Netflix France Turns 10

Marking a decade of major transformations for the French Premium Video landscape

Happy Birthday Netflix France 🇫🇷🎂

You turned 10 years old on September 15th, 2024. The French premium video market has gone through massive transformation since you launched. Did you change us? Did we change you? What lies ahead?

Let’s find out.

At a glance:

Rewind ⏪ to 2014

Pause ⏸️ in 2024

Fast forward ⏩ to 2034

Let’s Rewind ⏪ To 2014

The rumours around a French launch of Netflix started in 2011 and went on for 2 years until Netflix came out of the woods to say:

“Netflix has no present plan to launch in France” - Jonathan Friesland, Head of Coms @Netflix (July 2013)

The rumours still went on. The industry was worried. The concern was that local players would be outbidden by Netflix and its deep pockets. They were to some extent but it didn’t happen overnight.

So when Netflix did end up launching in September 2014, what did the French premium video landscape look like?

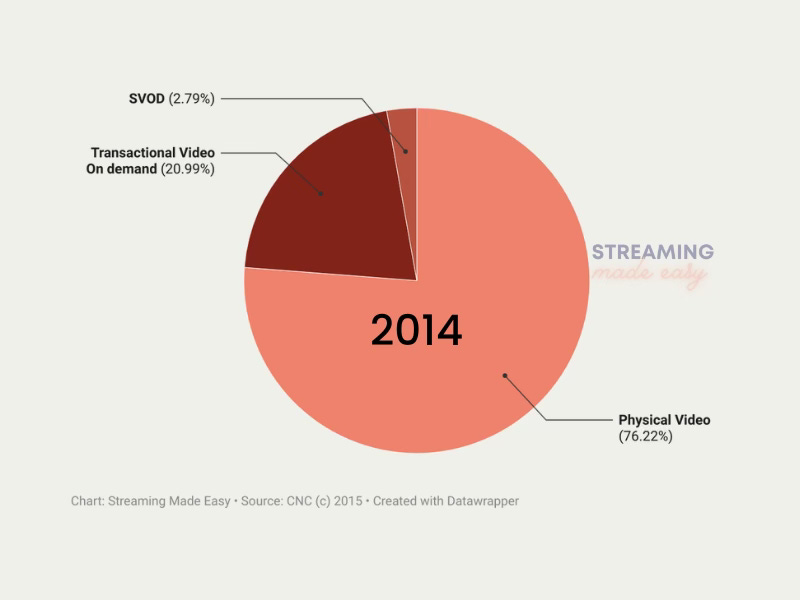

I dug out a report from the CNC. In 2014, the overall revenue from the French premium video market (physical and digital) amounted to 1,046.8M€, with the physical video segment still dominant, comprising 76.2% of total revenues while revenues from premium video on demand had grown +764.4% between 2007 and 2014 to stand at 248.94M€.

Within the video on demand segment, transactional video on demand weighted 88.3% of the segment revenues while SVOD stood at 11.7%.

6 493 programs were available on French SVOD platforms.

Who were the main SVOD players?

Netflix entered a market dominated by local players. A mix of pure players, broadcasters and Pay TV operators: CanalPlay, Club Vidéo SFR Pass Kids, Club Vidéo SFR Pass Cinéma, Dailymotion Kids+, Filmo TV, Jook Video, Pass M6 et VidéoFutur Pass Duo, Orange.

What did Netflix look like back then?

I’m fond of this website showing the UX timeline of Netflix (it stops in 2021 but note that Netflix recently completed a UX makeover). In 2014 already, after 8 screens, you were done and ready to go, a frictionless process.

Netflix made the 30-day free trial, cancel anytime, the market standard (today, we’re at 7 days and here’s the data to back it up).

It launched in France with OTT devices but knew already success in the market couldn’t be done without the Telecom operators. Guess who was the 1st operator to broker that deal? It’s not who you think. Telcos wanted to stay clear of Netflix (since Telcos had a vertically integrated strategy at the time). Once the 1st operator got Netflix, the others had to follow suit though.

