Welcome back to Streaming Made Easy. This week, we take a look at the FAST Platform ecosystem and whether we already have global market leaders or not.

Today at a glance:

Analysis: Will the rule of 5 strike again in FAST?

Streamer snapshot: Shadowz, the first screaming platform

Content recommendation: Quality trumps quantity at Apple TV with “Shrinking”

💡 Analysis:

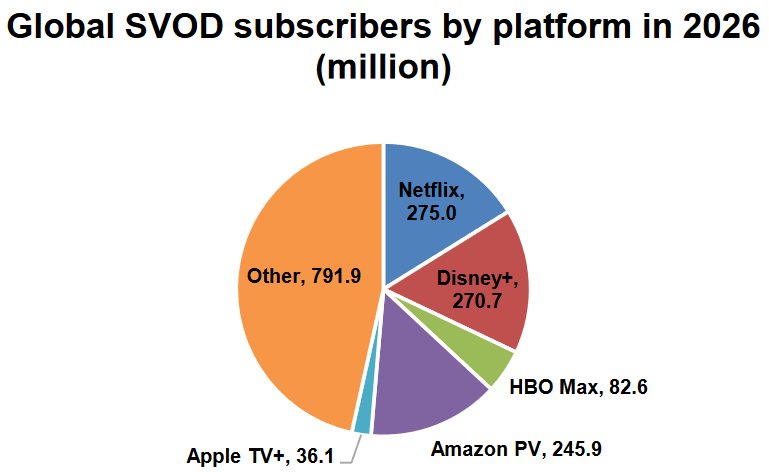

The FAST Platform ecosystem is still burgeoning unlike SVOD where the market leaders have long been identified.

By 2026, 5 major US-based platforms (Netflix, Disney+, HBO Max, Apple TV+, Prime Video) are indeed on track to grab over 50% of video consumption by 2026.

Source: Digital TV Research

It made me wonder whether we would see a similar scenario unfold in the FAST space, and if so, who would be the companies at the forefront of this market domination.

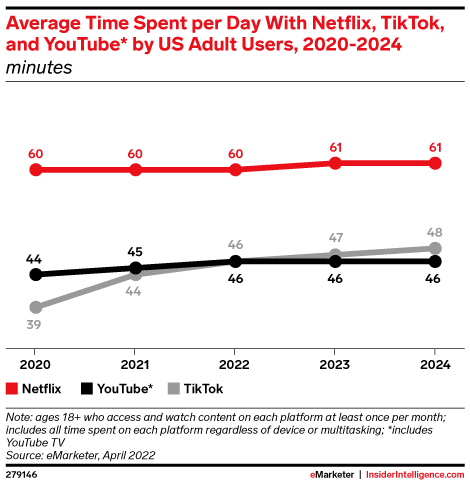

For the sake of this analysis, it’s important to mention that there’s no doubt companies like Youtube, Tim Tok will remain behemoths when it comes to video consumption in the ad-supported space. Today, Youtube and TikTok are 14 minutes away from Netflix (the streaming platform with the highest engagement in the US) when it comes to the average time spent per day by US adults.

However, they don’t qualify as FAST platforms (this will change when Youtube launches its FAST Channel Hub).

Who are the key FAST platforms?

Let’s break it down:

➡️ Pure players

These companies have FAST at the core of their value proposition. They are not tied to a particular device and therefore aim for ubiquitous distribution. Pluto TV and Tubi are owned by big media groups (Viacom and Fox respectively) giving them the advantage of tapping into an extensive library vault. Other pure players include Xumo, Crackle and Plex.

Pure players can also include the likes of Rakuten TV or Peacock which have a hybrid platform since they offer TVOD/EST, SVOD, AVOD on top of FAST.

For Rakuten TV, the offerings sit side by side, you can rent or buy a movie, subscribe to a SVOD or watch free content, either on demand or live.

Peacock operates differently as you need a subscription to access the service. The tier structure gives you access to a different viewing experience, one with ads (at 5$ a month), one without at 10$. Peacock recently terminated their Free tier but existing subscribers to this tier can still access it without a fee.

➡️ OEMs

Hardware manufacturers took a first 360 turn when they moved from being device manufacturers only to becoming platforms distributing 3rd-party services and now editing their own streaming services.

