SME#23: The Convergence of Telecoms and Advertising: Inside Europe's Addressable TV Market

Streaming Made Easy #23

Welcome back to Streaming Made Easy. This week, we take a look at how European Telecom & Pay TV Operators invest the Advertising space through their Addressable TV offerings.

Today at a glance:

Analysis: The Convergence of Telecoms and Advertising: Inside Europe's Addressable TV Market

Streamer snapshot: “OQEE Ciné” by Free

Content recommendation: “Air” by Ben Affleck

💡 Analysis:

Scene setting: a hotel lobby in beautiful Prague.

I’ve spent the week with the Dataxis team for their Nextv Ad and Nextv Series events. They built a strong line up of speakers across CTV, SVOD, Pay TV and Advertising.

I was lucky to moderate 3 panels on Programmatic advertising, FAST and Addressable TV.

For this week’s edition, let’s dig into Addressable TV, a segment of the Advertising business I was curious to learn more about.

What is Addressable TV?

It’s worth a definition for non experts, me included.

Addressable TV (or Segmented TV in France) is TV 2.0. Gone are the days where one ad was served to millions of TV homes all at once. It is now possible to deliver different ads to different households watching Linear TV. In a way, the worlds of TV and Digital meet and enable legacy TV advertisers as well as 1st time TV advertisers to target a specific audience with their messaging.

Addressable TV powers Linear TV but not only as detailed by Albert-Jan Tebbe, Director of Advanced Advertising at Liberty Global:

“ATV’s number one use case is Linear TV as this is still where the bulk of the audience is but ATV also enables us to advertise within the catch up / replay environment, in PVR recordings and in our OTT applications”.

What makes Addressable TV different from CTV Advertising? One major difference lies in the stakeholders.

Who operates in Addressable TV?

The ecosystem is made of 4 key stakeholders:

Broadcasters

Advertising sales houses

Brands and agencies

Telecom & Pay TV Operators

The last one is what distinguishes Addressable TV from CTV since the Telco / Pay TV operator is the one who manages the device and powers the ad break replacement technology but most importantly they bring their formidable data set.

In France for example, 60% of French people receive TV via their operator’s set top box (source: Realytics - Livre Blanc TV Segmentée). Being able, as an advertiser, to address this audience not in one go but in a targeted way brings incredible opportunities. Operators collect consent and subsequently valuable data which can then be fed to create segments based on their customer data. Their customers are later on served targeted ads during their viewing experience.

Where is Addressable TV live?

Addressable TV on Hbb TV or Set top boxes is live in 17 European markets today.

The UK led the way with Sky Ad Smart back in 2012. Belgium followed in 2017 and France 2021 to only name a few active European markets.

