Welcome back to Streaming Made Easy. This week, we take a look at the lack of industry-wide data and insights pertaining to FAST.

Today at a glance:

Thought: FAST and the data no man's land

Streamer snapshot: French Sports Media, L’Equipe, gets into FAST

Content Recommendation: “The innocent”, hands down the best French comedy you’ll watch this year

💡 Thought:

In the Broadcast TV world, organizations like Nielsen (US), Mediamétrie (FR) or BARB (UK) track audience’s ratings and provide data & insights back to the industry.

As described by BARB, their work fulfils 3 purposes:

Our viewing figures support decisions that are made in the making and distribution of television programmes.

Our data inform the ongoing conversation about how broadcasters operate in the public interest and in accordance with prevailing legislation.

Advertisers, agencies and broadcasters use our data to support the planning and buying of advertising campaigns, and to assess the brand and sales outcomes of these campaigns.

When it comes to FAST, we don't have industry-wide data at our disposal to understand who watches FAST, how often and for how long, what’s the biggest FAST platform, what channel gather the most viewership.

Each platform keeps the data to itself (and to some extent shares it with its content partners & advertisers). We get a bit of public data here and there from players in the space but not enough to back industry trends’ analysis.

In 2019, we could justify the lack of data set by saying FAST was still in its early days but now it's a 4B$ business in the US alone. By 2025, estimates put FAST at 6.1B$ of revenues.

It's about time we have a unified source of truth but it seems there are no initiatives in the works to fix this.

Is it that platforms don’t know how to do it or they simply don’t want to share their data?

How about we ask Waldo?

As always, the US is (slightly) ahead of the game. FAST players like Xumo, LG Ads, Samsung TV Plus or Amagi already see the value of sharing some data publicly. After all, it is still a nascent business model in our century-old industry, sharing data is part of the healthy education and adoption process.

Who knows about FAST?

According to VIP+ latest FAST report, 55% of US consumers watched a FAST channel in 2022, 25% were aware of FAST but hadn’t watched any, another 20% didn’t know what FAST was.

Who watches FAST?

This one is important because CTV platforms, FAST players, bang the drum about broadcast TV being deserted and the need to invest in CTV advertising in order to target light TV viewers or pure cord-cutters.

Now, would you want to invest without knowing who will be reached by your ad?

Probably not. That’s why advertising $$ aren’t moving to CTV as quickly as viewers do.

In the absence of market-level data, we then rely on platform-level data. In VIP+’s report, we learn more about LG Channels’ key demographics:

➡️ 58% are male viewers

➡️ 45% are aged 34-54 years old

➡️ 39% of children under 18

➡️ They make >75K$ a year

➡️ 45% of college graduates

Why do users watch FAST?

No surprise here, it’s because it’s free (69%).

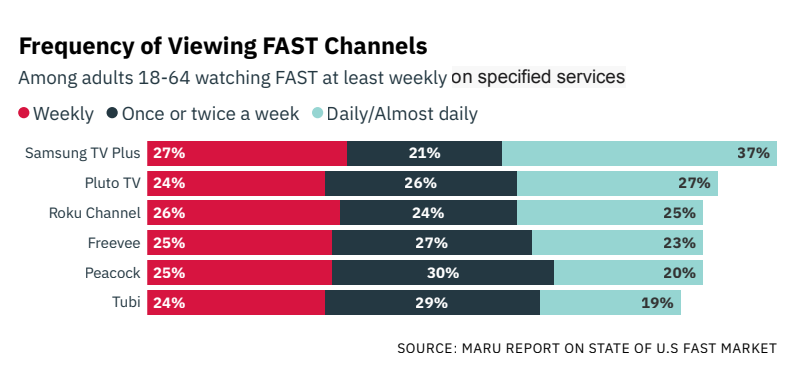

How often do they watch content on FAST platforms?

How many FAST services do they watch on average?

2.1 FAST Services used among adults 18-64 according to Variety.

Now, the data remains scarce, we know little about the methodology and we would love for it to be more granular and at market-level.