They were aggressive price wise with an entry point tier at 7.99€.

"We hope like in the rest of the world to be very popular by offering very low prices," Netflix chief Reed Hastings in 2014.

Content wise, “House of cards” was missing from the line up as it had been sold by Sony to Canal+. The line up was deemed decent but of course lacked local content, exclusives and library movies were old (due to the French Media chronology). Ingredients you can’t launch without in today’s competitive landscape but in 2014, Netflix had time to iterate and grow.

Reed Hastings’ goal at the time was to reach 2M subscribers by 2019 and a third of the 28M of French households by 2024.

How close are they to that goal?

📌 On September 26th at 9am PST / 12pm EST / 6pm CET, Streaming Made Easy will hold a Live Webinar to share with you “The Key Takeaways from IBC 2024”. A 1-hour session where we will give you the pulse of the industry. To attend, sign up here.

Let’s Hit Pause ⏸️ In 2024

Out of the 30.8M households (2023), Netflix had more than 10M French subscribers in 2022 (vs 6.6M in 2020). This is the last official number given by the firm. Mission accomplished.

What does the premium video landscape look like now?

The French premium video business has been turned upside down.

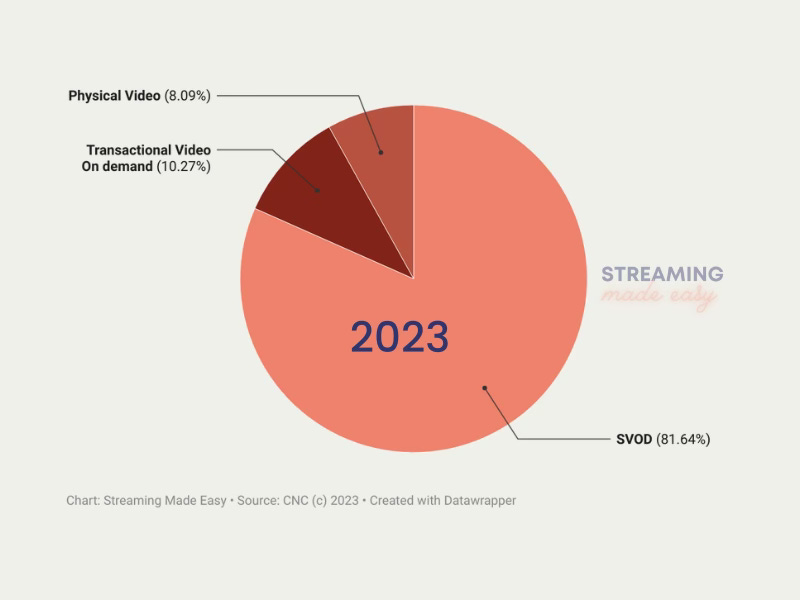

Physical video revenues weighed 82.3M€ in H1 2024 according to the CNC’s latest report while SVOD alone weighed more than the total video business did in 2014 (i.e. 1,046.8M€) and grabbed 84% of the total video business.

For the full year of 2023, SVOD revenues stood at 2 004,8 M€ (+8,3 % YoY).

How much did Netflix France make in 2023? 1.44B€ (+7.8% YoY) according to their company filing in August 2024 meaning Netflix grabbed 71% of SVOD market revenues.

Where does the ad-supported video on demand segment fit into that? Looking at Netflix alone, estimates put their ad revenues at 1M to 3M€ in 2023.

