SME#22: Behind the Scenes: An Insider's Look at MIP TV 2023

Plus access to our "Key Trends In Global FAST" deck

Welcome back to Streaming Made Easy. This week, I was on the road so I thought I would just take you with me.

When I started my company in 2022, I had set two goals for myself when it comes to speaking opportunities: IBC & MIP.

IBC ✅ in September 2022 for a panel on the future of Linear TV

MIP ✅ in April 2023 for a keynote on Global Trends in FAST

A few minutes ahead, I must admit, I really wondered why I was putting myself through this amount of stress but then you power through and you feel amazing so it’s all worth it in the end.

Thank you to the RX MIP Markets team.

Time to set new goals but until then, here are my top highlights from this year’s edition of MIP TV:

Clarity matters:

In our industry, we love acronyms for new business opportunities. It helps us make sense of them and we put them in a box to facilitate rights sales and acquisitions. Thing is, we tend to disagree on what they truly mean or their meaning evolves through time.

Case in point: FAST & AVOD. You have two teams.

Team A: FAST & AVOD are two distinct things

Team B: FAST includes both linear and on demand streaming

I’m team A.

FAST is free linear streaming, AVOD is on free on demand streaming. The opportunities and challenges brought by each are different. The gatekeepers are too.

Why does it matter?

Because once you’ve put AVOD in the FAST bucket, you have put The Roku Channel, Samsung TV+ in the bigger bucket that is Youtube, Tik Tok and the likes.

They all fight for our attention, no doubt about that but any M&E company will tell you that they have bespoke content strategies when it comes to each.

It also makes the market sizing more difficult. I don’t want one number about the global online video business. I want to understand the opportunity that each segment offers and design the right strategy for each.

Talking about multi-faceted strategies…

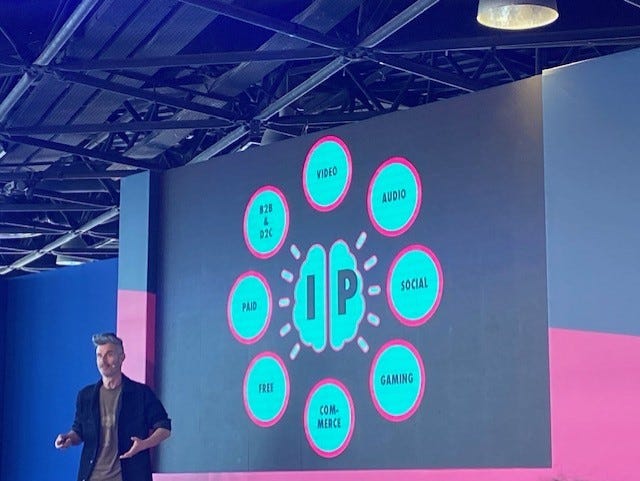

The “Yes, and” Strategy by Evan Shapiro

I missed Evan’s Mastermind keynote but caught the Kids version of it during the Kids Summit.

Evan is here to shake up our beliefs when it comes to how our industry must adapt and evolve to reach younger generations. Nothing like a “If you don’t do X, you will miss out on an entire generation” to get you to pay attention.

One element stood out for me because I feel it’s the hardest thing to do in a business: applying a “Yes, and” Strategy.

What does Evans mean by that?

It’s the need to tap into an array of verticals to reach your audience.

Here he took the example of how an IP must activate all verticals to ensure maximum exposure, across all age demos, globally.

The same example works for any business. You have your core business, it’s the line of business bringing the most revenues and naturally you put all of your resources to grow it.

Except it’s a strategy that works in the early years of your company only. Sooner or later, you will see growth slowing and if you haven’t applied a “Yes, and” strategy, you will need to deliver in 6 months a project that requires years.

Examples are legion:

Cable companies feeding on high subscription fees ➡️ now losing millions of subs a year

Broadcasters seeing a steady decline in viewership especially amongst the < 30 demo ➡️ now struggling to reach light TV viewers

Any M&E company should sit down and map its ecosystem to identify where are its next pockets of business.

One of these pockets is: FAST.

FAST, FAST, FAST:

MIP TV went all in with a FAST Summit and a FAST Breakfast.

The two were complementary. During the Summit, you had market level insights. During the Breakfast, you had insiders’ tips.

Numbers:

FAST has been a US phenomenon for years, one that left international markets in the dark especially on the data front. Well no more.

Maria Rua Aguete from Omdia shared top 10 FAST channel market revenue estimates:

While keeping things in perspective:

Steve Rifkin from OTTera took us on a CPM journey across the globe and boy some numbers were surprising.