If I had to draft a shopping list, here’s what I’d like to see each quarter:

1️⃣ The top performing FAST channels per platform and in total

2️⃣ The top performing FAST platforms by device and total

3️⃣ The most watched programs within channels

4️⃣ The most performing genres

5️⃣ Total monthly active users, total monthly hours

The list goes on.

I trust that things will quickly change because the growth of FAST will hit a brick wall otherwise. Content owners, advertisers and technology providers will not invest in the space if they have no clue who they can reach with their programming and advertising, how much revenue can be generated etc.

I’m eager to see what will happen in 2023 on that front.

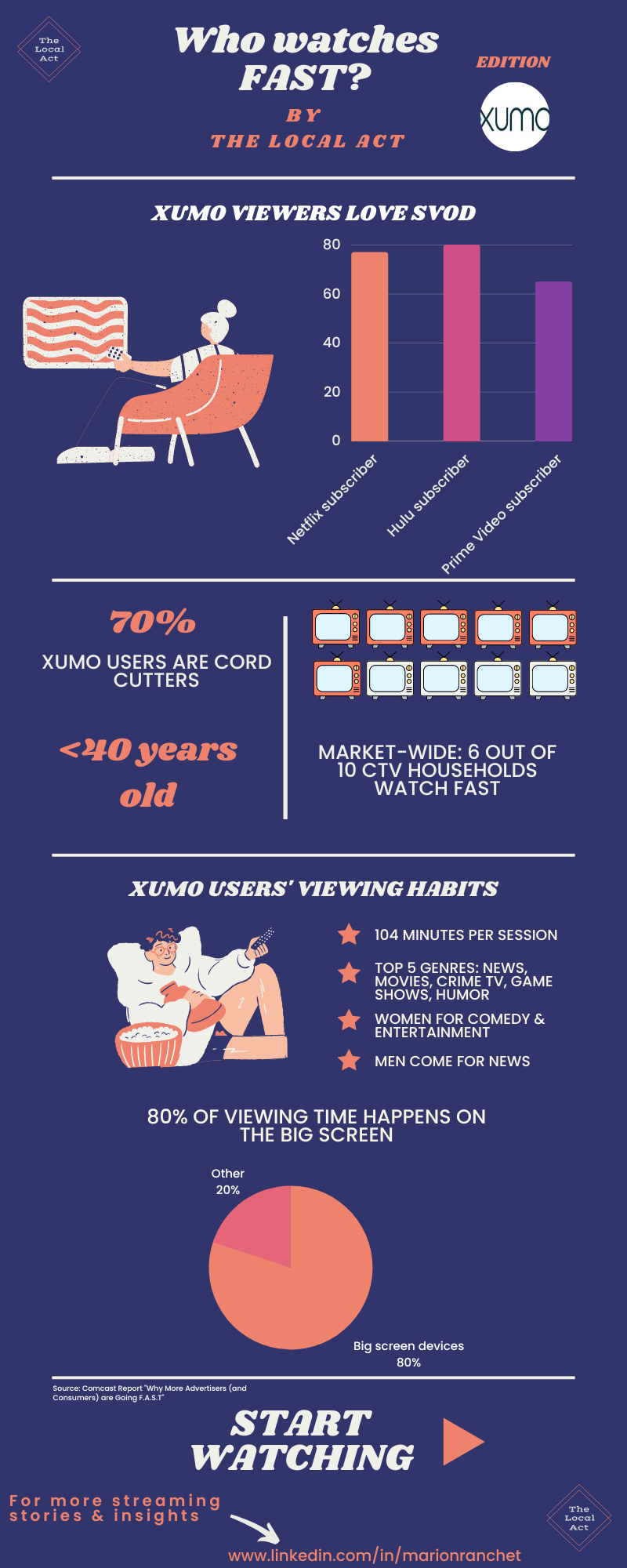

In the meantime, here's a cheat sheet I did on Xumo, a US free ad-supported streaming service with over 200 channels, to understand who watches FAST on their platform.

