Inside The Apple TV+ Strategy

Or how Apple TV+ keeps breaking free from the Apple ecosystem but for what?

Time’s up for the Apple fortress.

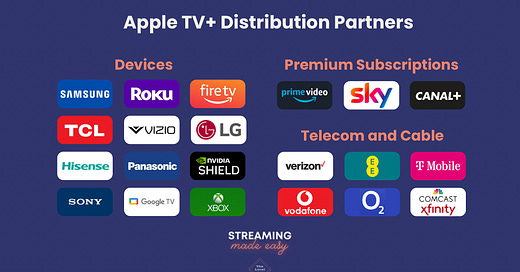

Apple TV+ keeps breaking free from the Apple ecosystem, one where Apple builds a self-sufficient device & content ecosystem and locks you in it.

Apple TV+ may have started as an essential pillar of the Apple ecosystem (remember when it was offered for a year for any new Apple device bought?) but this strategy was short-…