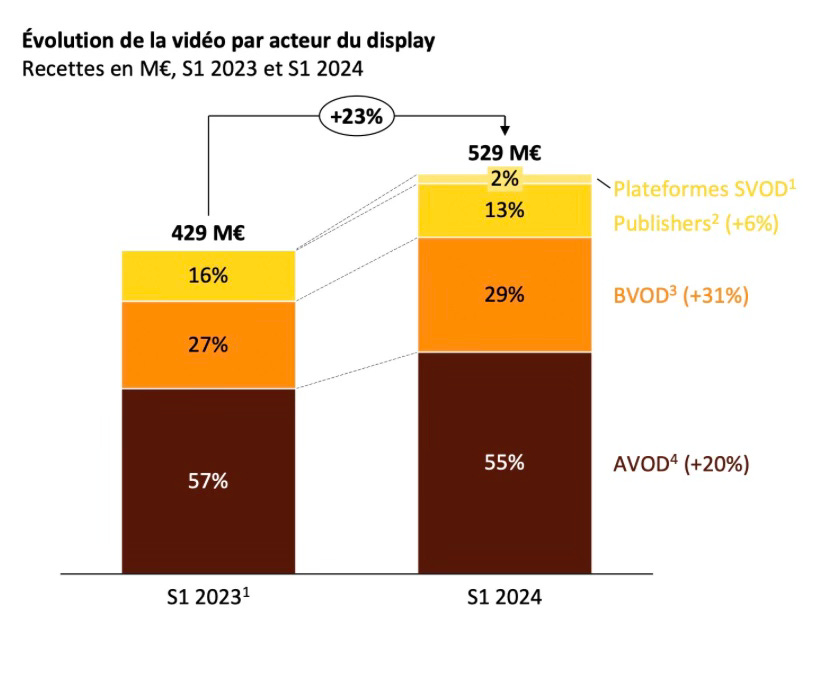

Now Disney+ launched in November 2023 followed by Prime Video in April 2024 and we’re still short on numbers. The latest SRI report gives us a 1st hint with ad-supported revenues from SVOD platforms coming in at 2% of the total display video business in H1 2024. My two cents is that Prime made a difference this semester where Netflix and Disney+ hadn’t yet.

What does Netflix stands for in 2024?