📺 Streamer snapshot: French Sports Media, L’Equipe, gets into FAST

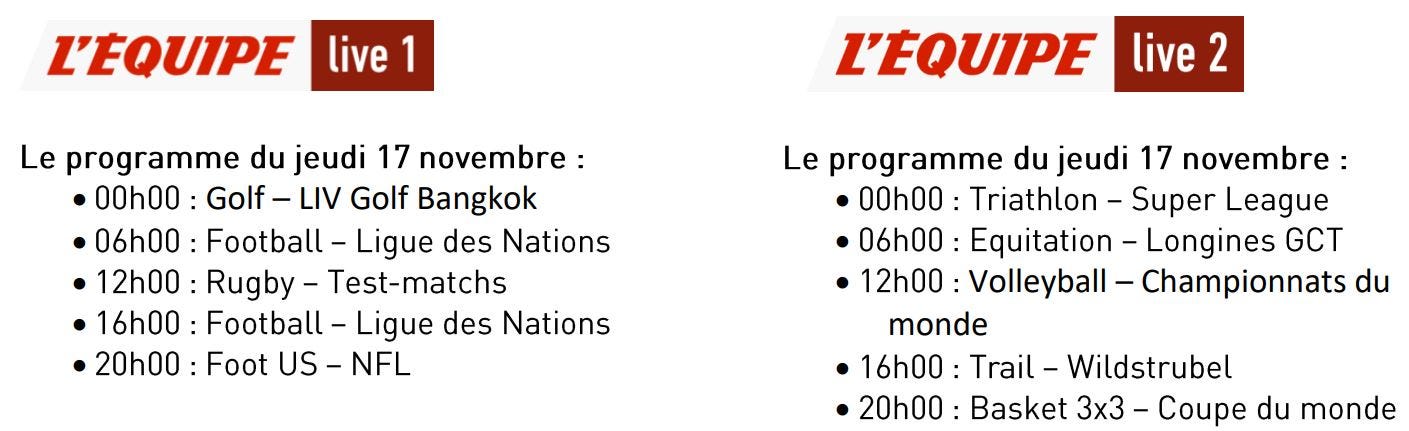

L’Equipe launched in November 2022 two FAST channels on its website & mobile application but also on Samsung TV Plus.

L’Equipe Live brings 30 sports, 2500 hours of live content (including 1800 exclusive hours), live and replay content from the TV channel “L’Equipe”.

It’s a major addition for Samsung TV Plus France as the line up is getting more local by the day.

An example of a day’s programming:

I wish I were in France to watch it more!

🎬 Content recommendation:

In November, I was lucky to attend “Tapis rouge”, a Dutch festival dedicated to French cinema. As a French expat, it’s the highlight of my year, I can get my shoot of French movies.

For the closing night, the movie “The innocent” by actor/director Louis Garrel was screened and boy it was amazing. I laughed, I got emotional and I grooved on the cool soundtrack they had put together for us.

Most importantly, I felt a very strong connection with the rest of the audience who experienced the movie like I did.

Synopsis: “When Abel learns that his mother is about to marry a man in prison he freaks out. With the help of his best friend, he will do whatever it takes to protect her. But meeting his new stepfather may well offer him a new perspective.”

A word of advice though: prepare to fall in love with Noémie Merlant who is radiant!

👉 Check it out on IMDb: “The innocent”

That’s it folks. I hope you found this interesting and if you did, please don’t hesitate to tell your colleagues, bosses, friends & families about it.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

At night, I post each working day on Linkedin and write Streaming Made Easy.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 2 ways I can help you:

If you’re looking to start a FAST Channel business, I designed a Program called "How to get into FAST" where I fast-track the launch of your FAST Channel Business in 90 days (Book a call to discuss).

Last but not least, work with me 1:1 to grow your streaming video business in Europe (new market entries, competitive benchmark, distribution expansion etc.).