Welcome back to Streaming Made Easy (SME). I’m Marion & this is your 5-min read to get a European take on the Global Streaming Video Business.

This week brings you a collaboration withThe Kids StreamerSpherewith fellow consultant in the wild

. Emily and I met for the first time at the VOD Professional OTT conference nearly exactly a year ago.We recently collaborated on an article for Streaming Made Easy covering single IP kids streamers.

It was about time I reciprocated and this brings you our overview of the kids FAST landscape.

Enjoy the read.

No genre is spared by FAST fever, not even kids.

Rightfully so.

It is a new opportunity to reach and monetize audiences, so any content business has a duty to assess whether they should get into FAST or not. Kids IPs also have some unique considerations in this space.

Platforms must cater to different audience segments too and therefore tap into different content genres to satisfy their users’ appetite for video content.

Watch out, here come the kids.

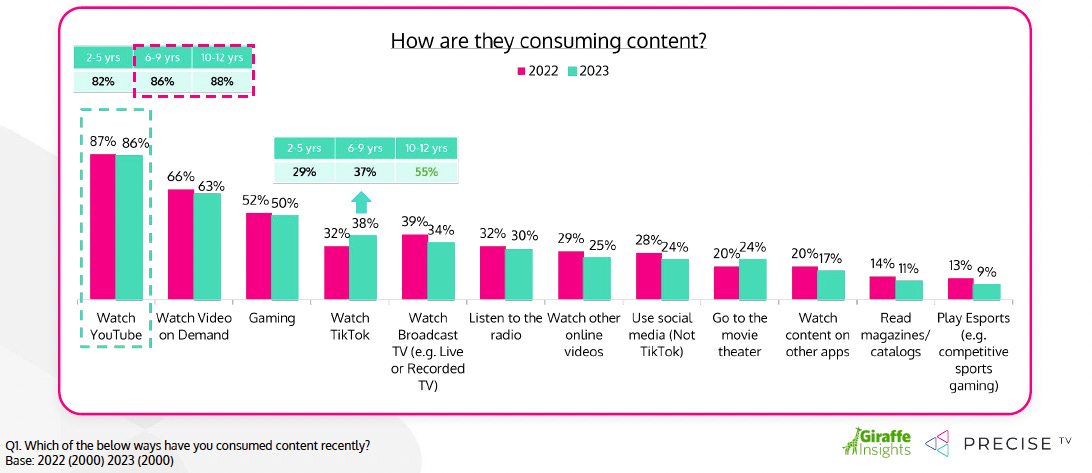

Children are heavy media consumers (video, games, music, social media).

Where do they spend their time? YouTube, of course.

YouTube is king with almost 9 out of 10 US children aged 2 – 12 revealing they consume YouTube content according to a report by Precise TV and Giraffe Insights from Q2 2023.

Click here to download a copy of the report

66% of this YouTube consumption occurs on connected TVs according to the same report, a major takeaway. YouTube is no longer just on mobile phones. For kids, it’s a core part of the living room experience.

CTV platforms want a piece of that action (for the kids segment and beyond). It’s one of the reasons why they launched AVOD/FAST hubs in the first place. To have a shot at being an alternative to YouTube.

Kids who are viewers today will be the adult viewers and consumers of tomorrow—a true subscriber conveyor belt. It’s in the interest of platforms, IP owners, brands and advertisers to build a rapport with them early on.

Is FAST a space where they can achieve that? Yes.

Do they? Not yet.

Most FAST platforms carry FAST kids channels (with some exceptions, notably Freevee, who had one channel in the UK in October 2023 and only six in the US).