The most advanced example is The Roku Channel which brings AVOD, FAST, premium subscriptions and its own slate of originals. But through the years, the list grew:

Vizio WatchFree

LG Channels

Samsung TV+

Vidaa Free

Freevee

Youtube has launched an AVOD corner in the US in 2022 and is said to work on a FAST channel line up for this year so expect to see them shake up the ecosystem.

➡️ Pay TV providers / vMVPD / MVPD

They weren’t at the forefront of the FAST trend but will play a role moving forward in my opinion as they are master aggregators already.

Fubo TV

Sling TV Freestream

Orange Spain

Waipu TV

Zattoo

➡️ Broadcasters

Europe brings a 4th set of FAST players with its commercial broadcasters investing the space. UK-based ITVX curates 20+ channels while French broadcaster TF1 has 50 channels.

What is their footprint?

Today, we do not have a Netflix equivalent in FAST i.e. a streamer with a truly global footprint so we cannot tell who will be the market leaders globally yet.

However, several platforms have a solid head start when it comes to market coverage. Rakuten TV (42), Pluto TV (35), Samsung TV+ (24), Tubi (10 although the FAST channel line up is US only for now) and LG Channels (25) are the platforms with the widest footprint.

Peacock (7), Freevee (3), Vidaa Free (2) and The Roku Channel (3) are only available in a handful of markets for now.

Pay TV providers, vMVPDs/MVPDs and broadcasters have a local presence (in some case a multi-territory presence but it is the exception rather than the rule) meaning they will not compete with the likes of Pluto TV at a global level. They may very well be strong local competitors though, especially broadcasters who have a strong grip on the local advertising market.