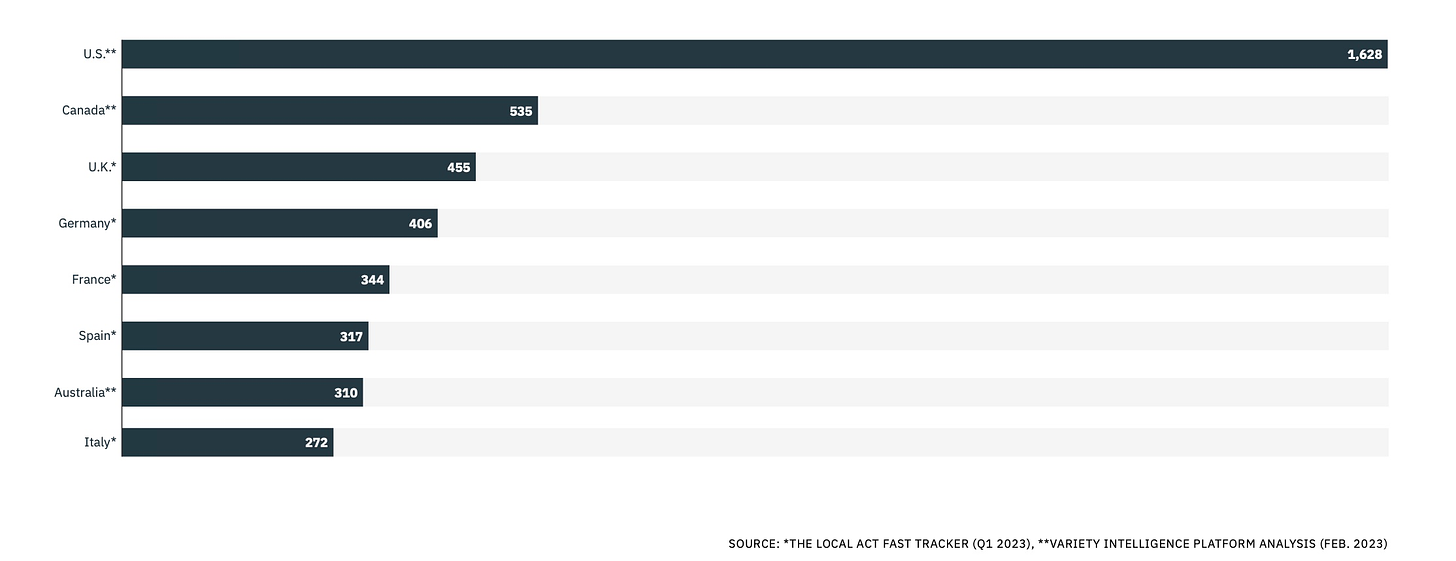

Gavin Bridge from Variety has been the reference when it comes to US channel count. He recently added Canada and Australia to its research.

I announced the launch of The Local Act FAST Tracker (more on that later) and shared unpublished data for Europe: a country channel count across key global and local FAST platforms.

Until now, we had no way to compare markets and although it cannot be the single metric, it gives the basis to understand where each market stands today.

Together, we were therefore able to release the numbers below:

Enough with the numbers, what were the trends discussed during the summit.

Trends:

Every panel brought a set of insights on what keeps them busy and what comes next:

Content

1️⃣ New channels in the works at Fremantle, Banijay

2️⃣ While Blue Ant focuses on building an infrastructure to promote, market, program, in smart ways, their existing channels

3️⃣ Exclusivities to differentiate: Paradise Hotel, Jamie Oliver, DAZN+

4️⃣ Platforms continue to launch their Own & Operated Channels: Rakuten TV and its new TV Series O&Os

Distribution & Monetization

5️⃣ Soft cap of 120 channels at Samsung Europe, channel takedowns

6️⃣ New markets on the way at Pluto TV, Vice

7️⃣ The fight against the asymmetry of data in FAST: a pain point for every channel owner

8️⃣ Monetization: mixing business models (revenue-share, flat fees, inventory share), getting to the bottom of the ad tech “taxes”, improved storytelling to advertisers, building in house ad sales capabilities

9️⃣ Discoverability: a major issue for everyone but little said on how it can be tackled.

🔟 If you’re hungry for more, Gavin Bridge and I did a 20’ keynote on FAST trends. If you’re a subscriber, like the post below and I will send it to you via email. If you’re not a subscriber, you know what to do.

Smaller is beautiful:

At least for me.

RX released numbers for this year’s edition with over 5K attendees, up from 2022 (by 22%) but down versus 2019.

I’ve heard many discuss the low attendance and quiet feel where you could grab a table anywhere.

I don’t think we should compare MIP TV to MIPCOM anyway. Yes both are in Cannes. Yes both cater to the M&E industry. But we now live in a “post COVID and cost cutting” era, some things have changed forever and it calls for reinvention which is what RX did this year.

The Series festival, the Kids Summit, the FAST Summit & Breakfast all in one work perfectly and leave room for high-quality encounters with key clients and prospects.

Ok the one thing I missed: not enough parties but I was still with tons of great people. See for yourself.

That’s it folks. Enjoy your weekend and see you in a few weeks for another edition of Streaming Made Easy.

Yes it’s time for a much-needed break with my loved ones. See you on May 12th.

By night, I write Streaming Made Easy and post each working day on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 3 ways I can help you:

Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here (booked until June 2023)

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss (booked until July 2023)

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion).

Love how you break down why AVOD and FAST should be considered to be separate. A pleasure to share the stage with you!

great pics!