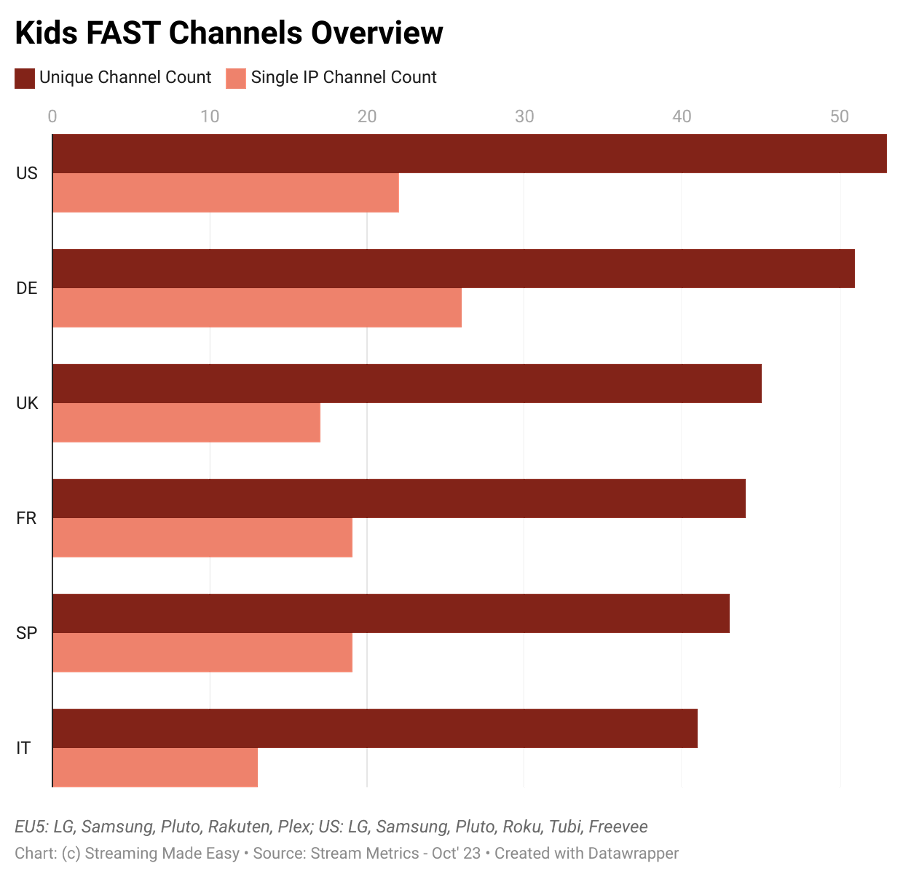

Here’s an overview of the FAST kids channel offering today in the US and in EU5 markets on a select number of platforms:

As you can see, kids FAST channels represent 52 unique channels in the US and 40+ across EU5 countries (on the platforms referenced above by Stream Metrics).

One third of these channels are single IP, the rest are thematic branded channels.

In the US, a platform like The Roku Channel carries 416 channels, of which only 31 are kids. This puts kids at 7.5% of the total channel offering.

In Europe, a platform like Samsung TV Plus France stands at 9.5% (with 11 out of 116 channels).

The genre is represented but it’s by no means the widest (in unique channels carried).

Who in kids media is doing a good job in FAST currently?

Without viewership data, it’s hard to answer this question. We can clearly see who is active, however.

Based on data supplied by Stream Metrics, Nickelodeon is truly doubling down on FAST, running an astonishing number of both bundled and single IP channels. From the perspective of the latter, old favorites like SpongeBob SquarePants, Dora the Explorer and iCarly have multiple iterations. Typical Nick competitors Disney and Cartoon Network are notably absent in comparison.

In addition to this, major YouTube companies Pinkfong (Baby Shark) and PocketWatch (Ryan’s Toy Review) are very active within FAST. Moonbug Entertainment is there too, but not to the same extent.

OTT bespoke kids VOD services, including Kidoodle.TV and Toon Goggles, are also part of the mix. Presumably supporting a selection of FAST channels as they look for alternative ways of building their brands and exploiting their ad-supported catalogues.

Finally, and understandably, legacy brands can be seen dabbling in FAST. These include The Smurfs, Garfield, Pink Panther, Inspector Gadget, Teletubbies and Transformers. Their instant familiarity among kids and parents does a heavy lift in terms of audience interest and discoverability.

How do you cut through in FAST? Are brands better suited to it?