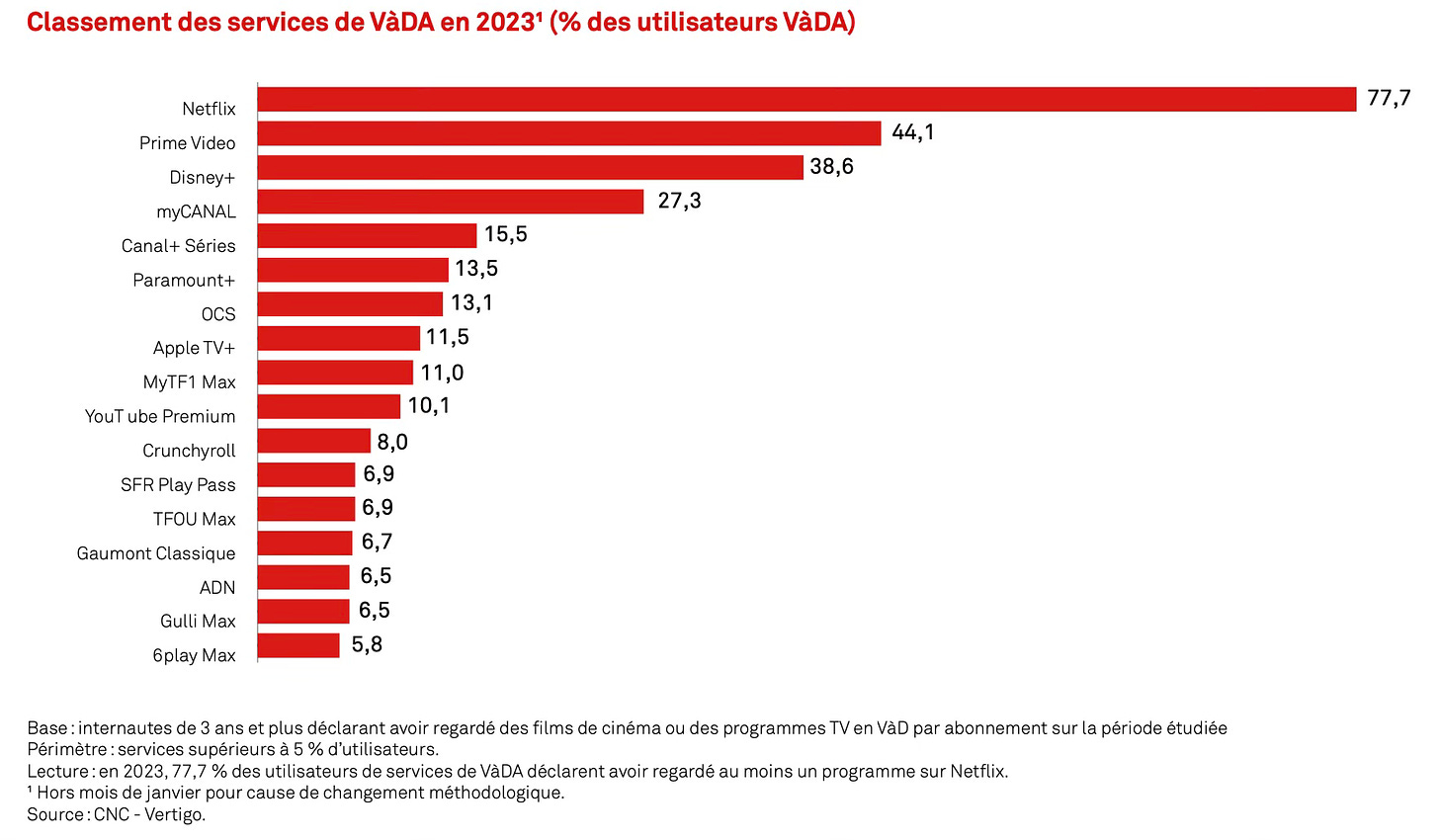

→ It’s the n°1 premium video on demand service in France (77.7% of French SVOD subs said they watched at least one Netflix program).

N.B. this graph includes SVOD as well as Transactional Video services, Premium tiers of Broadcasters, Pay TV channels.

→ It’s considered a must have service by French consumers.

→ It’s not so cheap anymore (13.49€ standard - 19.99€ premium).

→ It’s no longer the ad free king now that it has introduced a 5.99€ ad-supported tier.

→ Advertisers don’t get it yet (by year end in 2023, 5 Dentsu clients out of 80, a dozen at Values Media and Havas Media had spent with Netflix). It’s a scale issue (600K users or 750K ad-supported subs are numbers floating around), a price one (at launch 49€ for a 30” spot) and a measurement one (Netflix still isn’t measured by Médiamétrie, our BARB or Nielsen). The new local team has work on its plate.

→ They have ubiquitous distribution.

→ They patron the Cinémathèque Française but still doesn’t wish to release movies in Movie Theatres (to avoid the French Media chronology).

→ Netflix has fully complied with its obligation to finance French audiovisual and cinematographic creation though. It requires:

Subscription services to dedicate at least 20% of annual revenues in France to developing and producing European or original French cinema and audiovisual media. If they offer one or more films less than one year after the theatrical release in France, the number increases to 25%.

3/4 for independent film production

2/3 for independent audiovisual production

60% of the works in service providers’ catalogues to be European and at least 40% of these to be original French productions

→ Netflix secured a 15-month window after theatrical release for films in exchange for a promised annual investment of 190 million Euros a year (see a movie’s life cycle through the famously dreaded French media chronology here).

→ They have invested over 250M€ in French content creation in 2023, more than 66% went to independent production.

→ It’s the firm behind French global hits Lupin (the third most-viewed non English series of all time) and AKA (the 7th most-viewed non English movie).

Let’s Hit Fast Forward ⏩ To 2034

In 10 years’ time, I see a French market with Netflix still at the top. Netflix will have changed in depth though. How so?

N°1 - Netflix will more and more ressemble TV. As much as Netflix likes to dismiss the role of Linear TV, it taps more and more into the winning recipes of TV with game shows, cooking shows, live events.

