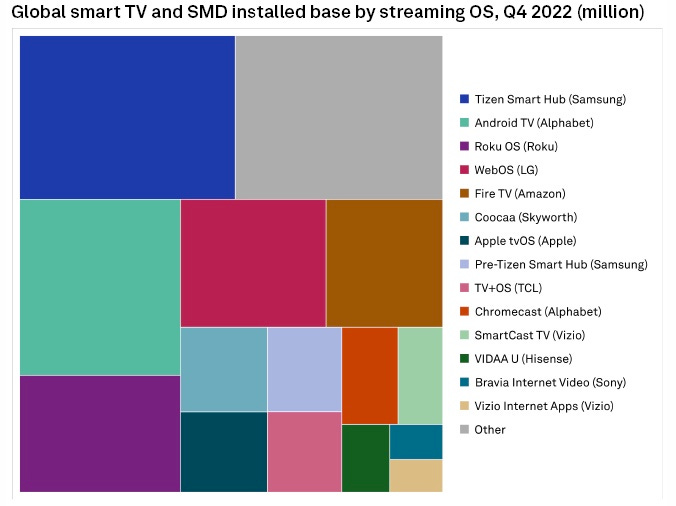

→ On TV, it looks more like this:

Source: S&P Global - March 2023

Operating systems power Smart TVs and/or Connected Devices (think streaming sticks, streaming players).

This is a global picture that screams fragmentation.

What are the different categories of players behind TV OS?

→ TV Manufacturers: Samsung, LG, Vizio etc.

→ OS Platforms: Roku, Vidaa, Foxxum etc.

→ GAFA: Apple, Amazon, Google

You will see that no one stays in its lane anymore. Roku manufactures its own TVs now while Samsung licenses Tizen to 3rd-party manufacturers.

What does that tell us?

TV manufacturers are no longer hardware-only companies. They are hardware and software companies.

The reason being that the hardware business is said to be a low margin business.

The total cost of the materials and components used to make the product is called a BOM (Bill Of Materials) cost.

The BOM cost of a 55-inch UHD Smart TV selling for 1000$ is approx. 800$. The costs varies for different sizes and technologies.

The operating margin sits at approx. 20% which includes the manufacturer’s and retailer’s share.

Costs relating to firmware updates, support come on top.

This is why manufacturers don’t want to be in the hardware business only and want to get a piece of the software action.

They’re now competing head to head with OS Providers, GAFA and new entrants like Telly who gives away TVs to focus on ad revenues (see my piece on Telly in SME#24).

That’s it for today.

Next week, we’ll go deeper into numbers around device sales, revenues and streaming hours from the key players in the TV OS ecosystem.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 4 ways I can help you:

NEW - The European FAST Tracker: 1700+ FAST channels in the US alone but what is happening in Europe? What are the leading genres? Who are the active content providers and platforms? With this Tracker, I lead masterclasses & workshops, draft strategy notes, bespoke reports, white papers or blog series for any company active (or looking to be) in the FAST space. Book a call to discuss

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until September 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).