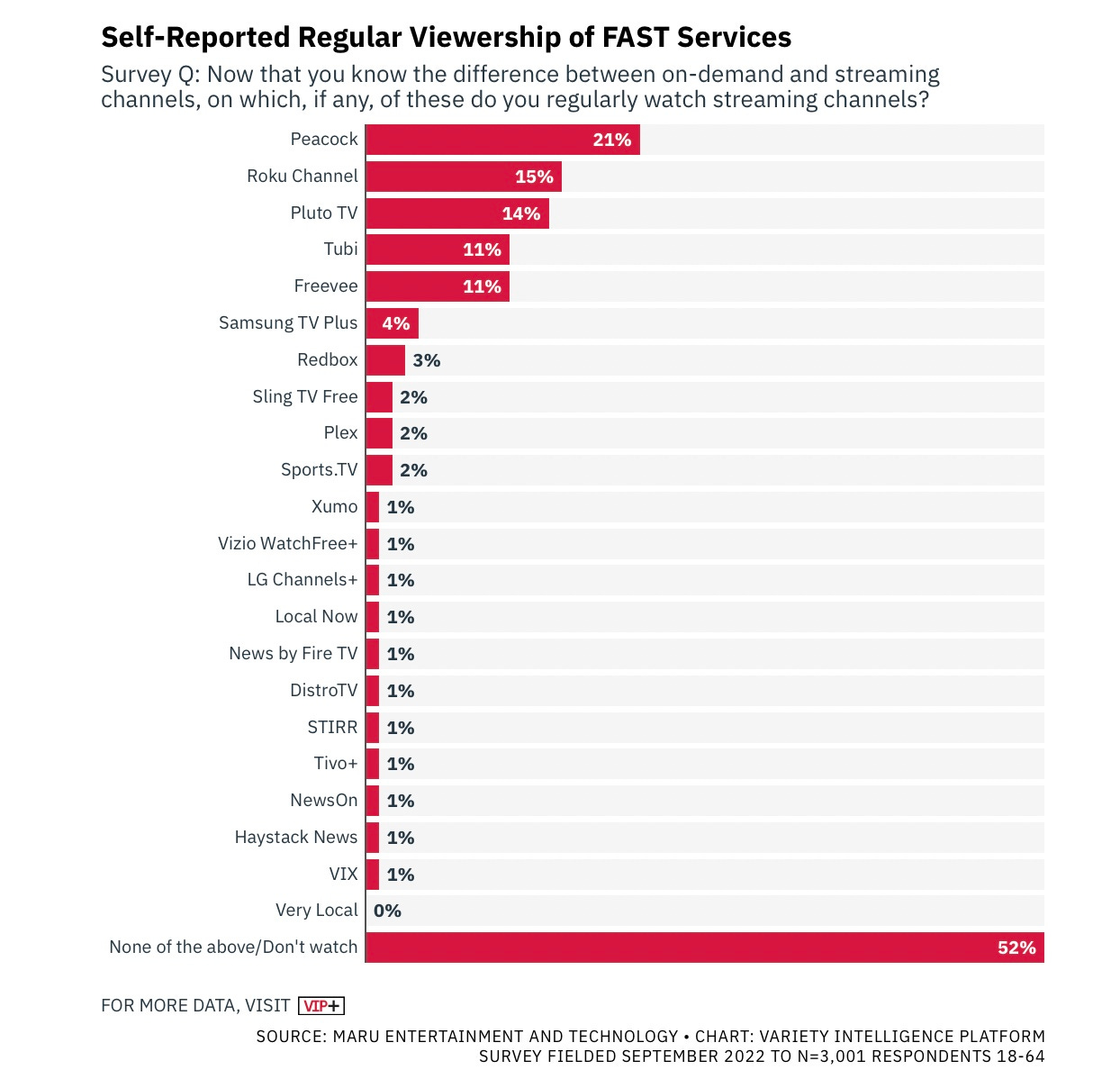

What is their viewership level?

In this chart, we’re looking at a survey on US FAST channel viewership. According to this piece from Maru, our 5 FAST market leaders are Peacock, The Roku Channel, Pluto TV, Tubi and Freevee.

How does FAST compare to other streaming methods?