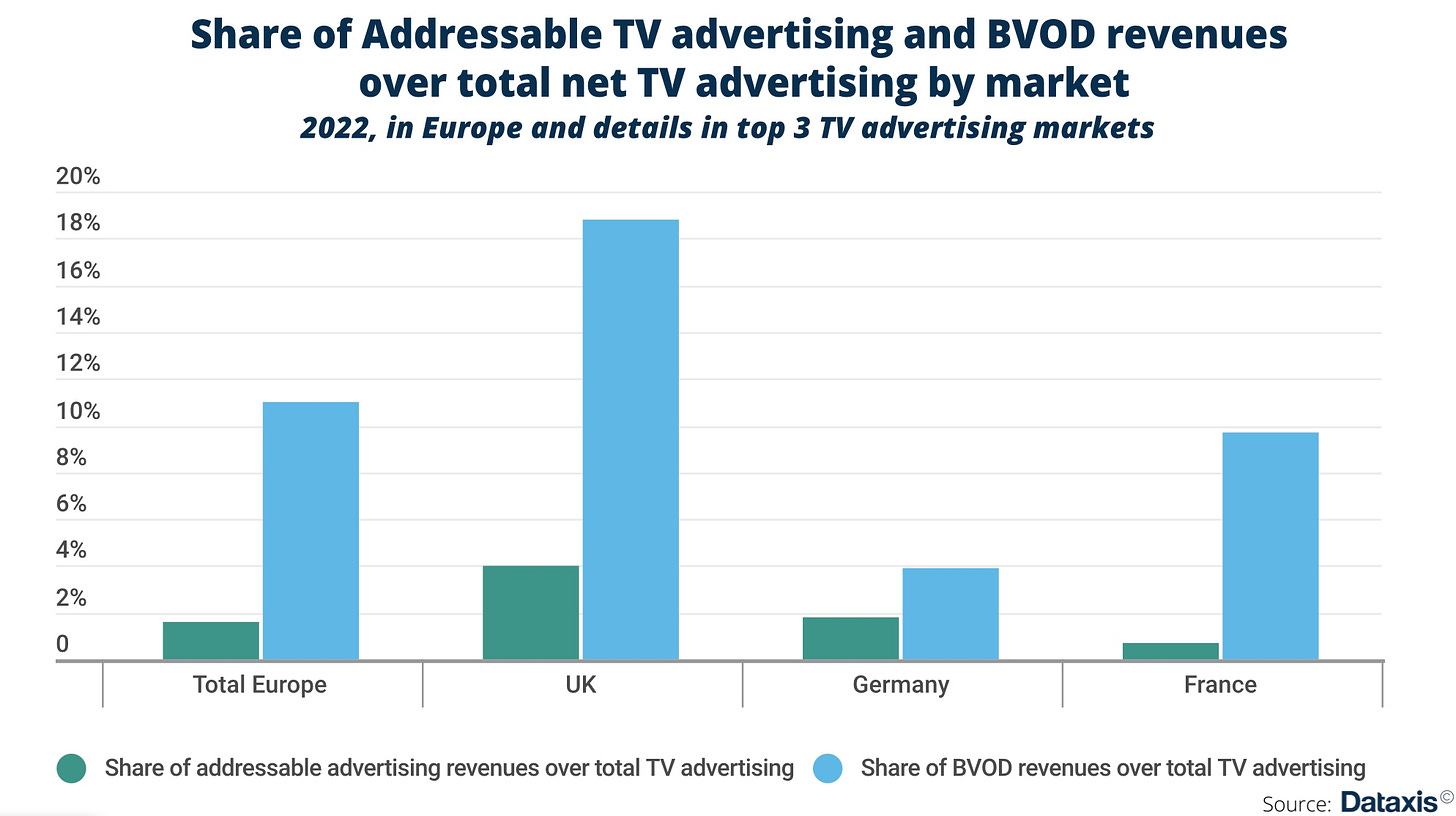

As evidenced above, EU5 markets are taking the lead when it comes to Addressable TV (ATV) market share but according to Ran Yanay, VP TV and Media at CETIN (part of PPF Group):

“Not all markets are ready for it nor can they see the model fly just yet. However, everyone agrees that it’s the future so all operators will launch ATV one way or another.”

There is no regional approach to ATV given the fragmented TV and advertising ecosystem in the region. As mentioned at the top, 60% of French people watch TV via their STBs while in Spain 70% of Spaniards use Hbb TV devices. Each market needs to adapt its advertising strategy to where and how the audience actually watches TV.

Therefore, it’s more a market by market deployment we witness with Sky Ad Smart being waved as the blue print for the sector:

Sky is live in the UK (via Synamedia’s technology) and has a >50% market share. In Italy, their Addressable TV base is limited to 3M homes and ATV is only available of Sky’s own and operated channels.

Liberty Global is live in 4 markets: UK, Ireland, Belgium, Switzerland and the Netherlands are set to launch this summer.

All Swiss operators including Swisscom launched at the end of 2022. They had to do said Dominik Krzysztofek, Chief Strategy Officer, because of a new law introduced in Switzerland preventing viewers to do ad skipping or ad fast forwarding.

Orange, SFR and Bouygues launched Addressable TV offerings in 2021 as a MVP before a full-fledged launch in 2022. Canal+ will launch ATV by the end of the year, first on its portfolio of channels and then more widely to 3rd-party channels as detailed by Emmanuelle Godard, Digital, Data & Innovation Director at Canal+ Brand Solutions.