As mentioned above, there is a strong trend from platforms towards recognizable IPs and brands; one must assume this is because these perform well. Leading with a known brand or character will have an obvious benefit within kids. This definitely offers the best chance you have to cut through in FAST today.

The challenge then comes from the volume of hours. Platforms ask for minimums that can be hard to achieve with shorter-form content (durations of <~20 minutes, which kids content typically is). When a channel is dedicated to one given IP, reruns will be high. Shoulder content can help take the pressure off if it fits well with the core brand. We all know kids tend to watch programs over and over, so refresh may not be as crucial as it is for other genres.

Only stopping by? Consider subscribing to receive it every Friday morning

Loving it? Consider sharing it with your network ❤️

The channel offering is here but what about the audience?

A recent survey conducted by CRG Research for Xumo states 93% of US consumers have heard of at least one major free streaming service that offers FAST.

As for consumption, the picture is murkier because the term “use” isn’t well defined. Ditto frequency... And a daily, weekly, monthly or once in a while usage paints a very different picture.

Several insights converge to around half of US consumers watching FAST; but again, see how the language varies (users, viewers, consumers, households):

Hub Entertainment (in its 2023 Best Bundle Report) surveyed 1.6K users aged 16-74 last year and shared that 57% of viewers in this age group use FASTs.

Kantar claims that 47% of US households use a FAST service each week.

CRG Research found that nearly half of consumers regularly watch at least one FAST service, with FAST viewers using an average of 1.9 FAST services.

Little to no data exists for FAST consumption in Europe today.

How do these channels perform?

In the absence of market-wide data on viewership, we can only rely on industry insights.

The buzz from numerous channel owners and platforms says that kids is hard. Viewership is good but they all agree on the fact that monetization lags.

For a business model relying on advertising, that’s problematic.

Channel owners face costs (of running the channel) that they may struggle to recoup if monetization doesn’t follow.

Why this lack of monetization?

FAST is still in its infancy when it comes to attracting ad dollars.

Another reason is specific to the genre and lies in the privacy rules applying to advertising towards made-for-kids content. Platforms are concerned about misstepping.

Also, FAST relies on programmatic ad sales technology.

As no personal identifying information can be collected for kids, Adtech companies are totally hampered when it comes to any targeting offered by their technology stack.

You can still serve contextual advertising but not the personalized ad experience FAST claims to differentiate with.

Who can do something about it?

Channels should build ad muscles and work with brands directly, or choose ad agencies specialized in kids. SuperAwesome and Little Dot Studios are names which come to mind.

The platforms should create a safe and easily accessible hub. An interesting example of this came from Samsung, who created a Kids Hub available on the left navigation bar of Samsung TV Plus. This is perhaps a first step towards a fully secured profile managed by parents with advertising made for kids.

Then why get into FAST at all?

As always, it speaks to having a 360-degree strategy.

Content owners must grow their audiences and diversify their revenue streams. Relying solely on YouTube, broadcast TV or SVOD is risky. Exploring FAST makes sense and does offer a living-room viewing experience within a safer walled garden than YouTube.

For some, it will be a reach play or a marketing vehicle. For others, it may be a way to give more value to their premium subscribers by offering a bouquet of FAST channels within their own app.

Long term, a financial model needs to be found so that channels can build a sustainable ad-supported business on top of YouTube.

Someone will crack the code to kids in FAST.

Let’s see who that will be.

That’s it for today.

Enjoy your weekend and see you next Friday for another edition of Streaming Made Easy!

By night, I write Streaming Made Easy and on Linkedin.

By day, I run The Local Act, a streaming video consultancy.

Whenever you’re ready, there are 3 ways I can help you:

→ Europe Made Easy: Get a trusted partner to launch and grow in Europe.

→ Masterclasses: For executives looking to get up to speed on all things streaming. My “FAST Made Easy” masterclass has been in high demand.

→ Content Marketing: Explore how I can put my 5.9K LinkedIn following + my 3.6K Newsletter subs to work for your company like I do for mine.

I cater to Streamers, Distribution Platforms and Technology Vendors.

Ping me to see if we’re a fit.