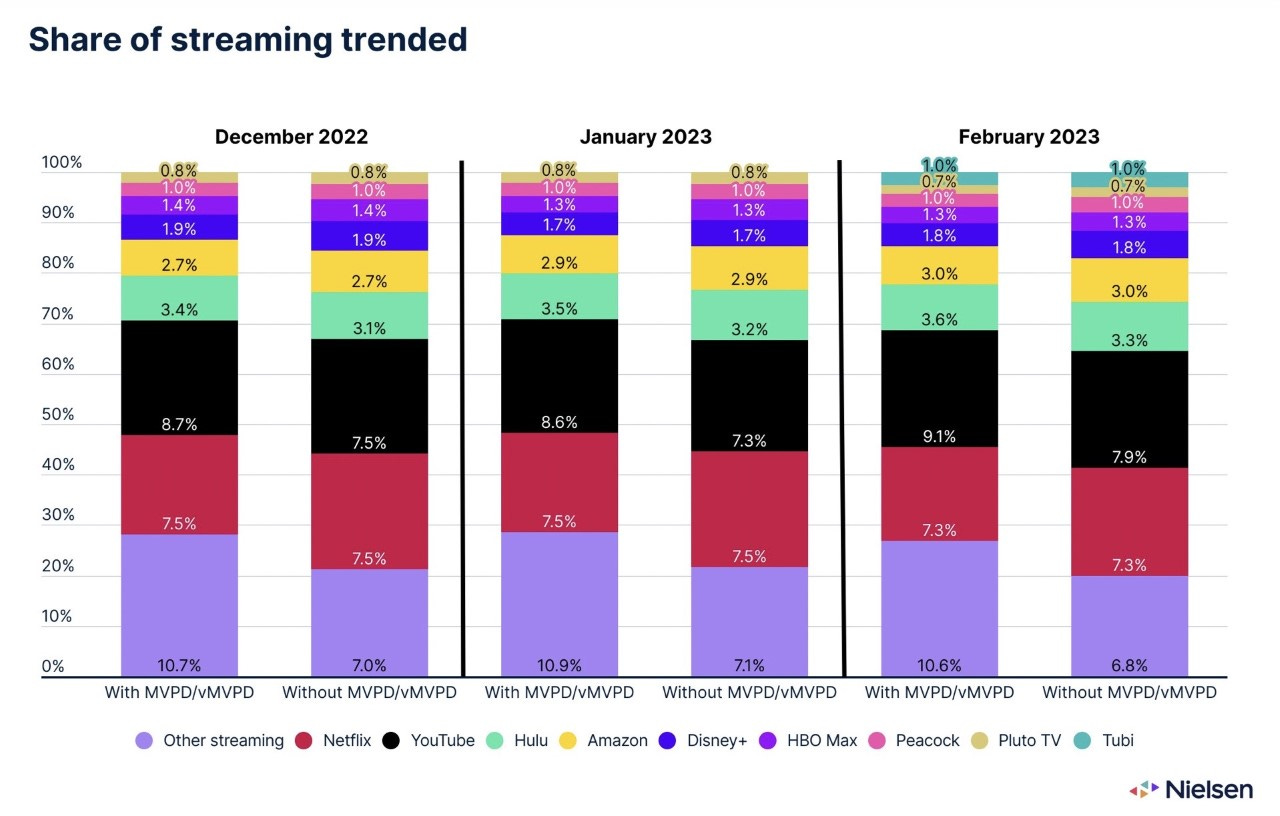

Data is scarce when it comes to FAST. I know Nielsen’s data is highly challenged due to their traditional measurement methods but it’s all I have right now.

Pluto TV and Tubi are easy enough to single out given that they only cater to AVOD & FAST. We don’t know however which business model weights more though.

Together, they grabbed 1.7% viewership in February, ahead of HBO Max (1.3%) and right at the heels of Disney+ (1.8%).

If you consider the fact that Peacock still has millions of subs to its Free tier and that in the “others” bucket, we surely have The Roku Channel, Samsung TV+, Freevee (unless it’s already counted under Amazon?), then there is no doubt that FAST is making headway in US viewership numbers.

By 2026, I don’t think we will see 5 services controlling the vast majority of FAST eyeballs worldwide. US leading platforms (e.g. Pluto TV, Tubi, Peacock, The Roku Channel, Freevee) have too much work to do to grow their footprint to the levels of a Netflix or a Disney+.

Moreover, launching globally is one thing, monetizing globally is another (a big difference versus SVOD driven global expansion strategies).

I therefore expect:

More fragmentation (with 8+ companies fighting for market share),

Strong local and regional heroes challenging global players (Pay TV Operators and Broadcasters in Europe for example),

Different regional dynamics (e.g. Samsung may be n°6 in the US but in Europe they’re closer to a N°1 or N°2 slot).

Either way, we’re far from global market domination in the hands of a few I will give you that. However, there is no denying that FAST is a force to be reckoned with and that the next 3 years are going to be incredibly exciting.

📺 Streamer snapshot:

This week, I’m taking you on a scary drive to discover Shadowz, the first screaming platform.

Shadowz is a French streaming service catering to genre movies ranging from horror, thrillers, sci-fi and fantasy movies. Everything to keep you from sleeping.

Their line up is made of 400 tightly curated titles and by now they have 100+ Originals of their own (the company indeed started its own distribution business where they release titles in theaters and video as well).

Shadowz is the perfect example of a successful niche SVOD. They know the genre fan base (1M+ in France alone) and how to appeal to them.

Go check them out 👉 Shadowz

🎬 Content recommendation:

There's not much to watch on Apple TV+ besides Ted Lasso. This is the main criticism I hear about Apple TV+.

How can they grow and be one of the must have SVOD with such a small library? Fair point. You need a regular influx of new shows to attract subscribers & library content to retain them.

According to Just Watch, Apples TV+ only had 41 movies & 93 TV series in 2022. Can quality trump quantity then? I'd say yes thanks to their recent line up: “Ted Lasso”, "Bad sisters", "Slow horses", "Severance", "Wecrashed", “Patchinko”.

That is great TV and I'm not the only one saying that. Apple TV+ has the highest average IMDb scores (7.08/10) for the 2nd year in a row.

They keep it up with high quality & quirky shows like Shrinking, add local originals, a good price point, and then go big on sports, and then I'm game to stay, Apple TV+.

Proof quality trumps quantity 👉 Shrinking

That’s it folks. Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and post each working day on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 3 ways I can help you:

NEW - Founders’ Hours: One-hour consultations for founders in need of quick answers to their most pressing business questions. I will block my calendar every Friday for these consultations. Book your slot here

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days. Book a call to discuss

Last but not least, work with me 1:1 to grow your streaming video business in Europe (market intelligence, go to market strategy, distribution expansion etc.).