Markets like Spain, Italy and Germany rolled out Addressable TV through Hbb TV standards.

What is the reach of Addressable TV?

In Belgium, 3M households across Proximus and Telenet are served addressable campaigns (60% market coverage).

In France, 6.6M French TV households are addressable today according to AF2M, the national association of ISPs (25% market coverage).

In Portugal, Dataxis estimates that NOS, MEO and Vodafone reach around 2.8 million households with addressable campaigns taking place on catch up services only.

In the Netherlands, Vodafone Ziggo, launching this summer, will garner 3.2M households.

In Germany, 52% of TV households are addressable TV households on HbbTV devices.

What is the weight of Addressable TV?

There is no doubt that outside of the UK we are still early days and Addressable TV represents a small portion of the overall TV advertising market.

If you look at the French ATV market though, the model is promising given what was achieved in a year’s time:

1300 campaigns across 700 advertisers were delivered in 2022,

50% of advertisers were legacy TV advertisers and the remaining 50% were new TV advertisers attracted by this TV 2.0,

18M€ of revenues were generated representing 5% of all TV budgets.

As more countries and, within each country, more players deploy ATV across their ecosystems, ATV will be a force to be reckoned with alongside the growth of CTV Advertising in our region.

Both have at heart to grow and diversify the Advertising pie while providing end users with a superior ad viewing experience.

📺 Streamer snapshot:

French Telecom Operator Free launched rather quietly a service called “OQEE Ciné” earlier this year.

OQEE Ciné is a AVOD service offering 300+ movies and TV series for the whole family (1000 hours of content). New titles go live each month.

The service is available to Free subscribers only and can be accessed on their set-top boxes and on 3rd-party devices thanks to the OQEE Free app.

Free is no stranger to the creation of its own and operated services. They often benefited from a 1st mover approach. Back in the 2010s, they indeed launched a SVOD offering even before SVOD was a thing and Netflix entered the French market.

The inventory is sold by Canal+ Brand Solutions (pre-roll, mid-roll and sponsoring ad formats available). Emmanuelle Godard, Digital, Data & Innovation Director, shared with me, during Nextv Ad, that the 1st results went beyond their expectations.

In less than 2 months (the service launched early March), a solid set of campaigns were booked by Tier 1 brands like CIC (groupe Crédit Mutuel), BNP Paribas, Matmut, Système U, Renault, Audi, Skoda, DS4, Peugeot, Cacharel, Azzaro, Vitalift, Zeplug etc. Advertisers were able to do contextual targeting and more targeting opportunities are in the works.

What I love about that move is that Free continues to be a super aggregator of third-party content services while gaining 1st hand experience on ad-supported streaming. There is no doubt that AVOD & FAST pure players like Pluto TV will seek distribution by Telcos like Free. Free will then be best placed to know exactly what’s in it for them.

Check out OQEE Ciné

🎬 Content recommendation:

I’m a Damon / Affleck fan. I’ve always been. “Will Hunting” remains an all time favorite of mine.

If you add Michael Jordan, Nike and Basketball then I can’t resist so I went to the movie theaters for “Air” last month.

The Pitch: We follow the history of shoe salesman Sonny Vaccaro, and how he led Nike in its pursuit of the greatest athlete in the history of basketball, Michael Jordan.

The Topic: There is a lot to unpack here.

→ Moms are the best. Michael Jordan’s mother is instrumental to his career and success, and ultimately she also contributed to the success of generations of sportsmen and sportswomen. You will see why in the movie.

→ Mid-level executives are the big brains. I really loved the story of Sonny Vaccaro. He’s the one who took Nike from being uncool running shoes to what Nike is today thanks to the Air Jordan line of shoes. Philip Knight, Nike’s CEO, is hung up on Board considerations and is afraid of taking a chance. Sonny isn’t and it ultimately pays off.

→ Design visionaries. I’m in awe of the design shoe process. I would have loved to see more of it in the movie but I guess it would have slowed the plot.

And last but not least, the 80s soundtrack is a delight. Listen to it here.

That’s it folks. Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post each working day on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 3 ways I can help you:

NEW - Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here (booked until June 2023)

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until July 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).