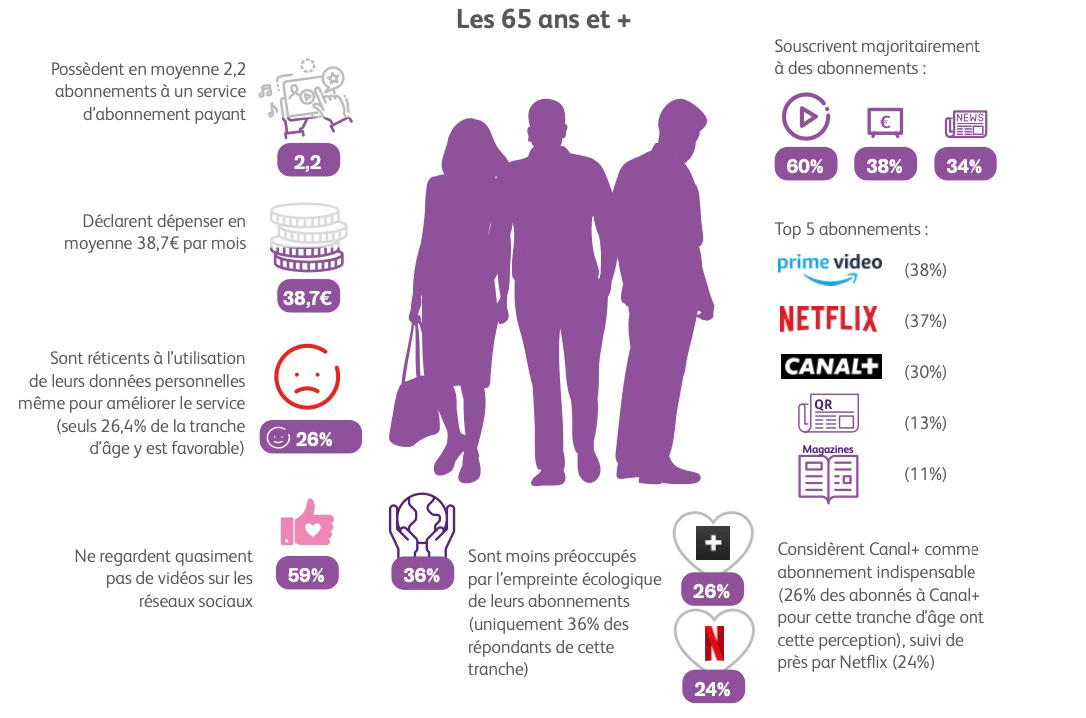

In order to grow its subscriber base, it will indeed need to offer content catering to a wider range of audiences. It’s interesting to see that Netflix isn’t the n°1 service for the 65+ demo, Prime Video is (ok it’s a close call but still).

N°2 - They will have live sports, sports and news anchors and more.

To stay the leading mainstream streamer, they will need to offer more to subscribers. Today, I couldn’t do without Canal+, I could cancel Netflix. Netflix could do it all alone or…

N°3 - Make super aggregation moves.

One way to compete with local players is to become a super aggregator. The uncancellable subscription you can’t do without because you have so much packed in one subscription. Why not launch Netflix add on channels like Prime Video? Why not bundle Spotify, Roblox and others?

N°4 - For sure, the island strategy won’t be good enough anymore.

I’d like to see more windowing on Netflix titles to grow awareness, more coproductions. They’ve done a few of these deals already with local broadcasters.

I also want to see movies in theatres. Yes the media chronology is a challenge, a fresh title you produce only becomes available in SVOD 15-17 months after its release but it builds up a title. A movie director deserves that life cycle. Who will remember “The Irishman” from Scorsese or “Roma” from Cuaron?

N°5 - Will they have figured out advertising?

Once a premium service, always a premium service? Although if they keep at it with price increases, this ad-supported tier may finally get traction and bring the scale advertisers want…

How about local players?

There is great momentum taking place.

From necessary consolidation of two historical SVOD platforms to Canal+ and broadcasters building super apps, French players are nowhere near surrendering in front of Netflix’s growing dominance.

See you in 10 years.

That’s it for today but before you go:

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

Until then, check out Streaming Made Easy on YouTube. In 10 mins or less, I will get you up to speed on a key topic about the European Streaming Video landscape so you can better design and execute your strategy in the region. Check out the 1st videos.